Crashing AMP's class actions party

It’s shaping up as arguably the biggest commercial legal battle that has ever taken place within Australia, and one that’s destined to clog up some of our courts for a long time.

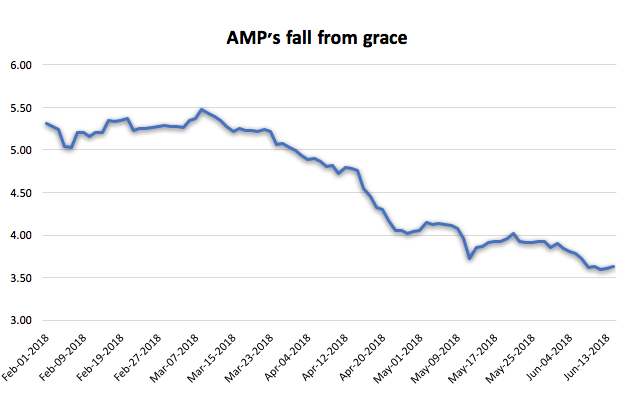

On one side is the financial services giant AMP, a company still bleeding heavily from a series of scandals that have recently claimed the scalps of its chairman, Catherine Brenner, chief executive officer, Craig Meller, and wiped off around 35 per cent of its market value since March.

In startling evidence to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, AMP admitted it knowingly charged customers fees for services it didn’t provide, and that senior advisers and executives deliberately misled the Australian Securities and Investments Commission on repeated occasions.

Now, AMP is being attacked by a veritable army of specialist class action lawyers, backed by powerful commercial litigation funders, on behalf of thousands of disgruntled shareholders seeking recompense.

Which is where things get really interesting. AMP is not just being sued through just one class action. On the contrary, it’s having to deal with five separate class actions that have been lodged in both the Federal Court of Australia and the Supreme Court of NSW.

That’s a new record in Australian legal terms. Never before have so many class actions been launched against a single company here. And that is adding to calls for a total rewrite of the existing laws governing the lodgement of competing class actions in Australia. Are competing class actions justified, or are they an abuse of the legal process and potentially detrimental to the very shareholders they are meant to be protecting?

All of the AMP class actions essentially cover the same ground, except that the dates clarifying which AMP investors are eligible to join the actions varies slightly between the different claims lodged. Most have a starting date for owning AMP shares in April or May 2013, and an end date in May 2018. But the fundamental claims against AMP in the various actions are the same – that it breached ASX Listing Rules and the Corporations Act.

Counting the fees

So, why do we have five AMP class actions on foot? Well, it doesn’t take Einstein to work that one out. One class action, by one legal firm and one litigation funder, equates to securing a big share of the spoils should they be successful. But one class action, shared with a group of firms and funders, means there will be much less to go around.

The five firms suing AMP can rightfully be classified as serial class action litigants. Collectively, they’ve sued hundreds of Australian companies and won hundreds of millions of dollars along the way.

In the mix is heavyweight law firm Slater and Gordon, which has teamed up with the Jersey-registered litigation funders, Therium. So is Maurice Blackburn, which has partnered with Singapore-based International Litigation Funding Partners. Meanwhile, other class actions have been lodged by Shine Lawyers and its UK-based funder Augusta Ventures; Quinn Emanuel and another UK-listed funder, Burford Capital; and by Phi Finney McDonald and ASX-listed litigation funder IMF Bentham.

It’s a legal feeding frenzy in every sense, because the potential financial stakes are so high. If AMP loses, it will have to pay out huge sums in compensation to the litigants, including the conjoined shareholders.

To entice as many AMP shareholders to sign up with them as they can, some of the law firms are operating on a no-win, no-fee basis. At least one litigation funder has trimmed its potential commission rate to 10 per cent of any damages awarded.

A week ago, AMP went to the Federal Court seeking orders to have all the class actions consolidated and moved to the Supreme Court of NSW. That’s because the Supreme Court has already held a directions hearing on the Quinn Emanuel action, in which AMP agreed to file its defence to the court by July 20.

Quinn Emanuel also agreed to establish a common fund for its class action, whereby all group members will pay a portion of their recoveries to the litigation funder Burford Capital as consideration for its funding of the class action.

But, in a system where legal precedents mean everything, Justice John Middleton of the Federal Court is now waiting on the outcome of an appeal against a landmark judgement in late May on the issue of competing class actions. In that ruling, involving three competing actions against the logistics software company GetSwift, another Federal Court judge did rewrite the legal books by ordering that only one class action against GetSwift could proceed. The other two were permanently stayed.

The outcome of the GetSwift appeal has huge implications for AMP and its five legal opponents, and for other live cases. If the appeal fails, in future only single class actions will be permitted.

A class actions explosion

To commence a class action, there must be seven or more persons with claims against the same defendant; the claims must be in respect of, or arise out of, the same, similar or related circumstances; and the claims must give rise to at least one substantial common issue of law or fact.

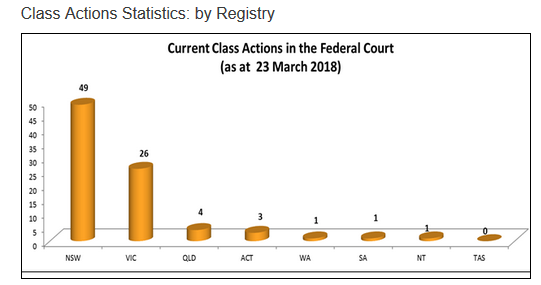

At March 23, 2018, the Federal Court had more than 85 class actions underway across Australia against corporations, governments and other entities, including 45 in NSW and another 23 in Victoria. Add to those the five actions currently on foot against AMP, plus the three against GetSwift. Separately, commercial class actions have been launched in various Supreme Courts around Australia.

Various class actions have been launched against the Commonwealth Bank following Austrac’s investigation into more than 50,000 breaches of money laundering and terrorism financing laws. Earlier this month CBA agreed to pay a $700 million penalty to resolve Federal Court proceedings relating to the breaches, the biggest civil penalty in Australian history.

There are also two class actions against transport and logistics giant Brambles alleging the company made misleading and deceptive representations to the market and also breached its continuous disclosure obligations. Then there are a hoard of single class actions against other major top 20 blue-chips including ANZ, NAB, Westpac, BHP, and Woolworths.

Bannister Law is running a class action against Ford over defective motor vehicles, and separate actions against Volkswagen (Maurice Blackburn also has a class action running), Dick Smith, and Sandalwood harvester Quintis.

More recently the investment group Blue Sky Asset Management has come under attack.

After being called out by US-based short seller Glaucus for allegedly overstating its asset values, this week Blue Sky flagged almost $60 million in potential losses and wrote down the value of its fee-earnings assets by $688 million. Since January its share price has dropped from almost $14 to below $1.80.

Blue Sky is now the subject of three class actions, from Shine, Gadens and another firm, Piper Alderman. The GetSwift appeal outcome will also be crucial in determining whether all three cases against Blue Sky can proceed.

When it comes to class actions, there’s no shortage of law firms behind them. According to the Australian Law Reform Commission, there are 43 firms operating in the Australian space.

But the big three dominate. Slater and Gordon currently lists 25 live class actions on its website, Maurice Blackburn 29, and Shine a further 24, including investigations it’s conducting that haven’t yet led to formal class actions.

A win-win for lawyers and funders

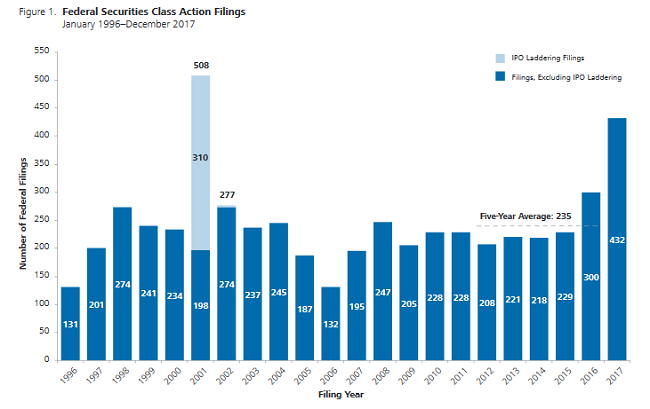

A report early this year from Nera Economic Consulting examined the growth of class actions in the United States over 2017, finding that the number of shareholder lawsuits rose by 44 per cent to 432.

“We're seeing generally an increase in what I would call smaller cases, which are ‘poor quality’ lawsuits often being dismissed or settled for pennies on the dollar,” commented one US corporate lawyer on the results. “Securities litigation for companies large and small has become common.”

There’s no doubt Australia is heading in the same direction, but aggrieved investors need to give them careful consideration before joining them.

There’s no doubt Australia is heading in the same direction, but aggrieved investors need to give them careful consideration before joining them.

An article published last year by Vince Morabito, Professor of Business Law and Taxation at Monash University, highlighted the case of a 2016 class action launched by the employees of collapsed Victorian auto parts maker Huon Corporation.

After months and months of litigation in the Supreme Court of Victoria, all of the estimated $5 million that was to be paid to Huon’s workers under an insurance claim was absorbed by legal and other professional fees. Almost $1.85 million went to the litigation funder, LCM Litigation Funding.

“The trustees eventually won the legal battle; but when it came time to distribute proceeds, the employees got nothing. Not a cent.”

He also cites the class action relating to the collapse of agribusiness company Great Southern Plantations, in which investors retrieved just $3 million from a $23.5 million class action settlement.

The Victorian Law Reform Commission (VLRC) has been examining the role of litigation funders and group proceedings since July last year, and has just has delivered its report on Access to Justice: Litigation Funding and Group Proceedings to the State’s Attorney-General. Its findings are due to be tabled shortly in the Victorian Parliament.

In its submission to the VLRC, the Australian Shareholders’ Association said it regarded class actions as helping to provide for access to justice for shareholders who would not otherwise be able to access legal assistance to secure redress for corporate misconduct.

“Class actions can assist in creating a more ‘level playing field’ between plaintiffs and very large, well-resourced corporate defendants. The Australian Securities and Investments Commission (ASIC) is on the public record as noting that class actions are a complementary private enforcement activity to its own regulatory role.”

Finding a legal balance

Yet, as with everything, there needs to be the right legal balance when it comes to class actions.

They are expensive to run, and for companies to defend, and as detailed above, sometimes shareholders are last in line when it comes to receiving compensation. In some cases, especially with smaller companies, one would have to question the financial capacity of the company to both defend itself in one or more courts, and later dole out big compensation payouts to shareholders and their legal teams.

A separate consequence is that the increase in the number of class actions in Australia has triggered a sharp rise in the cost of directors’ and officers’ insurance. For smaller companies, these ongoing insurance costs are a significant expense.

AMP has vowed to fight all the class actions against it “vigorously”, and to prepare its defence it has assembled its own regiment of high-powered commercial lawyers from Herbert Smith Freehills and senior barristers. It’s going to be massively costly, especially if AMP does have to fight five cases simultaneously.

On face value, as the high legal bills are racked up, AMP will be digging deeply into its large legal war chest to pay them. But there’s little doubt that, as legal proceedings wear on, all AMP shareholders could end up paying a financial price, one way or another.

Indeed, AMP will be a great legal case study down the track, not only in terms of its evident failings in corporate governance at the very highest levels of the company, but also in helping to define the future framework for class actions across Australia.

For the prosecuting legal firms and litigation funders behind them, not to mention all the big city firms and top barristers brought in to fight them, the fees bonanza will be epic. But 2018 could be the class actions turning point that's sorely needed.

Have a great weekend.