Don't inflate expectations about a US rate rise

Inflation remains benign but the Federal Reserve is all but certain to cut its asset purchasing program by a further $US10 billion during its meeting today. Still, it will be some time before inflationary pressures warrant a cash rate rise.

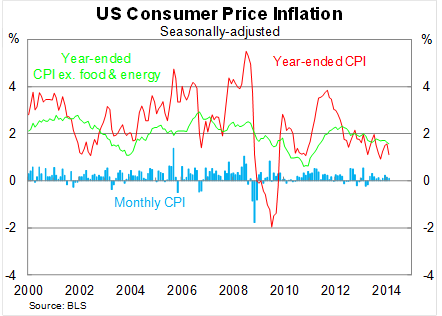

Inflation in the United States rose by 0.1 per cent in February, consistent with market forecasts, to be 1.1 per cent higher over the year. Measures of inflation remain comfortably below the Federal Reserve’s target of 2 per cent annual inflation growth.

Core inflation -- which excludes volatile items such as food and energy -- also rose by 0.1 per cent in February to be 1.6 per cent higher over the year. In fact, food and energy prices effectively offset one another in February, with food prices rising by 0.4 per cent and energy prices declining by 0.5 per cent.

There are several different inflation measures produced in the US and unfortunately they create a thoroughly confusing picture.

The Cleveland Fed produces two metrics – median inflation and trimmed mean inflation – which are similar to the inflation measures relied on by the Reserve Bank of Australia. These measures suggest that inflationary pressures are perhaps a little higher than indicated by headline and core inflation.

Median inflation rose by 0.2 per cent in February to be 2.0 per cent higher over the year. The trimmed mean measure also rose by 0.2 per cent to be 1.6 per cent higher over the month.

However, the Fed prefers a different measure altogether. Its preferred measure is the core personal consumption expenditure deflator, which climbed by only 1.1 per cent over the year to January.

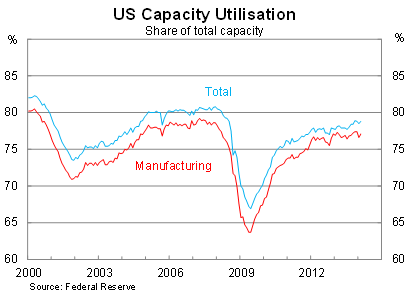

Here are the two key points. First, there remains considerable spare capacity in the US economy. Second, the Fed will not raise its cash rate for a long time.

On the domestic front, labour market conditions have certainly improved but wage pressures remain benign. Until wage growth turns around, we are unlikely to see a sustained increase in inflation.

There remains significant spare capacity across the US economy and that will be a key indicator of when wage pressures should rise. I anticipate that wage pressures will begin to emerge in some industries in 2014 but economy-wide pressures appear some way off.

However, the US dollar may partially offset emerging strength in US non-tradables inflation. The US dollar is likely to appreciate as the Fed continues to unwind its asset purchasing program. If that eventuates, it will put some downward pressure on inflation.

However, there are two reasons why this is of little concern. First, the US is a fairly insular economy -- more than Australia, for example -- with tradable goods accounting for only a small share of consumption. Second, the exchange rate mostly impacts volatile items such as gasoline and energy prices, which are excluded from the measures that the Fed focuses on.

The Fed meets today to discuss monetary policy. It is all but certain to cut its asset purchases by a further $US10 billion to $US55 billion per month. But it will be some time before inflationary pressures warrant a cash rate rise.

The Fed has explicitly stated that low rates will be appropriate as long as the unemployment rate remains above 6.5 per cent and inflationary expectations remain well-anchored and near the Fed’s target. The most likely scenario for those conditions being met is during 2015 but it will be interesting to see whether the Fed has adjusted its inflation outlook and forward guidance for its March meeting.