Director Deeds: May's biggest pay days

Some investors believe it's wise to follow the money. Others are just curious.

Director trades can be suggestive, and these things can become even more interesting towards the end of financial year. Tax selling can be telling.

Repeated selling by multiple directors is likely to be more indicative than an isolated sale. However, selling can be triggered for a myriad of reasons, while buying shows conviction in the belief a stock is undervalued.

Some directors also have more of an information advantage than others, for example, the CEO of a company as opposed to a new independent director. And on-market trades with a director's own money send a stronger signal than simply exercising company granted options.

Be careful though. As suggestive as these trades may appear, especially if they are happening in a block, all companies have different trading policies so things might just occur en masse because of blackout periods.

Company directors must notify the ASX within five business days of making a transaction through their own company. More selling than buying across the board could suggest stocks, overall, are trading at elevated levels.

Director Deeds is a new fortnightly column, where we will peruse and decipher the director trades from the preceding two weeks.

May trades

The biggest trades for the month revolved around two technology companies and a retailer.

MYOB co-founder Craig Winkler sold down his stake in accounting software group Xero, apparently as part of a 10-year plan to fund philanthropic pursuits. He sold three million shares, on and off market, for around $40 a piece. His investment vehicle, First NZ Capital, crystallised a gain of $67.9 million by doing so. Winkler still owns 10.5 per cent of Xero.

It quickly went from main street to high street as a deferred payments provider, and now two Afterpay Touch directors and founder CEO Nicholas Molnar have offloaded some of their parcels for “asset diversification” purposes. Since June last year, the stock has returned more than 195 per cent. Through off-market transactions, David Hancock sold $3.47 million worth of shares on May 22, a couple of days after InvestSMART's bull and bear case on the business, while Anthony Eiser and Molnar sold the lion's share at $17.35 million each. Citi and Bell Potter were seeking shoppers, or institutional investors, to pick up the slack via a bookbuild.

Adairs non-executive director David MacLean cashed out and sold around $3.61 million worth of shares in the furniture retailer this week to “diversify his own personal asset portfolio”. The week before, a fellow non-executive director at Adairs, Trent Peterson, offloaded his own holdings to the tune of more than $25 million, which were then picked up by Wilson Asset Management. Peterson, however, is still the one with the lion's share of shares — owning 83 per cent of director shares.

Elsewhere, Myer executive chairman Gary Hounsell and non-executive directors Ian Cornell and Julie Ann Morrison started the month buying shares in the troubled retailer, at prices between 43 cents and 48c. Myer's share price has treaded water since.

Also in the world of big brands, Mirvac CEO and managing director Susan Lloyd-Hurwitz offloaded $950,000 worth of shares around the same time, when shares in the real estate group were trading between $2.26 and $2.32, around their 52-week mid-point.

Three big wigs from the same company — a CEO, Chief Technology Officer and director — all sold out of positions on the same day. The three are at the helm of Updater, an ASX-listed software company with operations in the US that focuses on removals and real estate, of which Domain's Antony Catalono is also on the board. They transferred, or cashed out, more than $18 million worth of stock at the beginning of the month, to reportedly make way for a new investor. A large chunk was shifted into a private family trust, so is no longer reflected in the director shareholdings, and therefore no longer required to be reported on. Shares in the company have since been moving up.

QBE Insurance directors bought en masse at prices around 52-week lows. Total transaction value was relatively low though, and insiders still only own around 1 per cent of the company. This came after the company posted a $1.6 billion full-year loss in February.

Following a weaker guidance update earlier in the month, one non-executive director put more skin in the game and bought shares in Medical Developments International. David Williams loaded up parcels of shares, buying more than $4 million worth in different instalments over sequential days. He's still in the money, judging by the share price now, and now owns around 16 per cent of the company.

Micro-cap Cirrus Network Holdings saw a tonne of activity at the start of the month. All together, three directors bought up more than $680,000 of stock. This came in the weeks that followed the company's quarterly and the announcement of an Austrade contract win.

After the share price took a hit on the back of rising raw material prices, Amcor directors doubled down. In the wash-up, the CEO Ron Delia purchased a few more shares, to the tune of a few hundred thousand, and a non-executive director bought almost $150,000 worth. The packaging company is trading near a two-year low.

It may have been chump change, but the timing was most interesting. National Veterinary Care directors Susan Forrester and Stephen Coles together bought a little under $60,000 in shares this month. The purchases took place around the time rival vets and pets directors were buying up Greencross stock, which was smashed at the start of the month on provisions and impairments news. Paul Wilson bought almost $200,000 worth, and Christina Boyce $40,000. The day after another Greencross director purchased around $50,000 in stock. But the biggest trade came from non-executive director and chairman Stuart Bruce James, a little less than $1 million. The month finished with Managing Director and CEO, Simon Hickey, making a quarter-million dollar purchase. Who else is chewing on doggie biscuits? A fund manager seems to like the taste of Greencross, increasing its stake around the same time.

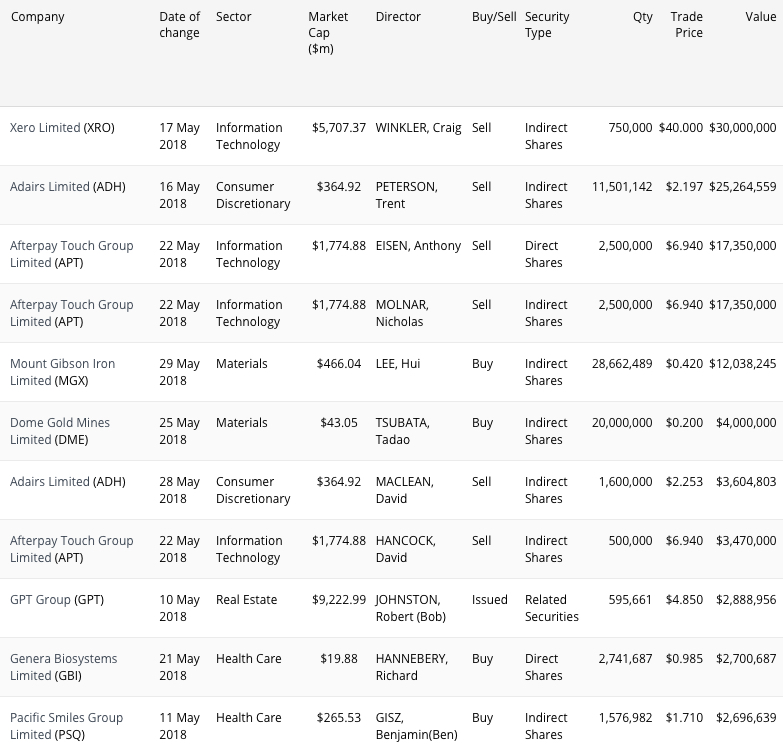

Top ASX director trades by value for May 2018

Source: Change in directors' interests data, InvestSMART

Time to restock the shelf. The wife of CEO Richard Henfrey stocked up on Blackmores medicine in the middle of May. She only bought $32,379 worth of shares, but that small parcel has since returned more than 15 per cent.

Activity has been ramping up in medical device company OncoSil for several months now. The company is currently conducting two studies to secure EU regulatory approval, with sights set on the end of the year. Three directors purchased three parcels in the pancreatic and liver cancer explorer worth $200,000 all up, at prices nearing a 52-week high. Soon after the ASX issued a speeding ticket.

Spotting what it perceived to be a pearly white opportunity, TDM Asset Management added to its position in Pacific Smiles Group. Benjamin Gisz, a director of the listed dentist and partner in the fund manager, spent another $2.7 million on shares in the company on May 11, increasing his total holding to around 13 per cent.

Melbourne entrepreneur Geoffrey Pearce has been upping the stakes on three of his investments in particular in recent years. But this May he spent some more loose change on Cann Group, Probiotec and McPherson's stock in a single week. It was just a little more than $200,000, but this year, all up, he has purchased $2.2 million worth of shares across the three companies.

Vita Group founder and CEO Maxine Horne sent shivers through her shareholder base halfway through the month, selling two parcels of shares when the company was trading at roughly half its 52-week high. However, the tax time parcels were only worth about half a million, and Horne does still own about 20 per cent of her maiden company.

Ashley Hardwick, a director with no other interests besides Specialty Fashion Group, shopped up at the share registry to now own roughly 20 per cent of the retailer. But there's more to this story behind the seams, with Specialty Fashion seeing a string of director buys recently. It comes at a time of rapid global expansion for the company, amid a brand downsizing strategy, and trouble brewing elsewhere in listed retail. One of the three purchasing directors hadn't shopped for shares in Specialty Fashion since 2009. They bought following a share price spike on structural review news, between 56c and 65c, with the price now hovering around the 70c-mark.

There were doubts around the discovery, and then came the disappointment on the drop of the maiden report. The dry salt lake, named Bombora, hasn't quite proven to be the break, or the gold discovery, that Breaker Resources was hoping for. A share price slide on a disappointing report about the 'greenfields' site led to board members buying shares. Chairman Tom Sanders spent $145,000 on two trades for the family super fund, and director Mark Edwards spent $30,000. They last bought when Breaker's share price was 70c in September — it's less than half that today.

Infrastructure was one of the words on the lips of politicians during May, but some investors saw it as a fitting opportunity to skip out of one of Australia's leading infrastructure stocks. Cimic Group's Adolfo Valderas dumped most of his ordinary shares in the company shortly after the Budget dropped in the middle of May, taking home $1.29 million from the trade. The stock has been falling since the end of last year.

At a time of runout sales, there have been more than a few transactions at the car yards recently. Nicholas Politis is single-handedly responsible for some of the biggest purchases. With the bulk of his wealth tied up in AP Eagers and Automotive Holdings Group, Politis revved up his AP Eagers holding to the tune of about $1.05 million, across five seperate trades in the one week.

A big bang from the blast furnace. Through a few different investment vehicles, Hui Lee loaded up to the tune of $12 million in Mount Gibson Iron. That takes his total spend on Mount Gibson Iron over the last 18 months to $18.5 million. Shares are trading much higher than this time last year, but the company is still a shell of its 2014 self.

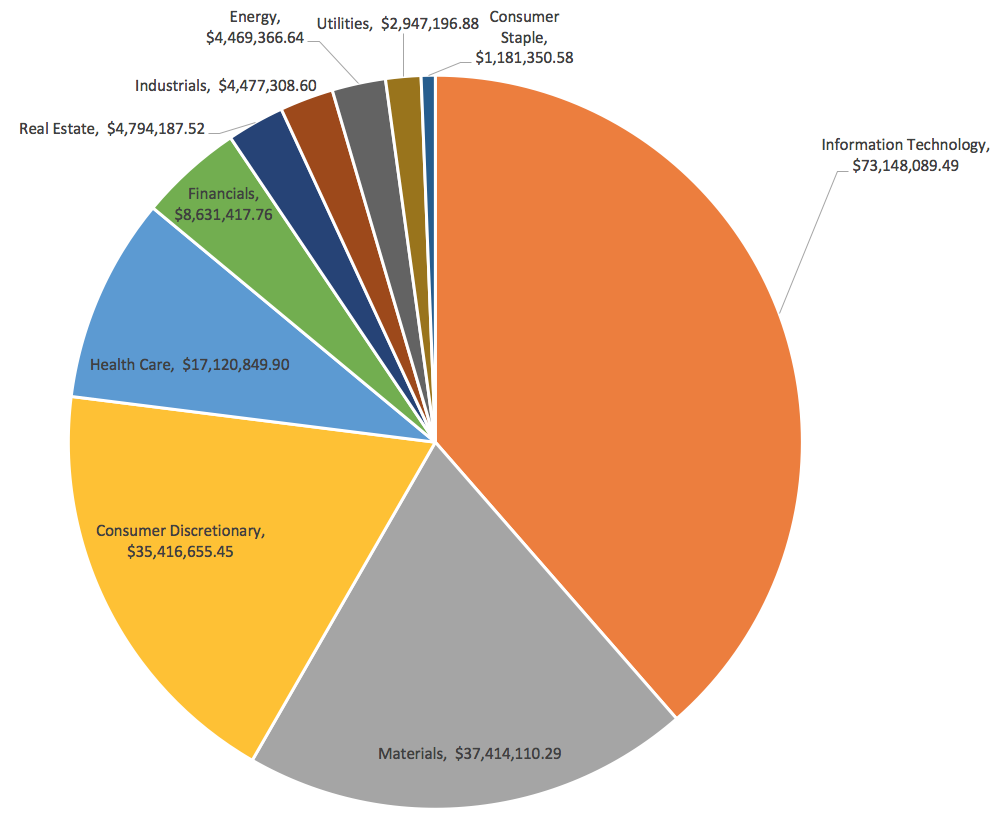

ASX director trades by sector/value for May 2018

*Chart includes convertibles, direct shares, indirect shares, options, and related securities. Article only discusses direct and indirect shares.