Electric vehicle jump start, solar turnaround

Clean energy

US unlocks $US15 billion financing door for alternative vehicles

Next generation vehicles received a boost last week when the US decided to restart its smart car technology loan program unlocking more than $US15 billion in funding. The track record of earlier financing has been mixed, with a highly successful Tesla Motors on one hand with a valuation that exceeded $US20 billion, and Fisker Automotive on the other, which ceased production last year.

The $US25 billion Advanced Technology Vehicle Manufacturing loan programme has made no new loans since 2011, according to Aoife McCarthy, a spokeswoman for the agency that administers the program created in 2008. “With no sunset date and more than $US15 billion in remaining authority, the program plans to conduct an active outreach campaign to educate industry associations and potential applicants about the substantial remaining funds available and the application process in general,” she said.

The other finance-related news of the week came from SolarCity, which is seeking to raise $US223.5 million by offering shares and selling convertible notes. Elon Musk, chairman and chief executive of Tesla Motors, is SolarCity's largest shareholder with a 27 per cent stake.

In Europe, German renewable energy developer Juwi secured a EUR 252 million credit line from a group of 13 banks to support its growth for the next three years.

China dominated the headlines in Asia, with announcements of new solar subsidies, and an increase in surcharge to fund them.

The world's largest carbon emitter also introduced a subsidy of CNY 0.42 per kWh ($US0.07) for solar plants where energy generated is distributed to nearby consumers, thus easing the strain on the electricity network. The capacity of projects eligible for the new subsidy cannot exceed 6MW, the official China National Radio had announced last year citing China State Grid Corp.

In a separate move, China also increased the power surcharge that is used to subsidise renewable energy to CNY 0.015 per kWh from CNY 0.008. This will not be raised for residential use and agricultural production.

The country’s largest solar manufacturers have been struggling with over-supply of panels as demand declined in European markets. Some of them are now reporting higher margins on the back of rising demand in Asia. Yingli Green Energy, the biggest solar panel producer, managed a gross margin of 11.8 per cent in the second quarter compared with 4.6 per cent a year earlier. Trina Solar, which expects to be profitable in the fourth quarter, increased its gross margin to 11.6 per cent, and JinkoSolar Holding is already profitable after its margins doubled to 17.7 per cent.

However, this turnaround does not extend to the rest of the manufacturing chain. GCL-Poly Energy, the world's biggest polysilicon maker, said its loss almost tripled in the first half of the year to HKD 917.3m due to dumping by overseas suppliers. Revenue fell 4 per cent to HKD 11.3 billion. “The consolidation of the industry has not yet fully completed and imported polysilicon was dumped into the Chinese domestic market at a price below cost, therefore our business performance was materially impacted,” the company said in a filing to the Hong Kong Stock Exchange.

Global solar installations are projected to reach a record 37GW this year, up 20 per cent over 2012, with Japan and China installing 9GW each.

Even with this growth, China’s energy mix will still continue to be dominated by coal, according to Bloomberg New Energy Finance’s latest research analysing scenarios to 2030. “China has started to change course towards a cleaner future. But despite significant progress in renewable energy deployment, coal looks set to remain dominant to 2030. More support for renewable energy, natural gas and energy efficiency will be needed if China wants to reduce its reliance on coal more quickly” said Jun Ying, country manager and head of research for China.

In wind, turbine maker Sinovel reported a net loss of CNY 457.9 million in the first half of the year compared with a net income of CNY 11.2m a year earlier. In contrast, wind power developer Datang Corp saw its first half profit more than double to CNY 231m as increased grid capacity allowed output to expand.

Suntech Power Holdings, meanwhile, said that it has reached an "understanding" with creditors that will allow a conversion of debt to equity, and the introduction of a strategic investor. The main unit of the Chinese company had filed for bankruptcy earlier this year. In a filing, Suntech said it expects to enter a restructuring framework agreement "in the next week or so".

On the trade disputes front, the European Union found that Chinese solar-panel makers did, indeed, benefit from government subsidies although this does not "undermine the amicable solution with China which resulted into the undertaking applied from the beginning of August in the context of the anti-dumping proceeding,” John Clancy, spokesman for EU Trade Commissioner Karel De Gucht, said in a statement.

Carbon and oil

EU CO2 jumped last week as Syria tensions sent oil soaring

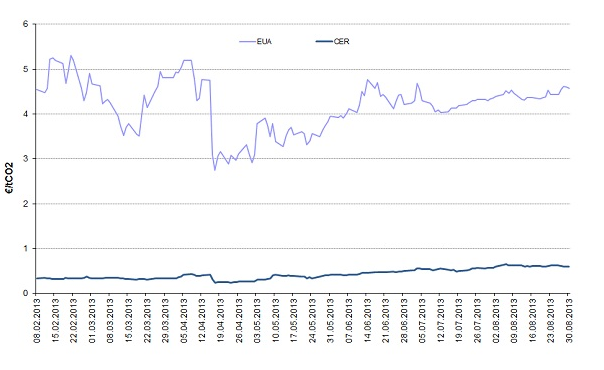

European Union carbon advanced last week, tracking natural gas, power and a surge in crude oil. European Union Allowances (EUAs) for December 2013 gained 2.9 per cent to end the week at EUR 4.57/t, compared with EUR 4.44/t at the close of the previous week. The EUA market was relatively quiet at the beginning of last week. Only 2.9Mt of front-year EUAs exchanged hands on ICE on Monday, 26 August – a public holiday in the UK. This was far below the 15-day moving average of 8.3Mt. Prices climbed above EUR 4.50/t on Tuesday and spiked to EUR 4.72/t at the start of trading on Wednesday. West Texas Intermediate crude rose as much as 3 per cent Wednesday on the New York Mercantile Exchange, its highest since May 2011, on concern that conflict in Syria may threaten oil supplies from the Middle East. Higher oil prices can influence coal and natural gas markets, which in turn can affect demand for carbon permits. EUA prices fell back later on Wednesday, along with oil prices, but closed the day at a seven-week high of EUR 4.61/t. The front-year EUA contract traded mostly in the range of EUR 4.55/t-EUR 4.60/t for the rest of the week. UN Certified Emission Reduction credits (CERs) for December 2013 slipped 4.8 per cent last week to close at EUR 0.59/t.

Carbon prices for European Allowances and UN Certified Emission Reduction credits (As of 21 Dec 2012, benchmark prices are for Dec-2013 contracts)

Source: Bloomberg New Energy Finance

The Energy Week in Review was originally published by Bloomberg New Energy Finance. Republished with permission

For information on how to subscribe to Bloomberg New Energy Finance's daily news, data and analysis on clean energy and carbon markets, click here.