Crypto: Exploring the New World of On-Chain Analysis

As Bitcoin has evolved and increased in market value, a new data science has also emerged to help market participants and observers make sense of Bitcoin’s network behaviour and price action.

Bitcoin’s blockchain is a fully transparent and incorruptible historical record of all Bitcoin transactions since the very first block was mined by Bitcoin’s pseudonymous creator Satoshi Nakamoto on 3 January 2009. This transparency allows anyone with an Internet connection to view “on-chain” data and combine network activity with price or other data to gain insight into market dynamics or investor behaviour.

On-chain analysis can be considered a kind of fundamental analysis for Bitcoin and other blockchain-based digital assets and sets them apart from traditional financial assets where transactions are opaque.

Leading providers of on-chain analysis include glassnode, Messari, Coinmetrics and Chainalysis, among others.

Chainalysis is believed to be the biggest with some 500 corporate clients (financial institutions, exchanges, governments etc) across more than 60 countries worldwide, so clearly there is significant institutional demand for these emerging services.

Transactions on Bitcoin’s blockchain ledger

The best way to understand the concept of on-chain analysis is to consider how a transaction works on a blockchain ledger.

Alan wishes to send some Bitcoin to Bob. Alan’s Bitcoin can be thought of as existing at an address which is public (much in the same way that a building has a public address). Alan has the key to this address which is solely his and private. Alan can send Bitcoin to Bob if he knows Bob’s address, which Bob freely shares with Alan because Bob’s address is public. Similarly, Bob has the private key for his own address which means he controls the security of any Bitcoin received there.

The only way that Bitcoin secured at Alan’s address can be released is by knowing the private key to that address. Because only Alan knows the private key, only he can authorise the sending of Bitcoin to Bob. If Alan were to lose the private key, he wouldn’t be able to unlock the Bitcoin secured there. If somebody were to steal Alan’s private key, they would then be able to steal the Bitcoin. This is why Bitcoiners’ say, “not your keys, not your coins”.

Alan’s wallet will “sign” the transaction details in an algorithmic way using his private key and transmit the details to the Bitcoin network. Miners will then compete to confirm that Alan’s private key really does control the Bitcoin secured at Alan’s address by spending energy to perform complex calculations. The miner that successfully confirms the block containing Alan’s transaction will win the block reward in the form of Bitcoin. This Bitcoin is created through mining and according to the predictable and fixed supply schedule designed by Satoshi Nakamoto and built into the Bitcoin protocol.

Every aspect of Alan’s transaction with Bob is recorded on the blockchain ledger including the public addresses involved, the amount of Bitcoin associated with each input and output making up the transaction and the transaction date/time. The blockchain is therefore a treasure trove of data showing activity on the Bitcoin network. Everything is visible, traceable, and unalterable. Compared to traditional financial assets and fiat currency, Bitcoin is significantly more transparent to regulators, tax authorities and law enforcement agencies.

How can on-chain data be used?

Bitcoin transactions are made up of inputs and outputs. When Alan sends Bitcoin to Bob, it is a transaction on the blockchain. The transaction consists of an input of Bitcoin that Alan previously received from somebody else and an output of Bitcoin that is sent to Bob. This output of Bitcoin is called a “UTXO” or unspent transaction output. It’s considered unspent in the sense that Bob can now send it onto to somebody else (ie. spend it).

This means that the Bitcoin blockchain consists of a historical record of all transactions performed including the UTXOs representing Bitcoin moving from one address to another. Every UTXO has a date/time stamp, which also means it has an age. On-chain analysis includes looking at the interplay of UTXOs, UTXO age, address growth, transaction value (in Bitcoin), the amount of “hash” power being employed by miners (to secure the network) and other data. It also incorporates market variables such as Bitcoin price, the cost of electricity or the cost of mining equipment to derive insights about historical or future price action.

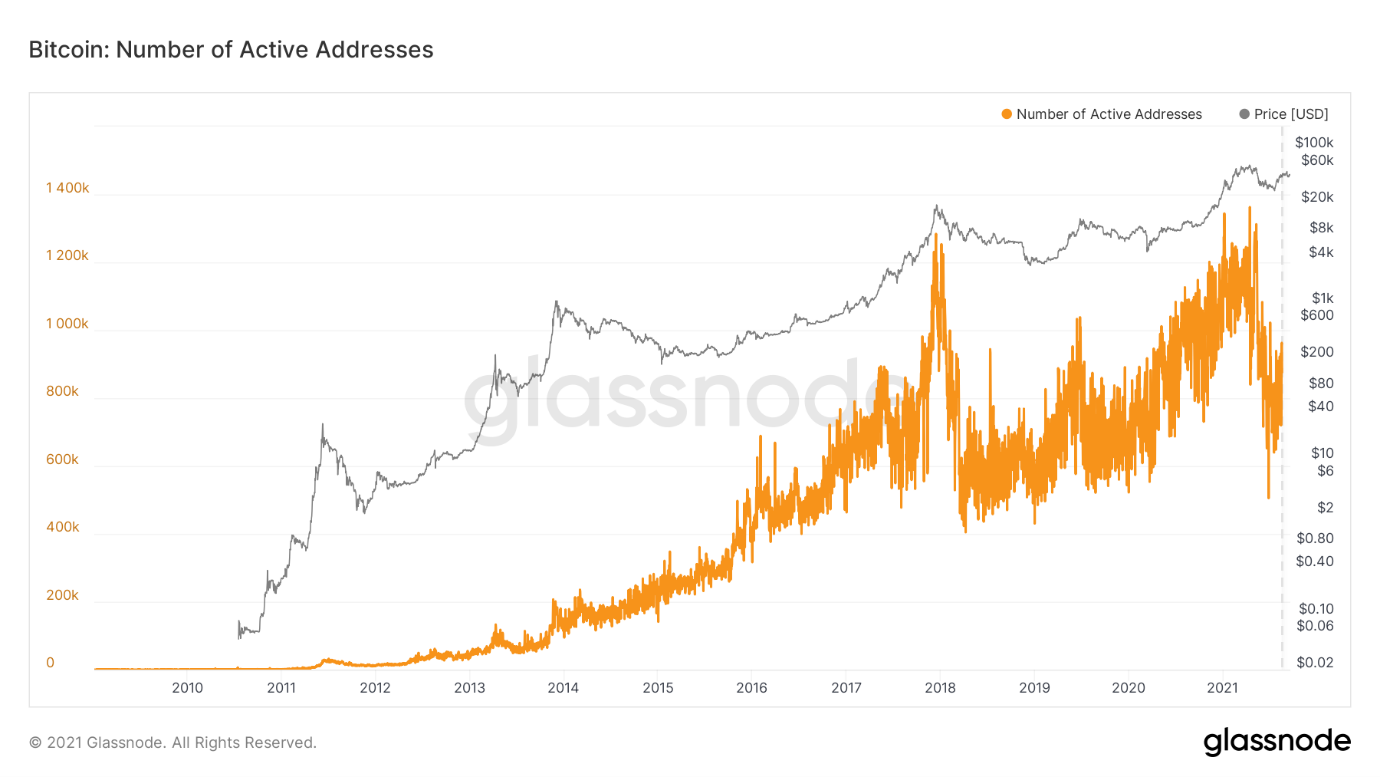

The following chart shows the number of active Bitcoin addresses shown over a log chart of Bitcoin’s price. The chart shows the considerable growth in active addresses on the blockchain, including the enormous growth leading into the 2017 bull run, the significant fall earlier in 2021 as Bitcoin price corrected, and its consolidation since.

New Bitcoin addresses are often created to receive incoming Bitcoin and may not be reused once the Bitcoin received at this address is spent (sent to another address). This is often recommended to increase security.

Growth in addresses doesn’t necessarily mean that the network is experiencing user growth. An individual user can create new Bitcoin addresses and even spend that Bitcoin by sending it to another address that they control. This would appear on the Bitcoin ledger as a transaction but is really like moving traditional money from one account to another. It doesn’t mean that the Bitcoin network is seeing growth from more users.

But growth in active addresses is an indicator that provides insights in combination with other indicators, just like indicators used by traders or fundamental analysts in equities markets.

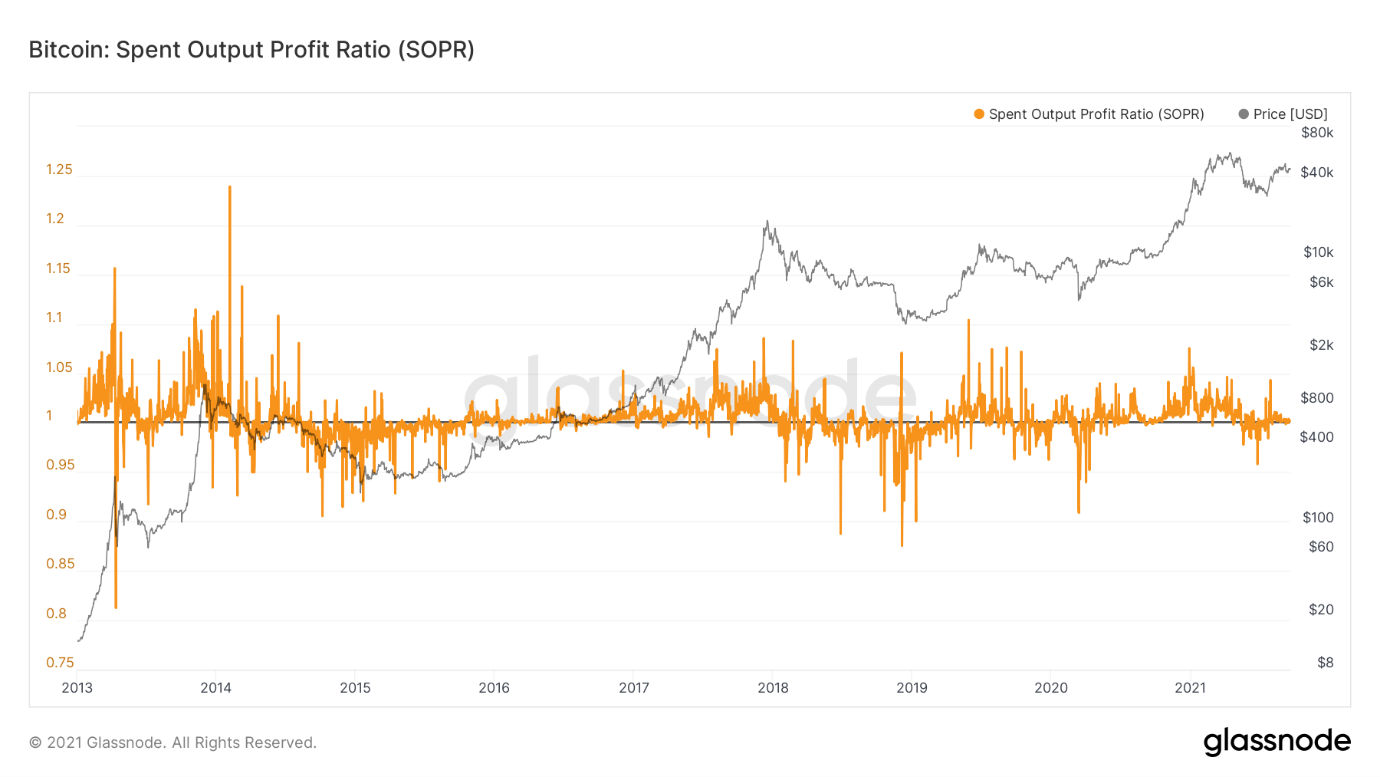

Another popular Bitcoin network indicator is the Spent Output Profit Ratio or SOPR. SOPR is simply the ratio of the Bitcoin price for a spent output to the Bitcoin price of that output when it was created. The chart shows the spent outputs combined, aggregated by the Bitcoin network date when they were spent.

SOPR can be thought of as a technical indicator like those used by charting analysts on traditional assets. It oscillates around the value 1.0 and shows the aggregate of holders in profit (SOPR > 1) or loss (SOPR < 1). It may help observers decide the current phase of the market or when markets turn from bear to bull and back to bear again. SOPR is possible because all outputs and their age are visible on the Bitcoin blockchain for all to see.

SOPR has been above 1.0 since mid-July 2021 and is virtually at 1.0 as of writing. This means that coins moved are on average selling at break even based on the current Bitcoin price, and this has been so since mid-July 2021.

Ethereum’s blockchain is account-based, rather than UTXO-based, which alters the interpretation of on-chain data. But on-chain analysis can be performed to derive insights about Ethereum’s network and market behaviour because the origin and ownership of coins can still be traced (from a wallet perspective).

The future of on-chain analysis

Crypto markets are still nascent and so the benefits and limits of on-chain analysis are also evolving. With only a decade or so of data to back-test, the value of indicators may change over time. Second layer solutions such as Bitcoin’s Lightning network may alter the interpretation of data on the base layer (and trigger analysis of second layer data). And the arrival of significant institutional investment into digital assets may alter market dynamics and impact on-chain analysis.

But there’s no doubt that on-chain analysis of blockchain-based digital assets is here to stay. Most of the service providers mentioned earlier also provide access for individual / retail investors too, in many cases for free (albeit with limitations).

Self-directed investors looking to make crypto investment decisions for themselves would do well to develop a basic awareness of on-chain analysis and how it might influence market behaviour.

Frequently Asked Questions about this Article…

On-chain analysis is a type of fundamental analysis for Bitcoin and other blockchain-based digital assets. It involves examining the transparent and immutable data recorded on the blockchain to gain insights into market dynamics and investor behavior. This includes analyzing transaction details, UTXOs, and other network activities.

Unlike traditional financial assets where transactions are opaque, on-chain analysis leverages the transparency of blockchain data. Every transaction on the Bitcoin blockchain is visible and traceable, allowing for a more detailed understanding of market behavior compared to traditional financial analysis.

Key indicators in on-chain analysis include the number of active Bitcoin addresses, UTXO age, transaction values, and the Spent Output Profit Ratio (SOPR). These indicators help investors understand market trends and potential price movements by analyzing the historical and current data on the blockchain.

The Spent Output Profit Ratio (SOPR) is a technical indicator that shows whether Bitcoin holders are in profit or loss. It oscillates around the value of 1.0, indicating if coins are being sold at a profit (SOPR > 1) or at a loss (SOPR < 1). This can help investors determine market phases and potential turning points between bull and bear markets.

Yes, many leading providers of on-chain analysis, such as glassnode and Chainalysis, offer access to their tools for individual or retail investors. While some services may have limitations, they often provide valuable insights that can aid self-directed investors in making informed crypto investment decisions.