Do buybacks benefit investors?

Summary: The ASX-listed companies undertaking share buyback programs, and things investors should consider.

Key take-out: Sometimes share buybacks will benefit partaking investors, and other times not.

Holding too much cash in your portfolio? Chances are the boards behind some of your ASX-listed investments can relate.

But they're taking action. Companies don't like cash for the same reason investors shouldn't – inflation erodes its value. Deploying capital elsewhere can be a wise move. Introducing the share buyback program.

Considering shareholder returns over the years, Warren Buffett's Berkshire Hathaway is a classic example of a successful ongoing buyback strategy. When Berkshire Hathaway trades at 120 per cent or less than its book value, there's a condition the company can buy back shares, a benchmark that will deliver “an instant and material benefit to continuing shareholders” in Buffett's own words.

In the US at least, share buybacks hit an all-time high in May 2018. Apple earmarked potential buybacks of up to $US100 billion, Micron Technology made a $US10 billion announcement, and Qualcomm's proposal weighed in at $US8.8 billion. Big names further down the draw were Adobe Systems and T-Mobile, both announcing buybacks still well into the billions. This was all on the back of corporate tax cuts.

Companies are considered wiser to undertake buybacks when their shares are trading relatively cheap and they are holding excess cash. In these cases, it's generally thought to be of benefit to investors, and perhaps an alternative to spending on acquisitions. The company buys back its shares to reduce supply, which in theory, could put upward pressure on its shares. Right now, stock markets on average are trading at historically high multiples while companies in aggregate keep growing their cash reserves as interest rates stay lower for longer.

Australian share buybacks

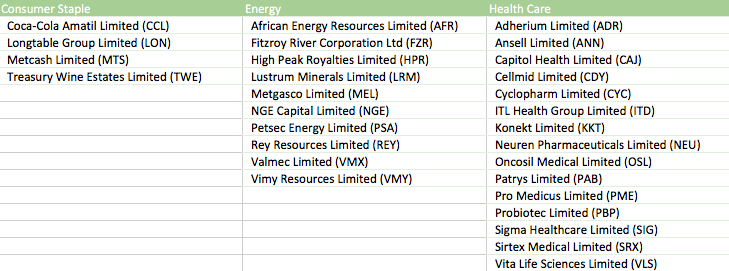

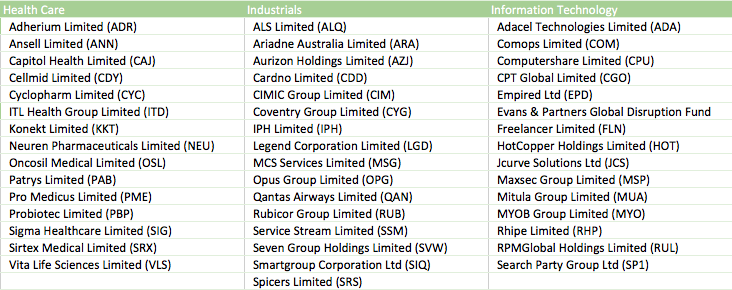

InvestSMART scraped the ASX for companies that made announcements pertaining to share buybacks in the financial year to June 30, shown in the tables below. Note, this still may not paint a comprehensive picture, being dependent on how announcements were labelled.

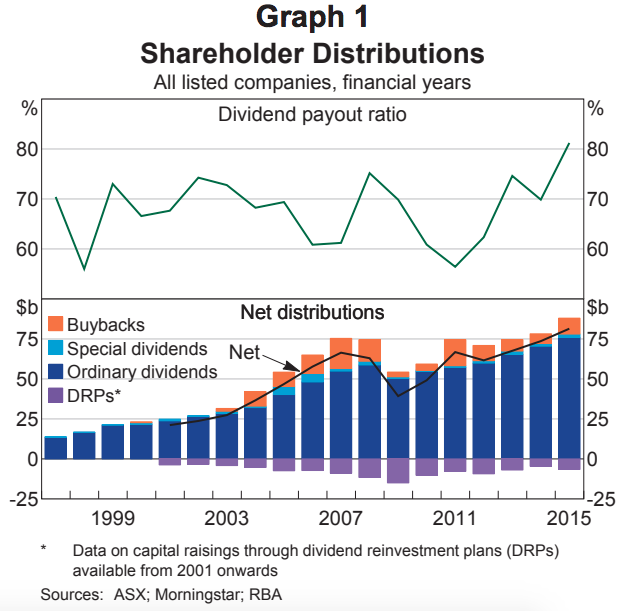

Traditionally, Australian companies have preferred operating in the dividend imputation system, but as seen in the chart to the right, buybacks have picked up steam in recent years.

As CommSec senior economist Ryan Felsman explains, there are two types of share buybacks — on-market and off-market.

“The off-market variety usually occurs through a tender process,” says Felsman.

“The distribution of franking credits has made off-market buybacks more popular with some Aussie companies. Given their tax advantage, it's more palatable to shareholders, and the company can purchase the shares at a relative discount to the market price – it's a win-win.”

Of the big-ticket buybacks, ANZ last month announced it was expanding its on-market share buyback program from $1.5 billion to $3 billion. But based on value (or proposed value at least), not the number of companies taking part per sector, Australia's resources sector seems particularly keen on share buybacks right now, in line with its growing cash reserves.

On a sectoral level, the financials sector wins out, but that's skewed by the fact listed investment companies (LICs) are traditionally big buyers of their own shares. For that reason, financials have been omitted from this data collection exercise.

Rio Tinto recently announced $US6 billion in share buybacks, predominantly off-market on the back of Australian coal divestments. And BHP is expected by market participants to announce a possible share buyback next month. BlueScope Steel has also recently extended its share buyback by another $150 million.

“In my view, capital returns should increase further with ongoing buybacks by Rio and BlueScope supplemented by special dividends,” adds Felsman.

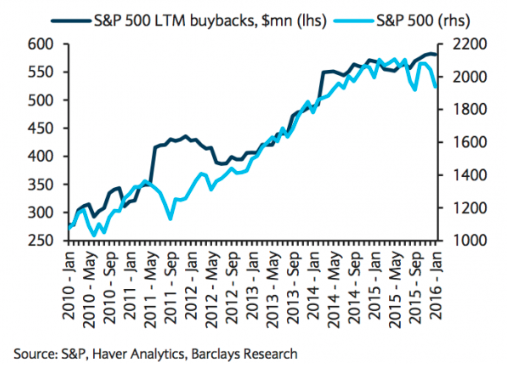

“Buyback activity is solid in Australia, driven by strengthening balance sheets and rising operating cash flows. But activity here lags the US where buybacks are near record levels.”

From grey area to legitimate purpose

In the five years to the middle of last year, US companies spent $US2.1 trillion on buybacks, according to HSBC.It's an alternative, or the alternative, to cashed up US companies spending on acquisitions, and essentially a replacement method to Australia's dividend imputation system.

And it's a relatively recent phenomenon too. Now a well-trodden path for public companies, before 1982 buybacks were of dubious legality and had to be done through public tender. In the US, buybacks were popularised in the 1990s before rapidly ramping up post-GFC against a backdrop of quantitative easing (see right).

Activist investor Carl Icahn wrote a letter to Apple arguing it buy back shares in 2013, where he calculated an immediate 33 per cent boost to earnings per share if it did so. Apple has since become a stalwart among the US ‘buyback monsters', a league which includes Boeing, Cisco Systems, GE and General Motors.

Icahn likes them, but not as a blanket rule, having admitted this June that too many companies were doing buybacks rather than investing in capital improvements.

Why so? Well, executives are often paid with stock, and buybacks can make their stock a whole lot shinier.

And some critics contend the only good buybacks do is reduce the number of shares to lift earnings per share, purely because this is a most-watched metric by investors.

Interestingly though, share buybacks in the US are fuelling share prices far less than they used to. Based on FactSet data, The Wall Street Journal reported this week that 57 per cent of the more than 350 companies in the S&P 500 that have bought back shares so far this year are trailing the index's 3.2 per cent increase — the lowest number since before the GFC.

Buyer beware?

Felsman from CommSec says there are some situations where 'buyer beware' applies to buybacks, in the sense investors should be wary of the buyer.

“While share buybacks are considered an alternative way of returning cash to shareholders, and are more flexible than dividends, they shouldn't be used by a company running out of growth options or responding to adverse news flow to prop up its share price,” says Felsman.

“A case-in-point may be UK-listed miner Glencore, which just announced a $US1 billion buyback after its share price tanked last week after being subpoenaed by the US Justice Department in an alleged corruption probe in the DRC, Venezuela and Nigeria.”

Underperforming companies may pull the buyback card to artificially prop up their share price and fend off takeover bids. Some will announce their intention to buy back shares, but take years to make headway, barely inching closer to the proposed volume goal. Buying back shares is an expensive exercise. The announcement alone might make a company appear a more attractive prospect. However, it's against ASX Listing Rules to announce a share buyback and never intend to enact it.

Retailer Oroton Group collapsed with a buyback looming over its head. Oroton announced a 10 per cent buyback in 2016, but this was less than 10 per cent complete when the company collapsed into administration at the end of 2017.

However, for every investor with a story like this, there's bound to be another who has participated in a buyback with many happy returns. For instance, take CSL investors who took part in a company buyback in the last couple of years – a quick calculation would show most would be laughing all the way to the bank.

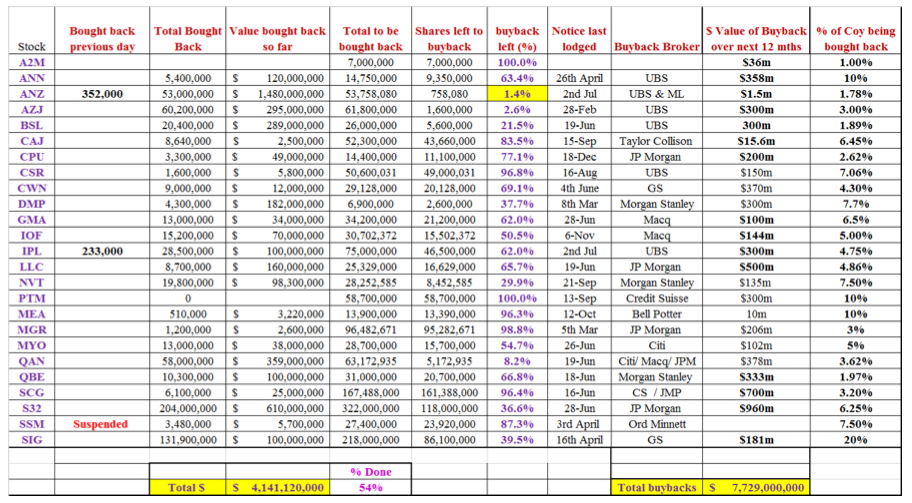

Big Australian share buybacks to July 2018

Source: Coppo Report, Bell Potter Securities; ASX company announcements to end of June 2018.

Note: Chart to be used for reference only as figures are subject to change.