Economics with a bang and a whimper

This is the second article in a three-part series on the self-destruction of neoclassical economic theory. See part one here.

As the neoclassical economics tradition gradually gave up its central position in universities over the last forty years, it remained triumphant in the real world. But the global financial crisis brought a sudden, shocking end to this exhuberism.

The failure of neoclassical models to anticipate it (and the success of many non-orthodox theorists to do so – including me, but also Wynne Godley and his collaborators using a sectoral balances approach, Ann Pettifor, Michael Hudson, Nouriel Roubini, Dean Baker, and numerous Austrian-informed commentators) suddenly called into question the role of the tradition.

That neoclassical economists – especially those relying upon neoclassical DSGE models – completely failed to anticipate the crisis is indisputable. As late as June 2007, the leading economic modelling and advisory body in the world, the OECD, was advising policy makers that the economic outlook was rosy:

“In its Economic Outlook last Autumn, the OECD took the view that the US slowdown was not heralding a period of worldwide economic weakness, unlike, for instance, in 2001. Rather, a “smooth” rebalancing was to be expected, with Europe taking over the baton from the United States in driving OECD growth,” it said.

“Recent developments have broadly confirmed this prognosis. Indeed, the current economic situation is in many ways better than what we have experienced in years. Against that background, we have stuck to the rebalancing scenario. Our central forecast remains indeed quite benign: a soft landing in the United States, a strong and sustained recovery in Europe, a solid trajectory in Japan and buoyant activity in China and India. In line with recent trends, sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment.”

So much for that theory. The crisis began two months after this typically Panglossian neoclassical forecast. By December the US economy had entered a recession, according to the US National Bureau of Economic Research . At the same time, the Federal Reserve’s economic unit was advising that a recession would not occur:

“Overall, our forecast could admittedly be read as still painting a pretty benign picture: Despite all the financial turmoil, the economy avoids recession and, even with steeply higher prices for food and energy and a lower exchange value of the dollar, we achieve some modest edging-off of inflation,” a FMOC transcript from December 11, 2007 said.

“So I tried not to take it personally when I received a notice the other day that the board had approved more-frequent drug-testing for certain members of the senior staff, myself included. [Laughter] I can assure you, however, that the staff is not going to fall back on the increasingly popular celebrity excuse that we were under the influence of mind-altering chemicals and thus should not be held responsible for this forecast. No, we came up with this projection unimpaired and on nothing stronger than many late nights of diet Pepsi and vending-machine Twinkies.”

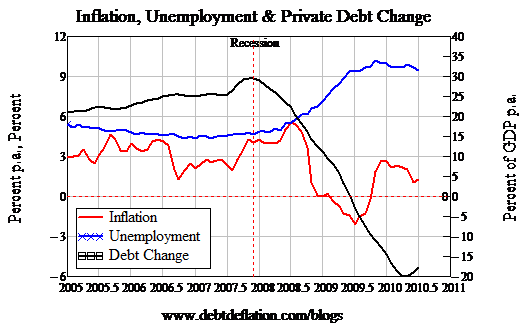

Figure 1 shows the sudden rise in unemployment and the collapse of inflation into deflation that neoclassical models completely failed to anticipate – along with the key causal variable those models exclude, the rate of change of private debt.

Figure 1: “The Great Recession”: Inflation and Unemployment diverge as Debt Growth collapses

In contrast, the theoretical response was muted, slow, and defensive. Somehow, slightly more than one year after the crisis, Olivier Blanchard – previously and subsequently the chief economist of the IMF, and then the founding editor of the AER: Macro – saw fit to publish a working paper on “The State of Macro” which included the simple statement that “The state of macro is good”.

Two years later, he had merely moved from oblivious to the defensive. At least Blanchard later had the good grace to accurately report how wrong that emphasis on fiscal sustainability proved to be. But his defensive attitude to retaining conventional theory, despite an unprecedented empirical failure, was typical of the neoclassical orthodoxy. Bernanke’s own defence was beyond absurd. As well as pretending that Bagehot’s Lombard Street was part of the modern economic curriculum, it involved such novel ideas as models that are designed only for good economic times (when, one might think, models were therefore not necessary) and they therefore can’t be criticised for their failure to anticipate or help manage bad times.

This circling of the wagons intensified as the crisis persisted. Initial statements that the crisis might necessitate a shift in paradigm gave way to the argument that the crisis could be interpreted simply as a set of unanticipated shocks to aggregate demand in an otherwise stock-standard DSGE model.

But the best that neoclassical economists have offered as a paradigm shift is in fact a “back to the future” resurrection of the IS-LM model – more than three decades after Hicks himself rejected it, precisely because its assumption of continuous equilibrium was surely violated during crises like that of 2007-08:

“We know that in 1975 the system was not in equilibrium. There were plans which failed to be carried through as intended; there were surprises. We have to suppose that, for the purpose of the analysis on which we are engaged, these things do not matter,” Hicks said in 1881.

“It is sufficient to treat the economy, as it actually was in the year in question, as if it were in equilibrium… There are plenty of instances in applied economics, not only in the application of IS-LM analysis, where we are accustomed to permitting ourselves this way out. But it is dangerous. Though there may well have been some periods of history, some "years," for which it is quite acceptable, it is just at the turning points, at the most interesting "years," where it is hardest to accept it…

“I accordingly conclude that the only way in which IS-LM analysis usefully survives – as anything more than a classroom gadget, to be superseded, later on, by something better – is in application to a particular kind of causal analysis, where the use of equilibrium methods, even a drastic use of equilibrium methods, is not inappropriate.”

Modern born-again Hicksians, unaware of the master’s epiphany and apostasy of equilibrium methodology, now seriously propose that this model be resuscitated to explain a crisis that neither it nor DSGE models could have anticipated. Simultaneously they are rubbishing the legitimate claims of non-neoclassical economists like Ann Pettifor, Wynne Godley, Michael Hudson and myself.

Figure 2: Disparaging rather than engaging with rival economic traditions

I expect that this intellectual revisionism will, if anything, accelerate the decline of economics in the Academy. The excuses that neoclassical economists deem sufficient to justify not changing tack after the economic crisis will justify an even further narrowing of the economics curriculum, but they won’t wash with their non-economist fellow academics in other business or social science departments – nor with university administrators. Economics is likely to shrink as part of Business degrees, and to be even further marginalised within Arts Faculties.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.