Direct Action to fine Origin, AGL, Alcoa, Santos, BHP …

Labor Climate Change Minister Mark Butler has released data illustrating how a large number of companies are likely to be paying penalties under the Coalition’s Direct Action scheme. These companies include Origin Energy, Rio Tinto, BHP, OneSteel, Qantas, Virgin, Alcoa, Xstrata, Woodside Petroleum and Santos.

The Coalition’s climate spokesman, Greg Hunt, says they aren’t budgeting for any revenue from the application of penalties. Nonetheless, the policy as currently articulated in their 2010 election platform (an update for 2013 has strangely not been issued), and which Hunt’s office maintains as an accurate reflection of their platform, states:

“Businesses that undertake activity with an emissions level above their ‘business as usual’ levels will incur a financial penalty.”

Hunt has since clarified that the business as usual emissions levels or baselines would be set based on the average of a company’s emissions in the previous five years using data reported via the National Greenhouse and Energy Reporting scheme (NGERs). However, he has refused to provide even a general indicator of the level of penalty the Coalition might impose for companies exceeding their baselines.

At present there is only four years of emissions data reported via NGERs so it’s not possible for us to know precisely how the penalties might ultimately play out. However, based on historical data it seems reasonably likely that a fair proportion of firms are likely to exceed their baselines.

One needs to remember that the last five years includes the period of the Global Financial Crisis which led to a major drop in industrial production for many firms. In addition, the very high Australian dollar over recent years has also acted to curtail industrial production for many large emitters.

Also, a number of mining firms have expanded capacity during the five-year period, and their steady state production going forward is likely to be noticeably higher than the average over the past five years.

Lastly, since 2008 demand for electricity has gone against past trends and declined. This means a number of electricity generators have been producing well below the levels they have been designed to achieve. If electricity demand returns to growth as expected by the Australian Energy Market Operator and most electricity market analysts, then these generators will find themselves exceeding their baselines.

Using the four years of data that is available and taking the first three as the baseline, Mark Butler’s office has shown that, in 2011-12, around 190 of these companies increased their direct emissions from their average emissions level of the previous three years. Another 30 increased their direct and indirect emissions levels.

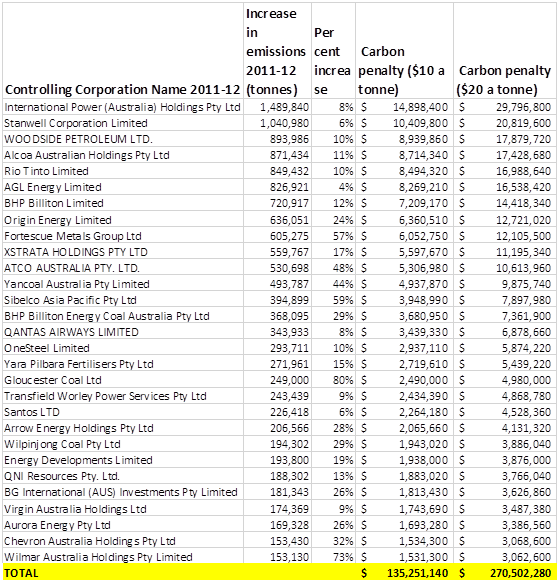

The table below details the companies with the biggest increases in direct emissions and the corresponding value of penalties paid assuming either a $10 or $20 per tonne of CO2 penalty.

Penalties paid by polluting companies based on 2011-12 emissions relative to prior three years.

The value of these penalties are not huge. For a number of companies these would be well below what they would pay under the government’s emissions trading scheme even taking into account free permits.

But it serves to illustrate that based on what scant detail we have available on the Coalition’s policy, penalties are likely to come into play.

Indeed, if penalties didn’t come into play then there would be real question marks about the effectiveness of the Coalition’s policy. If it turned out that firms were given emission baselines that they never exceeded, then taxpayers would be shelling out money to polluters for doing nothing to reduce their emissions. That’s because polluters are able to sell any excess baseline entitlement to the government as abatement (even if it would have happened without a taxpayer inducement).

If Hunt is genuinely serious that he plans on implementing a scheme where penalties for exceeding emission baselines never apply, then it poses a real problem for taxpayers.