Carr's Call: Retailers losing bargain appeal

| Summary: Poor sales results among listed retailers, in conjunction with their current price earnings multiples, raises questions over the sustainability of the rally in the discretionary retail space. This isn’t a market that will sustain a premium for too long. |

Key take-out: JB Hi-Fi’s key advantage over other discretionary retailers with positive sales and EPS growth is that it is still comparatively cheap. |

| Key beneficiaries: General investors. Category: Growth. |

The surge in the Australian stockmarket through the 5000 point barrier today was another strong signal that investors are back in shopping mode.

But, when it comes to listed discretionary retail stocks, the buying signals are still mixed. There are definitely some bargains out there, but in a tough sales climate stock shoppers need to be quite discerning.

Investors in electronics retailer JB Hi-Fi (JBH) are enjoying good upward momentum right now. Its recent gains have been nothing short of remarkable – up 18% over two days at the time of writing.

This is especially remarkable following what was a cautiously optimistic outlook by the company, and quite modest revenue growth of 2.3% (less than half the previous year’s growth). I mean retailers everywhere keep telling us that conditions remain challenging, and even JBH’s chief executive seemed surprised at the spike – noting that short-covering by hedge funds may have been responsible for the price action.

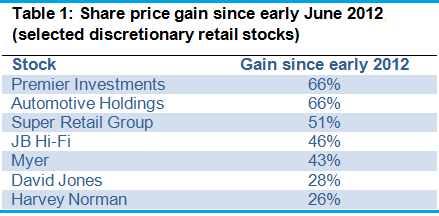

That said, it is a widely held view that the current rebound in sentiment may lead to a generalised re-rating of the discretionary retail sector. So what to do? Short-covering to my mind is hardly a basis to become excited over a stock or a sector more broadly. Moreover, and since my call in June last year that the retail sector had bottomed, we’ve already seen substantial gains in the discretionary space, with the sector as a whole rising 26% (just above the market average). These indexes (dominated by media stocks) hide some truly stunning performances in the retail space though, and some stocks have outperformed their index by two to three times. See table 1 below.

This is an outstanding performance given the negative sentiment (at least rhetorically, sometimes more) toward the sector. The question to my mind is whether these stocks have now done their dash and whether any re-rating will be nothing more than analysts catching up to the price action. Consider that the Australian Bureau of Statistics’ monthly retail survey paints a very bleak picture of retailing, with sales down in three consecutive months to December and only 2.3% higher for the year. Company accounts in the discretionary space aren’t universally as bad, but there is a mixed picture there – an obvious skew.

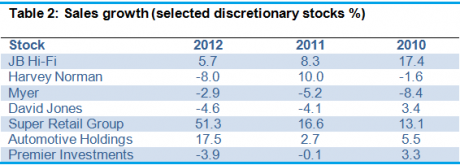

As the table shows, sales growth from some of the large discretionary stocks has been abysmal – especially the large department stores Myer and DJ’s – and Harvey Norman has had a hard time of it also. Conversely, Super Retail Group (who own Amart Sports, Rebel Sport, BCF, Ray’s Outdoors and Super Cheap Auto) have strong sales growth, as has Automotive Holdings.

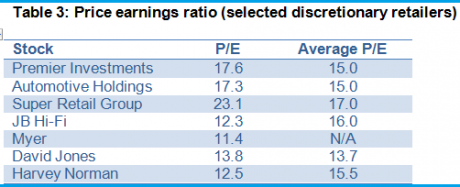

Anyway, it is sales results like these in conjunction with price earnings multiples that make me question the sustainability of the rally in the discretionary space (see table 3 below).

Take Premier Investments – the star performer over the last six months, rising 66%. The problem is it has had declining sales over the last two years. EPS growth has surged, sure, but again this isn’t sustainable without a solid foundation in revenue. Cost cutting can only go so far.

Elsewhere, one of the more impressive performers, Super Retailing Group, has had a great run (up over 50%) and looks to be a great stock on a paper. Certainly it has a solid history of strong revenue and EPS growth. Having said that, it’s all built into the price already, with a P/E of 23. Indeed, even if it manages the same EPS growth it recorded last year (8% or so to June 30) the stock would still be expensive at 21. Double EPS growth to 15% and the stock is still at a P/E of 20. I would certainly look to buy this stock on any dip, but at the moment too much is priced in and it is exposed to any earnings disappointment. This isn’t a market that will sustain a premium for too long.

Myer and DJ’s I simply wouldn’t touch. They’re not expensive relatively, but neither are they cheap – and they should be cheap with the revenue and EPS growth they’ve got. They need to be cheap for me to buy their stock, and there needs to be a turnaround story, something to lift their revenues. But I’m not seeing that.

It’s a similar story with Harvey Norman. This stock needs a turnaround story. It doesn’t look expensive on a trailing basis or anything, but unless it does something to arrest declining revenues and EPS, then the fact is it is going to look expensive. EPS has declined in three of the last four years, which if repeated leaves the stock with a P/E closer to its average – too high for its earnings performance.

This is where JBH comes into its own. For me there is better value in this stock – even after this week’s rally. I don’t doubt that price deflation will continue to weigh on results, not only for JBH but also for others, and a return to double-digit revenue growth is unlikely in the near term, despite an abatement in deflationary pressures (and the stabilisation of the A$).

But, when you look at its books, JBH has consistently positive, albeit somewhat lower sales growth, and generally positive EPS growth. Moreover, its key advantage over other discretionary retailers with positive sales and EPS growth (admittedly not in the same space) is that the stock is still comparatively cheap with a P/E of about 12.2, which compares to an historical average of 16.

The current sales trajectory of 2.3% actually suggests a P/E of about 11.8, or if you want to take the company’s own profit guidance, a P/E of between 11.5 and 11.8. That’s very low and to ‘correct’ to today’s multiple implies further upside to JBH of between 3% and 6%.

That assumes no multiple expansion though, which probably is a little unrealistic. If it was true to say that JBH was one of the most heavily shorted stocks in the market, then you can safely assume some modest multiple expansion as this pessimism unwinds. What would be a reasonable multiple in that environment is anyone’s guess.

I doubt the market is in the mood to pay a premium, and so taking the admittedly arbitrary P/E of 13 (still some way below the average) would give you further gains of about 9-13%. Not too bad, and if multiples return to average (a reasonable best case assumption) then you’re looking at gains between 20-25%. On that basis I think a reasonable upside is probably between 10% and 25% from today’s value ($14.2 to $16.15), which is still 30%-40% below its 2009 peak.

To conclude then, I think many discretionary retail stocks have indeed done their dash. Either they are lacking the revenue or EPS growth to justify current multiples, or the earnings growth, and are simply too expensive. The exception is JB Hi-Fi, which is my pick among the larger discretionary retailers and certainly the stand-out in its space. In executing strategy it has proven success, so I remain confident as it branches out into household goods – more to the point, it is still cheap, which is rare among that sector.