Digital Gold Vs Gold: A New Store of Wealth?

Investors looking for a safe haven to preserve wealth against inflationary pressures have traditionally turned to hard assets such as gold or other precious metals, art, jewellery or real estate.

Hard assets are typically scarce, costly to acquire and limited in supply. Gold’s track record is proven over millennia and is traditionally the option that most investors turn to when the inflationary bells ring out.

But gold’s lustre isn’t quite as brilliant as it used to be, nor perhaps is it as desirable. At least, not to a new digital generation. That’s where Bitcoin comes in.

Bitcoin is often considered digital gold by enthusiasts: A pristine asset in digital form that acts as a store of wealth more conveniently, more securely, and more effectively than physical gold. While Bitcoin evangelists and gold bugs furiously debate this online, how can investors cut through the noise to find the signal, and make an investment decision?

One way is to compare and contrast common attributes to identify which asset has greater appeal. Since everyone is different, there is no right or wrong answer. Investors should consider their own objectives, timeframe, and appetite for risk.

Supply

It’s estimated that around 200,000 tonnes of gold have been mined to date with perhaps 50,000 tonnes still below ground. Nobody really knows how much gold lies below, so it’s possible that more will be found in the future.

Gold’s annual production rate is around 2-3k tonnes per year, which is roughly a 1.5 per cent annual issuance rate, sometimes expressed as a stock-to-flow ratio (200 / 3 = 66).

Some 18 million bitcoins have been mined from a guaranteed fixed supply of 21 million. Around 900 bitcoins are mined per day as of writing, which is around a 1.8 per cent issuance rate or stock-to-flow of roughly 55.

Verdict: While the stock-to-flow is currently similar, Bitcoin’s supply is absolutely fixed, whereas gold is not. Bitcoin wins.

Demand

Gold’s jewellery and industrial use contribute to its demand during periods of economic expansion, which complement its hedge properties during periods of inflation.

Bitcoin’s historical demand has arguably been driven by price speculation so far. But the Bitcoin space is evolving rapidly, with ongoing developments involving the “second layer” Lightning Network and decentralised finance (“DeFI”).

Verdict: If price reflects demand for a limited supply asset, it’s hard to argue that Bitcoin isn’t the winner. But both are likely to see periods of demand in future.

Concentration

Around 46 per cent of all gold exists as jewellery, with some 17 per cent held by central banks, 22 per cent by private investors, and most of the remainder for industrial use.

Bitcoin “whales” who own 1,000-5,000 bitcoin and “humpbacks” (5,000 bitcoin) own 37 per cent of all current supply. But 23 per cent of supply is held by owners of less than 50 bitcoin, and owners of 1 to 10 bitcoin are the fastest-growing segment.

Verdict: Of the gold held as an inflation hedge, almost half is held by central banks. This concentration might be considered a risk if central banks were to lose confidence in gold to act as a reserve asset. Bitcoin is held almost exclusively by private investors and so doesn’t have the central bank concentration, but large “humpbacks” and “whales” have traditionally wielded material influence over the price. Let’s call it a draw.

Portability

Being a physical asset, gold needs to be securely stored and physically transported. This is costly, time consuming and risky.

Bitcoin is digital. It is also virtual in the sense that it is just an address on the blockchain ledger, secured by private key cryptography. It can be secured and transmitted anywhere in the world at negligible cost and practically instantly.

Verdict: Bitcoin wins, game, set and match.

Acceptability

Acceptability means being recognizable and accepted. Gold can be forged and isn’t uniformly recognized. It also isn’t readily divisible.

Bitcoin can’t be forged and only comes in one flavour. It is divisible into “satoshis” (being 100 millionth of a bitcoin) and can easily be accepted anywhere (albeit with some technology assistance).

Verdict: It’s difficult to argue that Bitcoin isn’t the winner here too, but gold bugs may point to a track record going back millennia versus Bitcoin’s short decade in existence.

Volatility

Source: https://www.gold.org/goldhub/research/gold-and-cryptocurrencies

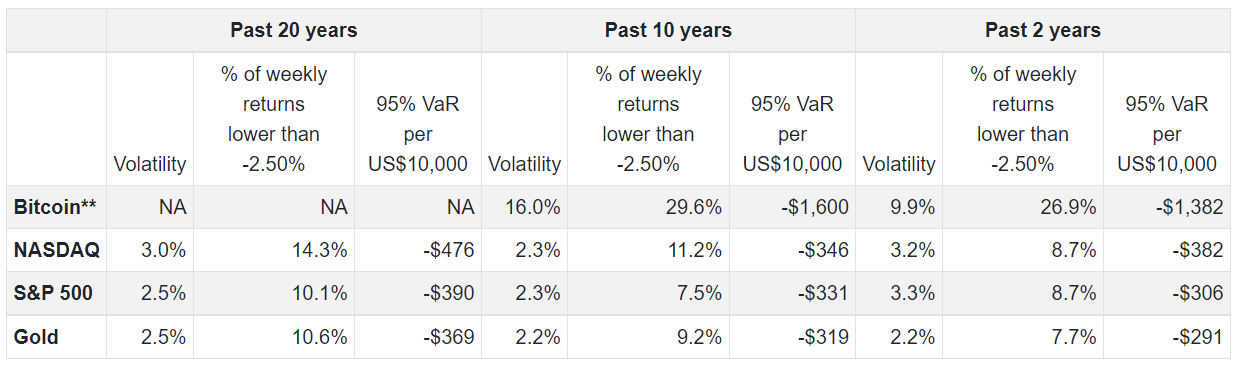

According to the World Gold Council, Bitcoin has lost 2.5 per cent or more once in four weeks on average compared to once in 12 weeks on average for the S&P 500 or NASDAQ. This compares to once in 13 weeks on average for gold.

Bitcoin’s Value-at-Risk (VaR) has also been considerably higher. During the last 10 years, investors had a 5 per cent chance of losing $1600 for every $10,000 invested in Bitcoin. The same risk for gold would have resulted in only a $319 loss.

Verdict: Bitcoin has been four times as volatile as gold over the last two and 10 years. If a good night’s sleep is paramount, then gold wins.

Liquidity

Source: https://www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2021

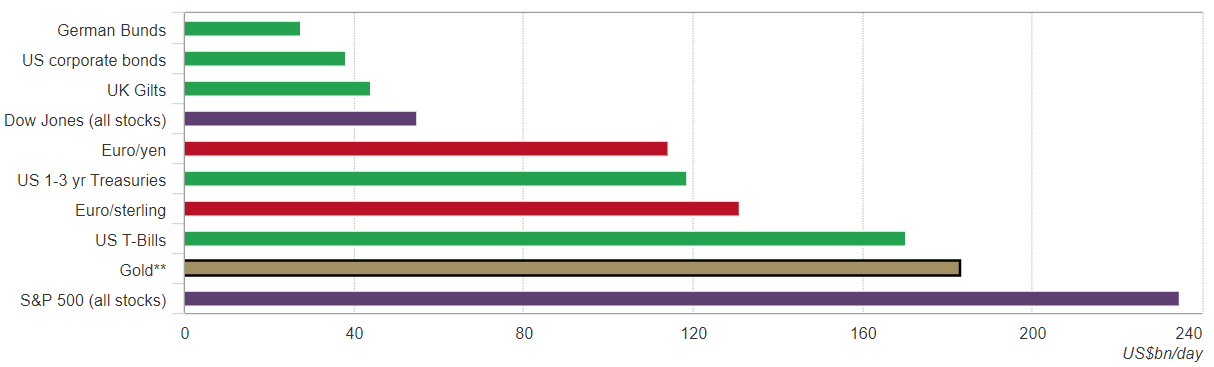

The gold market is deep and highly liquid, averaging $US180 billion per day in 2020. Gold’s average daily trading volume in 2020 was second only to the S&P500.

Source: https://casebitcoin.com/charts

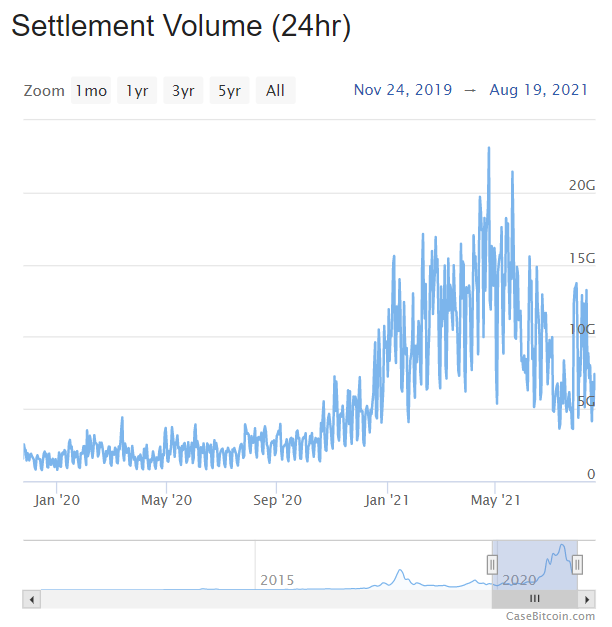

Bitcoin’s daily volumes averaged less than $US5 billion per day during most of 2020. They have risen significantly into 2021 as Bitcoin price has risen, but daily volumes are significantly less than gold.

Verdict: Gold trumps Bitcoin for average daily trading volume, but this also reflects gold’s market cap of somewhere in the order of $US11 trillion compared to Bitcoin’s $US880 billion as of writing. Gold’s market cap is more than 12 times that of Bitcoin.

Consider only the approximately $US4.3 trillion gold held as a financial asset (by central banks and private investors). The average daily volume of $US180 billion is around 4 per cent of the supply, which compares to say $US10 billion for Bitcoin or around 1.14 per cent. The liquidity of “eligible” gold is still deeper than Bitcoin’s.

Return on investment

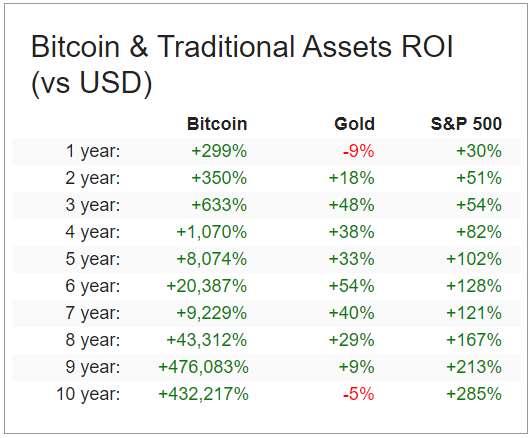

Gold has lost 5 per cent of its value over the last decade (as of writing) although its average annualised performance over 20 years is around 11 per cent pa.

Bitcoin has been one of the, if not the best performing investment of all over the last decade. Anyone who held Bitcoin for the duration would have achieved a return of over 430,000 per cent!

Source: https://casebitcoin.com/

Verdict: Over the last decade, Bitcoin wins …game, set, match and championship! Gold has failed to hold its value over the decade. (Bitcoin has only existed since 2010, so longer comparisons aren’t possible).

Opportunities and risks

Perhaps the main threat to gold is simply that some investors will reallocate some of their gold holdings to Bitcoin to capture Bitcoin’s greater return potential, or other assets that are likely to deliver a better return over the next decade (remember, an investment in gold for the last decade is down 5 per cent).

This might be offset by a tailwind brought on by excessive money printing, leading to inflationary pressures that drive gold’s attractiveness and price.

Bitcoin is still emerging as an asset class and so regulation, disruption, ESG concerns or technical failure still loom as potential hazards. Of these, only ESG concerns might affect gold.

Where Bitcoin clearly differs from gold is that in addition to being a financial asset (gold bugs might dispute this), it is a network. Bitcoin exhibits the attributes of Metcalf’s law, which says that a network’s value rises proportionally to the square of the number of users. Users are attracted by its attributes as both a financial asset (speculation and/or store of wealth) and utility (settlement layer for payment).

Investors who believe in the potential for Bitcoin’s future value in a digital world are betting that the current concerns are ephemeral. Gold bugs can rely on gold’s enviable track record and hope it continues.

Other sources:

https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold

https://www.gold.org/goldhub/data/above-ground-stocks

https://www.buybitcoinworldwide.com/how-many-bitcoins-are-there/

Frequently Asked Questions about this Article…

Investors often refer to Bitcoin as digital gold because it acts as a store of wealth in a digital form. It offers convenience, security, and effectiveness compared to physical gold, appealing especially to the digital generation.

Bitcoin has a fixed supply of 21 million coins, with around 18 million already mined. In contrast, gold's supply is not fixed, with approximately 200,000 tonnes mined and potentially more to be discovered. This makes Bitcoin's supply more predictable.

Gold's demand is driven by its use in jewelry and industry, as well as its role as an inflation hedge. Bitcoin's demand has been largely speculative, but it's evolving with developments like the Lightning Network and decentralized finance, potentially increasing its demand.

Yes, Bitcoin is significantly more volatile than gold. Over the last decade, Bitcoin has been four times as volatile as gold, which means it can experience larger price swings, impacting investors' peace of mind.

Gold offers better liquidity with an average daily trading volume of $US180 billion, compared to Bitcoin's significantly lower volumes. Gold's market cap is also much larger, making it a more liquid asset overall.