Canberra's chaos masked some big events

Summary: Last week was big in Australia, but there was a lot happening in global markets.

Key take-out: US interest rates are likely to rise in the future, but it will be done at a relatively slow pace.

While we were all concentrating on the melodrama in Canberra, a number of highly significant events were taking place in the US and other parts of the world.

It is likely that many Australians missed the developments, but they have certainly grabbed the attention of world markets.

The Fed and the President on the same page?

The first development came during the famous Jackson Hole Conference, where new Federal Reserve Governor Jerome Powell strangely seemed to align himself with President Trump.

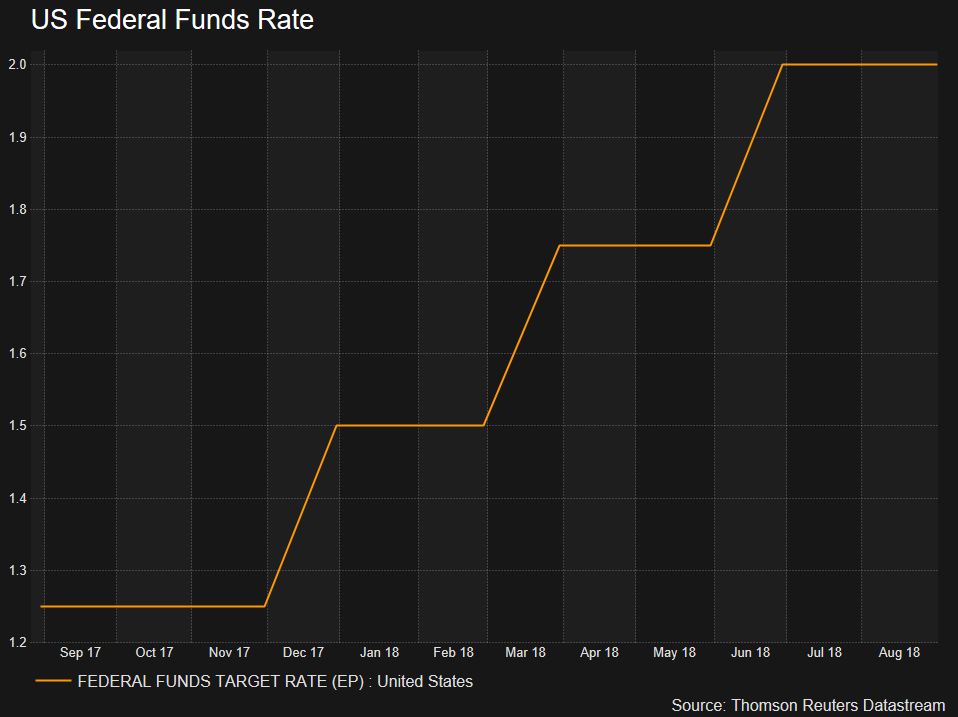

He emphasised that he wouldn't plunge the global economy, or indeed the US, into recession in the foreseeable future. This means he will be very careful in the way he lifts interest rates. They will rise, but the rise will be gradual and in line with the strength of the US economy.

To put it differently, you could say the relatively loose monetary policy will continue into the years ahead, which is exactly what Trump has been predicting and advocating.

In months gone by, the US President has given the Federal Reserve a mild rap for endangering his ‘Make America Great' campaign.

The Americans seemingly now have everybody kicking in the same direction, and Wall Street loves it.

Movements in metals and bond markets

We also saw rallies in the gold and base metal markets, including the much-maligned copper business. This week, those rallies corrected, but copper kept advancing.

If world activity is to remain strong, copper will have to participate. Copper bulls have taken an enormous beating, and I suspect there are plenty of shorters out there. I have been a copper bull for a while, and while I haven't lost money, I also feel a bit battered.

Meanwhile, the US bond market continues to offer low yields, with the 10-year bond rate below 3 per cent, and the 30-year bond rate only a fraction above 3 per cent.

There is very clearly a lot of money floating around the world looking for a safe home, and it often settles on US bonds. If Powell exercises restraint on his official interest rate rises, the risk will be lowered, but accepting 3 per cent for 30 years is a very high-risk proposition.

How Trump differs from other leaders

President Trump is totally different to any world leader I have seen before. Let's set aside his personal characteristics and the activities preceding his election for the moment and take a look at what he is actually doing.

Conventional politicians set out exactly what they are hoping to achieve, but Trump does so as a negotiating position, with the trade situation a prime example. He then begins discussing the issue at hand and nobody actually knows his final stance.

He is bringing the skills of a corporate negotiator to the global stage, which completely “offsides” global politicians who don't work this way.

Europeans are now talking about spending more on their defence, but it took a series of negotiating positions from Trump to make them think this way. The Mexicans are close to clarifying NAFTA, a situation in which Trump made many outlandish anti-Mexican negotiating statements as part of his approach.

He took similar steps with Canada, although the Canadians are going to wait to see what happens to Mexico.

When it comes to China, he is taking the same approach, but it is much more difficult and dangerous because the Chinese are much more entrenched in their long-term positions. There is also the question of “face”. It is actually possible that there will be an all-out trade war between the US and China. That's a big danger for Australia, and usually when the situation worsens, our currency falls.

Meanwhile, the Chinese are making their own internal changes, as they look at ways to reduce their pollution. I think they will want better raw materials for their metal production, as they aim to lower pollution rates. That represents good news for mining companies like BHP and Rio Tinto.

Australian market restrained by banks and housing prices

Back home, we see the enormity of the opinion poll gap new Prime Minister Scott Morrison and his Treasurer Josh Frydenberg must narrow. They can certainly gain traction via the franking credits debacle and by embracing a proper small business policy, but energy is a quagmire, and they will need to find a vision for the nation to break out of the current mire.

There is no sign of this at present. Nevertheless, there will be no leadership challenges between now and the election, so that source of instability has been removed.

Given the mess, a Morrison/Frydenberg combination – neither of whom were part of the leadership spill plotting – is probably the best the Coalition could have expected.

In theory, our market should be performing better than it is given the strength on Wall Street, but the anchor is, of course, the big four banks and the fact that house prices are slipping.

We now have a situation in which 40 per cent of home owners are locked in their present house because if they were to sell, then try to move into a similar dwelling elsewhere, they would find it difficult to re-negotiate a new bank loan. This is because the banks have slashed the amount they will lend to individuals by about 30 per cent.

I emphasise that the 40 per cent ‘loan prisoner' rate is very different to problem loans. Many ‘loan prisoners' are ahead in their repayments, and are not classified as problem loans. They also probably don't realise that they would not be able to borrow their current level of debt if they entered the market now.

Accordingly, they feel trapped. Many do understand though, and they either drive longer distances to work or accept less rewarding jobs, with all this happening against the backdrop of drifting house prices. Add to that the increased regulations which will come out of the Royal Commission, plus stronger regulators, and it will not be a good time for banks.

In this environment, their rankings in the total market capitalisation table will likely fall, holding back the Australian market in the process. However, our miners should do well in such an environment.