Diversified Portfolios - Intelligent Investor Equity Income - 31 October 2016

COMMENTARY

PORTFOLIO COMMENTARY

After a strong performance in the September quarter, it was heavy going for the Intelligent Investor Equity Income Portfolio in October, with a loss of 3.9% compared to the 2.2% loss for the All Ordinaries Accumulation Index.

The performance would have been worse, but for a 34% gain from PMP Ltd after it announced a merger with its rival IMPG. This was particularly welcome since our investment case for PMP has always been that it was mildly undervalued as it stood, but more so if it could participate in industry consolidation.

PMP added more than 1% to the portfolio’s value on its own, which more than offset losses from Trade Me Group, which lost 15% in October after setting an all-time high of $5.70 in September. Other stocks fell by more but, with Trade Me beginning the period as the portfolio’s largest holding, its fall knocked just over 1% from the overall value on its own.

Behind the fall was an announcement by Facebook that it had launched its Marketplace ‘no-frills’ forum for trading goods in the US, UK, Australia and New Zealand. The threat from Facebook is not to be taken lightly, but it has always been there – and we’re not much closer to knowing whether it will be successful. There are good reasons to think the frills that Trade Me offers – in terms of security, payments, logistics and feedback facilities – are often worth it.

The other big fallers for October were Ainsworth Game Technology, which fell 20% due to a profit warning, and OFX Group, which fell 18% due to fears of disruption from ‘blockchain’ technology, increased competition and a lack of volatility in the Australian dollar against the US dollar.

Other than PMP, there wasn’t much to offset these falls, with South32 the next best performer with a gain of 7% and Westpac behind that with a gain of 3.3%. During the month we purchased a new 3% holding in Crown Resorts, after its share price fell following the arrest of members of its staff in China, funded by the sale of our 2.8% holding in Hotel Property Investments.

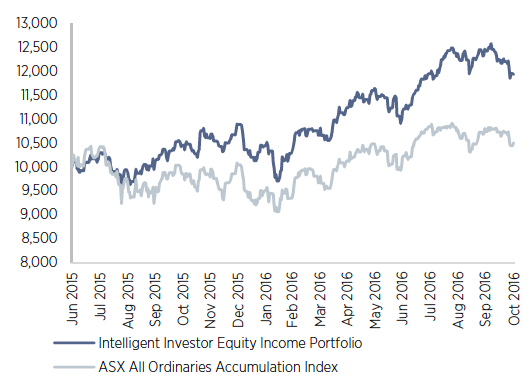

GROWTH OF $10,000

Income Reinvested

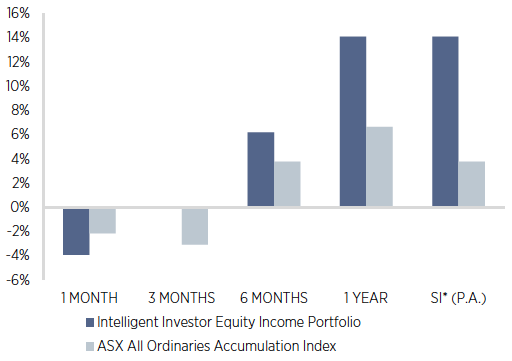

PEFORMANCE SUMMARY TO 31 OCTOBER 2016

Source: Praemium, RBA. Returns are after fees and before expenses. Returns are shown as annualised if the period is over 1 year. * Since Inception (SI) date is 1 July 2015.

| PERFORMANCE TO 31 OCTOBER 2016 | 1 MONTH | 3 MONTH | 6 MONTH | 1 year | SI* (P.A.) |

|---|---|---|---|---|---|

| Intelligent Investor Equity Income Portfolio | -3.94% | -0.13% | 6.16% | 14.09% | 14.08% |

| ASX All Ordinaries Accumulation Index | -2.18% | -3.09% | 3.77% | 6.63% | 3.76% |

| Excess to Benchmark | -1.76% | 2.95% | 2.40% | 7.45% | 10.31% |

Important Information

While every care has been taken in preparation of this document, InvestSMART Financial Services Limited (ABN 70 089 038 531, AFSL 226435) (“InvestSMART”) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document has been prepared for InvestSMART by InvestSense Pty Ltd ABN 31 601 876 528, Authorised Representative of Sentry Asset Management Pty Ltd AFSL 408 800. Financial commentary contained within this report is provided by InvestSense Pty Ltd. The information contained in this document is not intended to be a definitive statement on the subject matter nor an endorsement that this model portfolio is appropriate for you and should not be relied upon in making a decision to invest in this product. The information in this report is general information only and does not take into account your individual objectives, financial situation, needs or circumstances. No representations or warranties express or implied, are made as to the accuracy or completeness of the information, opinions and conclusions contained in this report. In preparing this report, InvestSMART and InvestSense Pty Ltd has relied upon and assumed, without independent verification, the accuracy and completeness of all information available to us. To the maximum extent permitted by law, neither InvestSMART, InvestSense Pty Ltd or their directors, employees or agents accept any liability for any loss arising in relation to this report. The suitability of the investment product to your needs depends on your individual circumstances and objectives and should be discussed with your Adviser. Potential investors must read the PDS, Approved Product List and FSG along with any accompanying materials. Investment in securities and other financial products involves risk. An investment in a financial product may have the potential for capital growth and income, but may also carry the risk that the total return on the investment may be less than the amount contributed directly by the investor. Past performance of financial products is not a reliable indicator of future performance. InvestSense Pty Ltd does not assure nor guarantee the performance of any financial products offered. Information, opinions, historical performance, calculations or assessments of performance of financial products or markets rely on assumptions about tax, reinvestment, market performance, liquidity and other factors that will be important and may fluctuate over time. InvestSense Pty Ltd, InvestSMART Financial Services Limited, its associates and their respective directors and other staff each declare that they may, from time to time, hold interests in Securities that are contained in this investment product.