ER fund manager series: Antipodes Global Fund

Summary: The Antipodes Global fund (IOF0045AU) can own companies listed in any index, and since inception in July 2015, has outperformed the MSCI AC World Net Index. The fund has the ability to hold both long and short positions in any equity, and has a detailed qualitative research approach to identifying which stocks are best taken as long and short positions. |

Key take out: Investing in a long/short fund gives investors the opportunity for returns very different from the indexes they are familiar with. A 1.2 per cent management fee makes this one of the more affordable funds for overseas exposure. |

Key beneficiaries: General investors. Category: Managed funds. |

Investing in 2013 was a walk in the park compared to the turbulent times we have experienced at the beginning of this year. Every sector of the US-based S&P500 closed out the year in the green in 2013, with all but two notching up double-digit returns. Locally, the only group of shares to post a loss was the battling miners.

The sea of green and buoyant investor sentiment seems a thing of the past so far in 2016. There are more sectors in the red than in the green, making it almost impossible to work out where to invest for a positive return. In these market conditions, volatility is a double edged sword: it makes savers conscious of their portfolio value, and creates plenty of opportunity for a fund manager with the flexibility to profit from falling share prices.

Commonly, fund managers look for undervalued companies with potential to grow their cash flows. While it works, it's also generic and reflective of many value fund managers. Jacob Mitchell, heralding from Platinum Asset Management, has gone out on his own and started Antipodes Funds Management – where finding investment opportunity comes down to identifying when market conditions have become irrational, and where the resilient businesses lie.

The intention to generate excess returns from irrational market conditions allows the fund to own - or be “long” - in companies that it expects to have rising share prices, and sell companies by being short those it expect to decline in value.

Having the flexibility to sell companies is appealing when sharemarkets are in decline, as it's a way to earn a positive return. Businesses in sectors facing structural changes - think oil and gas - or those that have prices not supported by current valuations are prime candidates to be sold short.

The fund

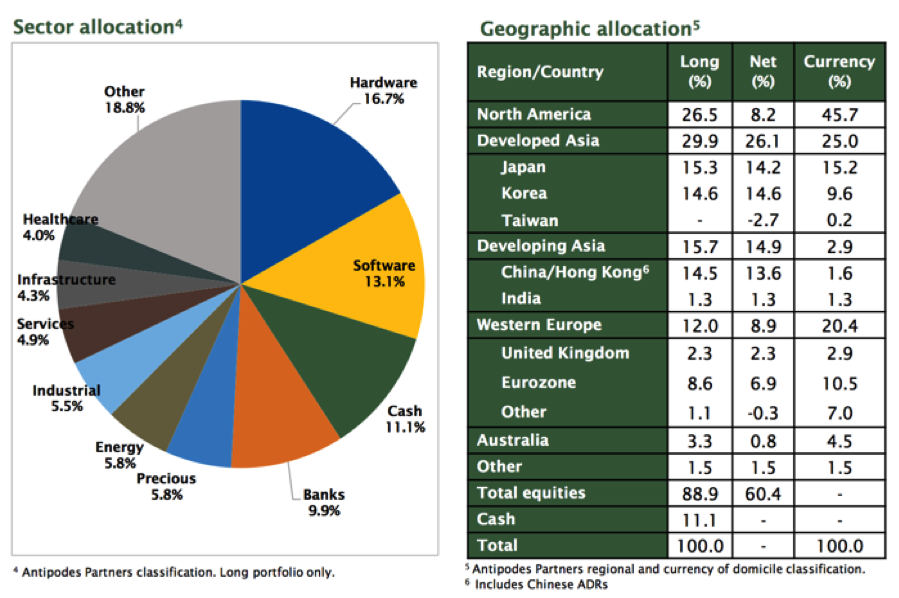

The Antipodes Global Fund (IOF0045AU) can own companies listed on any index. Unlike many global fund managers, it can own both developed and emerging market companies. Having a broad investment mandate makes the universe for identifying opportunities much bigger. In current conditions it means the fund can find businesses that are similar to some of the biggest brands - think Google, Apple and Nestle - trading at cheaper valuations to their peers.

Baidu, one of the companies owned by the fund, accounts for 70 per cent of internet searches in China, earning it the moniker of the Google of Asia. It's growing at around 30 per cent per annum and is trading at a steep discount to its better-known international counterpart.

While some investors fear investing in Asia, stemming from concerns surrounding China, the fund is currently finding high quality companies within the region that are cheap compared to their US and European peers.

The ability to invest anywhere in the world makes understanding the relationships between multiple currency pairs important as exchange rates, along with share price movements affect the overall return. Consequently the fund evaluates currencies owned and makes the decision to hedge or not accordingly.

A management fee of 1.2 per cent makes it one of the cheaper funds for international exposure. The team is also entitled to a performance fee of 15 per cent when the fund returns more than the yardstick - the MSCI AC World Net Index in Australian dollars.

The investment style

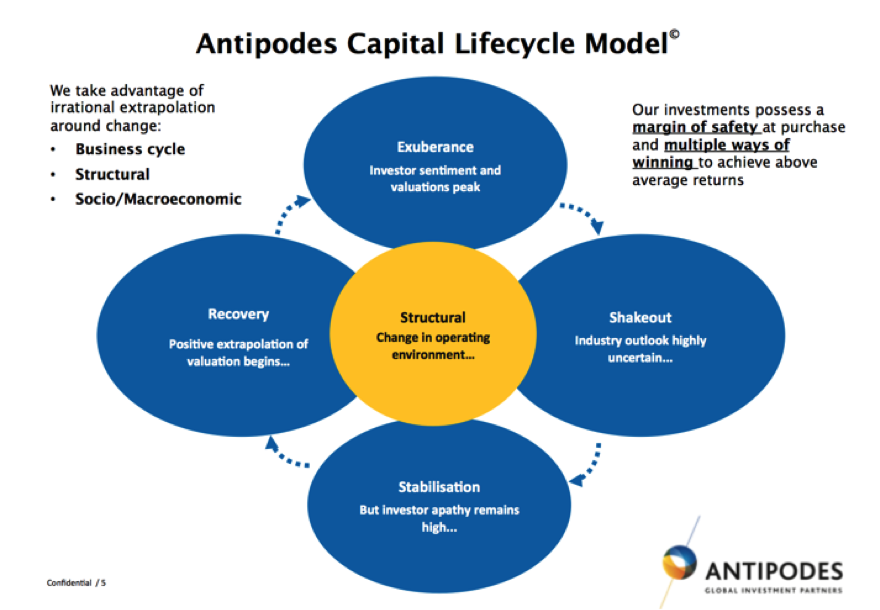

The Antipodes Global Fund looks to profit from the irrational exuberance – as management call it – that can plague the business cycle, industry structure or the macroeconomic environment.

The peak of investor sentiment is known as exuberance, and it's more than just share prices being pushed higher than consensus valuations. It can also be characterised by management being overconfident, leading to poor decision-making, or competition increasing, shrinking the profit once confidently banked. A perfect case in point is the mining industry five years ago – not only did competition increase, but the decisions about where capital should be allocated was far from optimal.

Companies at exuberance stage are ideal for shorting; as it is expected shareprices will decline.

More information about each stage can be found below:

When buying companies, the fund is looking for those at the end of the shakeout phase, which is characterised by the clearing of excess capacity and management making rational decisions. These companies are on the cusp of a recovery or resurgence.

A recent example would be the purchase of major gold miners Newcrest and Barrick Gold.

These are not a play on the gold price rising, rather it's about the opportunities now facing these companies and the decisions management have made in how the businesses will move forward. In terms of the life cycle, they have recently passed through the exuberance and shakeout stages.

Shorting theory

Investors often think of shorting as a way to offset the risk of a portfolio: For example, owning a portfolio of Australian shares and taking a position that would profit if the Australian index were to fell. This type of shorting can be referred to as a passive hedge, but in the case of the Antipodes Global fund, shorting is used as a way to drive return. Just as a fund manager generally owns stocks on the hope of share price rises, they can also sell companies banking on price declines.

A fund that can only own companies has to rely on shareprices rising, which can be a tall order when valuations appear stretched. In terms of the Antipodes model, these are companies that are on the cusp of moving from exuberance to the shakeout phase.

Not every cyclical company that appears to be a peak (at the exuberance stage) is a prime candidate to be shorted. The main attractions are companies or sectors that are perhaps overhyped and don't actually have strong business models.

For example, the Antipodes Global Fund shorted the biotech index last year. The rationale was a combination of record high valuations of the sector, in part driven by the expectation the intellectual property these pioneering companies are developing could be commercialised.

As the value of the biotech index fell, the fund was able to collect a positive return for investors. It's a way of winning and driving alpha not available to a long-only manager.

Shorting can either be done at a company level, sector or market. While some managers might only be comfortable to be short for a small period of time, the fund has no set timeframe for the period of the short, leaving it with the patience to see the payoff.

However, shorting is not without risks. When prices rise, it causes the position to notch up a loss. Theoretically, there is no end point to potential losses when shorting, which is why the fund looks for a higher margin of safety than going long.

The numbers

The Antipodes Global Fund has only been in operation since July 1, 2015. While the fund hasn't been around long, Mitchell and the team aren't strangers to managing money and have an average of over a decade of investment management experience.

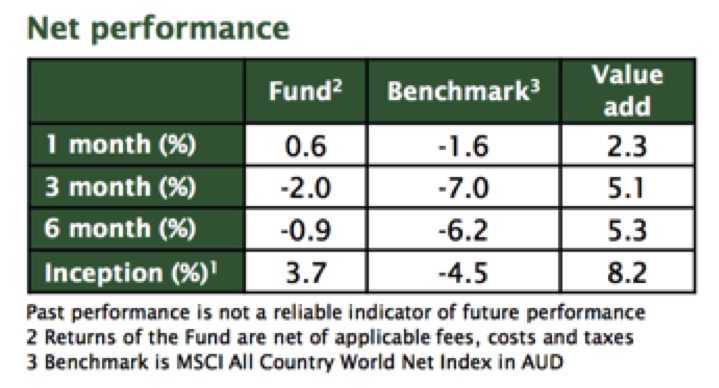

So far, the numbers bode well. For one, the fund has outperformed the index over key time periods.

At the end of February, the fund is 90 per cent long, 30 per cent short.

Your portfolio

Owning a fund that has the ability to go both long and short theoretically increases the possibility of returns that are significantly different to broad-based indexes.

While the fund invests independently of the benchmark, its performance measurement is the MSCI World Index and returns could be significantly different to this measure.

Total allocation should be considered in the context of exposure to shares overall.