Coal's crippling demand roadblock

Australia’s coal mining sector has been hit by an incredibly rapid turnaround in fortunes personified by the rapid rise and fall of coal cowboy Nathan Tinkler, profiled in Monday’s Four Corners.

Within the space of little more than a year it has gone from boom to breaking point.

The reason is superbly illustrated in our chart of the week from the Goldman Sachs report, The window for thermal coal investment is closing.

Goldman Sachs states that demand for coal in power generation will be gradually eroded due to three global trends:

1. Environmental regulations that discourage investment in coal-fired power plants in OECD countries, and to a lesser degree in non-OECD countries as well.

2. Strong competition from gas and renewable energy, partly driven by the shale gas revolution on the one hand (with other regions poised to emulate the success of US producers) and the maturing of wind and solar technology on the other hand (for instance in China, Europe and the US).

3. Improvements in energy efficiency at the macro level (e.g. lower electricity demand per unit of GDP) and in the power sector (e.g. lower coal burn per unit of electricity).

The Australian coal mining sector has been riding an incredibly long-lived boom in seaborne thermal coal demand growth, which commenced at the turn of the millennium. Even the GFC did little to hinder it, with robust growth following 2008.

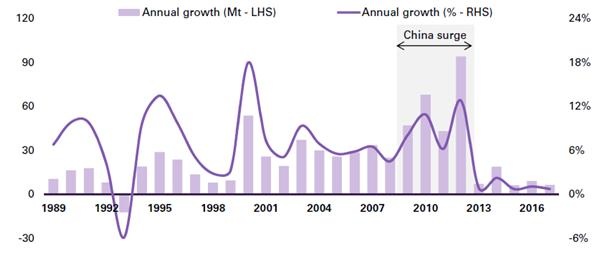

But as the chart below illustrates, it came to a screaming halt this year, and according to Goldman Sachs, it won’t recover. Its analysts expect average annual growth of 1 per cent between 2013-17, compared to 7 per cent in 2007-12.

Seaborne Thermal Coal Demand – annual growth

Source: Christian Lelong et al of Goldman Sachs with International Energy Agency data.

Australian coal producers had been riding a once in a lifetime boom, turbo-charged by China moving from an exporter of coal to an importer.

But China has changed tack almost on a dime.

Firstly, the central government decided to rebalance the economy away from industrial production and capital investment towards domestic consumption. Power demand growth dived and coal demand growth dropped even more, while renewables continued to grow.

In addition it has consolidated its own coal mining sector into bigger, safer and lower cost mines that reduce the need for imports from overseas.

Lastly, it is slowly moving to address the distortive free-ride that coal has been given. This is about more than climate, it’s also about health and removing economically inefficient subsidies.

A recent study published in the Proceedings of the National Academy of Sciences provides an extraordinarily stark example. During the 1950–1980 period, the Chinese government established free winter heating of homes and offices via the provision of free coal for fuel boilers in cities north of the River Huai.

Cities north of the river suffer from cancer-causing airborne particulate levels 55 per cent higher than those south of the river. The end result: the 500 million residents have lost 2.5 billion years off their life expectancy relative to those living south of the river.

Without China things are look very bad for coal exporters, according to Goldman Sachs. While Goldman believes demand for coal from India and other countries in Asia will grow strongly, this is significantly offset by declines in the developed world.

The analysts conclude, “seaborne thermal coal demand could peak in 2020, and this will undermine the profitability of growth projects in the current project pipeline; the window for profitable investment in thermal coal is gradually closing.”