Deferred annuities get new lease of life

| Summary: Sales of lifetime annuities are surging, as investors seek out the safety of a steady income stream in retirement. They have their limitations, but last week’s proposed super tax changes relating to deferred lifetime annuities could spur a stampede. |

Key take-out: Recent changes to annuity products have eliminated many of their perceived negative features. |

| Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Income. |

Annuities. The very mention of the word conjures up adjectives like safe, boring, low yielding and dull.

Let’s face it. You didn’t set up your own super fund so you could plod ahead with returns that would make even your average professional fund manager look a hero.

No, you went DIY because you were tired of all those fees and you reckoned you could easily outsmart the professionals. The chimp with the dart usually does.

If that sounds like you, clearly you weren’t alone. In 2000, annuities – fixed term and lifetime – accounted for 40% of all assets in the retirement income market. By the end of 2012, they accounted for just 9% as allocated pension products dominated.

In 2004, six companies sold $280 million worth of lifetime annuities between them. The following year, as a result of tax changes, barely $27 million were sold and the issuers began pulling the product from their shelves.

But the perception of annuities, their attributes and how best they can be incorporated into a portfolio, is being re-examined. And last week’s proposed taxation changes to superannuation – particularly for deferred lifetime annuities – has piqued the interest of investors. This is one of the few Government initiatives supported by the Opposition.

In the aftermath of the financial crisis, there was a sudden swing back into fixed term annuities as investors and retirees sought certainty. And, in the past year, demand for lifetime annuities once again has surged.

Fixed term annuities – particularly short term annuities – are similar to term deposits but with the added advantage of a regular income stream.

This year, sales of lifetime annuities are likely to exceed $100 million for the first time in nine years. Why? It’s not just investors seeking safety. There have been dramatic changes to the products that have eliminated many, although not all, of their perceived negative features.

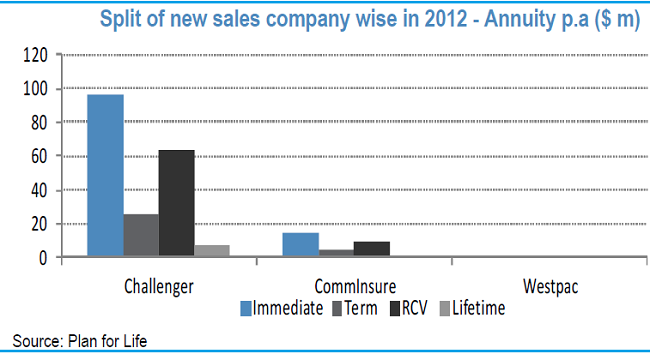

Only three companies, Challenger, Comminsure and BT, offer annuities, and of those Challenger dominates. When it comes to lifetime annuities, Challenger holds more than 95% of the market, with Comminsure picking up the rest. Deferred lifetime annuities, as referred to in last week’s pre-budget statement, are dormant. But the changes are expected to result in their rebirth.

One of the great criticisms of the Australian superannuation system is that we have moved from a defined benefit scheme – where the risk was on the superannuation provider – to a defined contribution scheme where the individual wears the risk.

It is highly likely that future government interference in the system – or reform, as every change is now deemed – will involve some kind of pressure, perhaps even mandatory, to include more annuity style products.

Why annuities?

Advocates argue that rather than a stark choice between equity and fixed interest, balance is the key. While many allocated pension products are supposedly balanced, they are skewed heavily in favour of equities, just as many supposedly balanced super fund options.

A lifetime annuity can form the basis of a portfolio – as a fixed interest instrument – to provide a guaranteed income stream that will meet future requirements, while allowing investors to continue to manage the remainder of their portfolio.

While Eureka Report subscribers are well aware of investment risks, there are several other major but largely unappreciated risk factors with the ability to wreak havoc on an investment portfolio.

Longevity is one of them. We never know how long we will live, which makes it difficult to plan for financially. Retirees tend either to spend too much too early and run out of cash in their later years, or they deny themselves during the early years of retirement. Inflation too can eat away at your capital.

But it is sequencing risk that is the most lethal. While the finance world talks in terms of long-term averages, it is completely misleading.

Without delving into the intricacies of the theory, financially we are at our most vulnerable in the five years before retirement and the five years after. A major downturn in equity markets during this period can have a devastating impact on the amount of wealth available during retirement.

A 30 year-old’s retirement wealth will be less affected by a global market meltdown than a 65 year-old, primarily because he or she has a smaller balance. The same goes for a 90 year-old.

Annuity proponents argue that building in a safety mechanism during this crucial period through a fixed interest product, such as an annuity, can alleviate that sequencing risk.

Clearly, lifetime annuities also address the longevity and inflation risks, if indexing is included as an option.

What are the negatives?

The most oft-cited criticisms of annuities are cost, returns, lack of flexibility and, crucially, the potential loss of capital for your partner or beneficiaries in the event of early death, which was a major turn-off for many retirees.

Challenger, far and away the biggest provider, has addressed some of these issues, which explains their sudden return to favour.

While a long-term or lifetime annuity is still a punt on how long you will live, Challenger’s Liquid Life annuity allows for a full return of capital within the first 15 years of the policy.

As long as one annuitant is alive during this period, the annuity is paid. If both die, then a commutation value is payable. This is calculated as a percentage of the purchase price, depending on your age when you took up the annuity. For those who bought the product before they turned 66, the percentages would be 85% for males and 100% for females. The older you are at purchase, the lower the commutation value.

Lifetime annuities don’t come cheap. While there are numerous options available, a 65 year-old male after a $40,000 a year annual income indexed for inflation for life wouldn’t get a great deal of change from $1 million. Unindexed, the price drops to around $650,000. For women, the cost is substantially more, above $1.3 million for indexed, and around $800,000 for unindexed. Sexism it isn’t. The discrimination is mathematical. Women live longer.

Those costs reflect the fact that annuities essentially lock in current interest rates. And, as Reserve Bank governor Glenn Stevens keeps telling us, rates are at record lows.

A common misconception of lifetime annuities is that the company keeps the balance if you die early. Not so. It simply remains part of the insurance pool. As the pool increases, and a greater representative sample of the population – rather than just those who reckon they’ll live longer than average – take up the product, prices could be expected to drop.

Deferred Lifetime Annuities

While dormant now, last week’s proposed tax changes – if they are ever enacted – are expected to revive the market.

The changes last week reclassify deferred lifetime annuities from “non-pension” to “pension” product. That puts them on the same tax footing as allocated pensions or lifetime annuities and, in a statement this week, shadow Treasurer Joe Hockey hinted a Coalition government would encourage innovation in this area.

They have several advantages. One is flexibility. The other is cost.

A 65 year-old can purchase a lifetime annuity to begin at any time in the future, thereby ensuring continuity of income during old age. While it does lock up capital that could be earning income, it now will enjoy the tax advantages associated with being a pension product.

As a rough figure, deferred annuities will cost somewhere between 15% and 20% of a full lifetime annuity. Costs are expected to drop sharply if there is a rush for the product. It would be safe to assume more providers would enter the market, with the likes of AMP, and perhaps Suncorp.

That lower cost allows retirees to direct a larger portion of their wealth to products or investments that have drawdown flexibility during the early years of their retirement. But it will still essentially involve locking your money away for a considerable period of time.

It is possible, however, that these instruments could be useful for those wishing to reduce their superannuation income below the proposed $100,000 threshold.

A JP Morgan study this week calculated that a 65 year-old wanting a deferred annuity providing $25,000 a year from the age of 85, would probably be up for $40,000.

This kind of product, it argued, would probably appeal to a retiree with super balances between $300,000 and $700,000.

Any less, and the costs are too great. If you have more, the investment bank reckons you probably have enough to not worry about running out of cash in old age.