Carr's Call: Why healthcare is unhealthy

PORTFOLIO POINT: The healthcare sector has had a great run through 2012, but it’s time to get out before the big stocks catch a cold.

As Eureka’s last publishing day, this is my final note for 2012. So I thought it might be worthwhile to look at some of the trends that we saw develop in the domestic equity market and see if there is something we might learn from that.

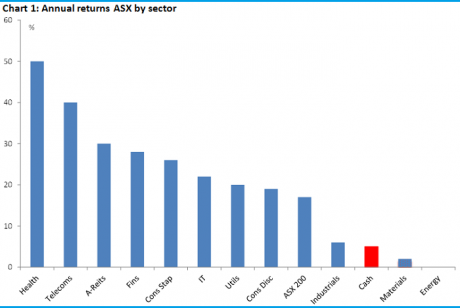

We know the broad story, and I put a table up on Monday (Eight investment lessons from 2012) that summarises returns to date across the various sectors on the ASX.

As you can see there is a visible trend towards defensives and yield. Health stocks in particular have been the key outperformer of the market, although they pay no yield to speak of, and if you stuck with that well done. If you recall I had urged a switch out of the low-yielding sector into telecoms and financials (around mid-year). I don’t regret that, as neither of those alternative sectors have done badly. It was peace of mind, more than anything, although I concede that taking the 10-20% outperformance would have been nice.

That said, and to the extent that I would have switched out of health mid-year, this is doubly the case now. I’d go so far as to say the sector’s performance reflects nothing other than a good old defensive bubble – and of all the bubbles out there right now, this is the one most likely to burst in 2013. For me, it’s time to get out.

Now the health sector by and large is made up of four stocks – CSL, ResMed, Ramsay Health Care and Sonic Healthcare – which together account for roughly 85% of the index. They’ve all had a good run this year, but the relative outperformance of the index vis -a-vis telecoms, financials or even A-REITS has been largely due to one stock: CSL. By itself, CSL is 55% of the index and over the last year provided 75% of the gains overall, rising almost 70%. ResMed isn’t too far behind, but is a much smaller weight. My point is if healthcare stocks are to again outperform over 2013, you really need to see the exceptionally strong performance of both these stocks to continue.

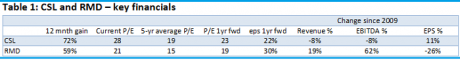

Up front, both CSL and ResMed are great companies and earn good money, with revenue growth over the last year about 7% and 16% respectively, and that’s all great. However in the case of CSL this isn’t that different from what it earned in 2010, and is lower than what it earned in 2009, when the stock was 40% cheaper! Then consider EBITDA is 8% lower over that period and the current price action doesn’t make a lot of sense to me. I mean, even earnings per share is only 10-11% higher now than what it was in 2009.

It’s not surprising then that the p/e – 12-month trailing – is at a record high (28) and by some margin compared to the average (19). Now earnings growth estimates vary (from what I’ve seen between 10% to over 20%), but even if this eventuates (taking the mean of 22%) the stock would still be expensive at its current price with a p/e of about 23 (that’s the one year forward p/e). In fact you’d need to see earnings growth of 50% or so to justify the current valuation.

You can see a summary of these stats for both CSL and ResMed in table 1 below.

Am I nervous about this call? Yes, I am to be honest. The Australian market is extremely pessimistic. Having said that, and like the government bond market, the risks to health stocks are just too high. The reason? You can’t justify the price based on fundamentals alone. I personally wouldn’t touch them then, as the gains themselves don’t make sense – they are based on irrational exuberance, or maybe irrational pessimism. The truth is, because it’s so difficult to justify the price surge based on fundamentals, CSL and healthcare stocks more generally have lost their defensive characteristics. That the sector is so exposed to a correction makes it one of the riskiest equity investments around, just like government bonds. At the very least investors need to ask whether it is likely that healthcare stocks have another 50% in them, 30% or even 20%?

Now, on my macro view of both Australia and the globe that I’ve outlined over the last few months, I suspect 2013 will see another strong performance by our banks and miners – with stocks in the building and construction space set to outperform. Even some of our discretionary retailers like JB Hi Fi will do well if I’m right, and many of these stocks are very cheap.

Not everyone agrees with that view though, although to be honest, with healthcare stocks already extremely expensive and cash yielding you nothing, it’s going to be very difficult to play a defensive hand in 2013. But for those who insist, and compared to stocks like CSL, Telstra looks to still have value. It’s on a p/e of about 14 (only a bit above the average of 13 since 2007), offers great yield and, unlike some the large healthcare stocks, is still generally growing revenue. If forecasts are accurate, and often they’re not, Telstra’s eps will fall 8% over the next year. Even so, a p/e of 14.7 (which is what it would rise to) still offers better value compared to CSL and ResMed.

Woolworths is another stock I put in that space. At a p/e of 15 it is cheaper (average since 2007 is nearly 18), it has had reliable and consistent revenue growth as well as eps growth – and pays yield. For me, it is a no brainer for defensive outperformance in 2013, if we do indeed end up going that way.

Banks, as I mentioned before, will do well either way and I don’t buy into the growing pessimism on either their ability to pay yield or prospects more broadly. We are at the bottom of the credit cycle (three to five-year view) – and that’s not asignal to sell.

Merry Christmas and see you in 2013.