ER international fund manager series: Lazard Global Small Caps fund

Summary: The Lazard Global Small Caps fund invests in companies between $US 5 million and $US 1 billion and aims to beat the MSCI World Small Cap Accumulation Index by 3 per cent per annum over a rolling three year period. They have successfully achieved this aim by employing detailed qualitative research of the small caps on offer – the management team's focus on interviews with companies on the watchlist ensures the best businesses are included the portfolio. |

Key take out: Small caps are a volatile asset class, and best for investors who do not mind waiting out bumpy markets – but given they can deliver returns simply not on offer from blue chip companies, it's worth considering an allocation in your portfolio. |

Key beneficiaries: General investors. Category: Managed funds. |

As a Eureka Report subscriber, you are probably familiar with our intention to find small cap companies worth investing in. And just as local small cap companies have a place in your portfolio, so too do their international counterparts.

Today I want to look at the Lazard Global Small Caps fund. This feature is part of our expanding coverage of international investment opportunities in selected managed funds – to read recent items in the series click on these stories: IFP Global Franchise Fund, BT Wholesale shares Fund and Legg Mason Global Equity Trust.

Investing away from the largest listed companies and big brand names and owning companies that might be in their infancy or pioneering a new technology can be an opportunity, because they give investors a chance to achieve returns that are not provided by more established blue chip companies.

While small caps can deliver investment glory via stellar returns, this is not an asset class without problems. When share markets experience increased volatility, these are the types of companies that can be sold off first, forcing share prices lower.

Consequently, small caps are investments for the patient and those who understand things can get ugly in the short term.

Moving past potential downsides, small caps tend to trade in unchartered waters, because analysts and institutional investors tend to stick to blue chips. This makes it easier for a fund manager, or plucky analyst, to uncover a truly good business. With fewer eyes trawling over the financials there are rich pickings to be made.

The Lazard Global Small Caps Fund uses its analytical capabilities to uncover the best opportunities across the small cap landscape, which has led to consistent outperformance of the benchmark.

Why small caps?

Research cited by Lazard concludes small caps have delivered better risk-adjusted returns than large caps since 1980. In other words, the return received is more reflective of the risk that has been taken on.

While assessing the risk-adjusted return of individual investments is not something that an individual managing their own portfolio might be interested in doing, it's good to know the fund is looking at this measure. For one, small caps are inherently more volatile and signing up for the rollercoaster ride should lead to a greater return. It's comforting to know the fund considers this when making investments.

Performance

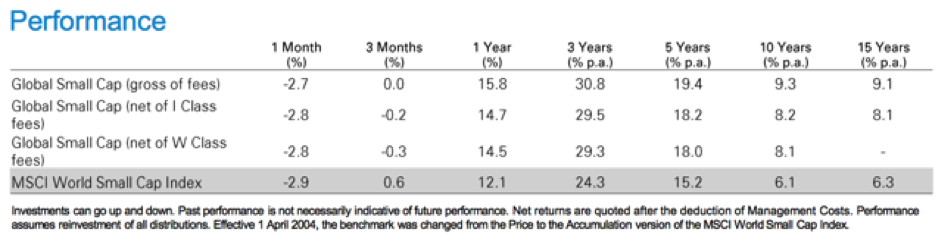

The fund has a return objective of beating the MSCI World Small Cap Accumulation Index by 3 per cent per annum over rolling three-year periods.

This is despite heightened share market volatility over the past five years, which can create opportunity but also wreak havoc on a portfolio.

Consistent outperformance is particularly noteworthy as this asset class is notorious for experiencing greater volatility than larger, more established companies. It's not unusual for smaller companies to remain out of favour with investors for a period of time, even when profits or economic conditions pick up. This fickleness can be explained in part by the risk adjusted returns many investors seek – if the return it isn't up to scratch, it's in the sin bin.

There are over 7,000 companies in the small cap universe, offering the Lazard Global Small Caps Fund plenty of opportunity to find businesses capable of delivering exceptional returns. Pursuing a relatively targeted approach, the fund only invests in around 60 or 70 stocks at any one time, allowing for the star performers to have a significant impact on the overall return.

Over the past five years, some of the top holdings have generated returns investors dream about. j2 Group, a cloud technology solution provider, has delivered a 25 per cent compound annual growth return. Online broker IG Group has posted 34 per cent, and the UK-equivalent to realestate.com.au, Rightmove, has hit over 40 per cent.

To consistently outperform, the fund needs to uncover businesses like j2, IG and Rightmove. Identifying opportunities that deliver exceptional growth comes down to the specifics of the company (including financial position, production offering and execution ability) and the economic outlook for the sector it operates in.

Sector differences

The composition of the global small cap index is significantly different to its larger peers. While financials are still the largest sector, industrials and consumer discretionary come in as the next biggest, giving the asset class a greater tilt to cyclical businesses. This is one of the reasons why, as an index, it can underperform large caps during economic downturns.

What is a small cap?

Very specifically, the fund only targets companies between $US300 million and $US5 billion. For context, $5 billion in Australia would have top-50 companies on the radar. The size of the companies targeted means they have already established some footing within their industry.

In contrast, Australian small caps generally fall outside the ASX100 and have a market cap of less than $1bn.

The method

In such a large universe, the fund can afford to be discerning of which companies it owns. Broadly, the investment criteria is a trade-off between financial productivity and valuation. In this case, financial productivity is used to describe cash flow returns based on return on equity and return on total invested capital.

These financial measures are used because investors ideally want to earn a return greater than their cost of capital – the return they could have achieved if they invested somewhere else. As an investor, you don't need to be making these calculations, but it's a good way for the fund to judge the appeal of an investment opportunity.

The Lazard Global Small Caps Fund goes beyond number crunching, with a qualitative approach also employed. Company managers are hauled over the coals in many interviews before a company can be included in the portfolio. This process opens the door to finding out how the company continues to allocate its capital, whether it will further investments in the business or make dividend payments instead. Either way, the fund it looking for a total return that reflects the level of risk assumed.

A flexible investment mandate means the fund can doesn't have to stick to sector or country weights of the index. This luxury means unattractive pockets of the investment universe can be avoided entirely.

Your portfolio

Owning both small and large caps is a way to give you access to both the big brand names and many of the new ideas and technologies that haven't hit the big time yet.

As we have discussed, small caps suffer from greater volatility than their larger counterparts, as investors often prefer the perceived safety of larger, more established companies. For this reason, unless you can wait it out when volatility picks up, small caps as an asset class might not be for you.

However, if you are looking to diversify you international exposure away from some of the largest brand names a small allocation could be suitable for your portfolio. Exactly ‘small' is a personal decision, but consider it in context of your overall exposure to shares.