Can the Aussie dollar carry on?

The recent change in the Reserve Bank's policy to a neutral setting has been a major reason why the Aussie dollar has rallied in March.

In addition some are pointing to a better-than-expected outlook for Chinese GDP, and a pick-up in eurozone inflation. Yes all of these factors, including a weaker greenback, have played some role -- but they are yesterday’s news. As we know these things can unravel rather quickly, with politics sometimes overriding economic developments. I fear this could be one of those times.

Escalating tension surrounding the Ukraine has created tension in financial markets too, with the well-worn phrase “risk appetite” making a strong comeback. But isn’t the Aussie dollar known to go up when risk is “on” and down when risk is “off”?

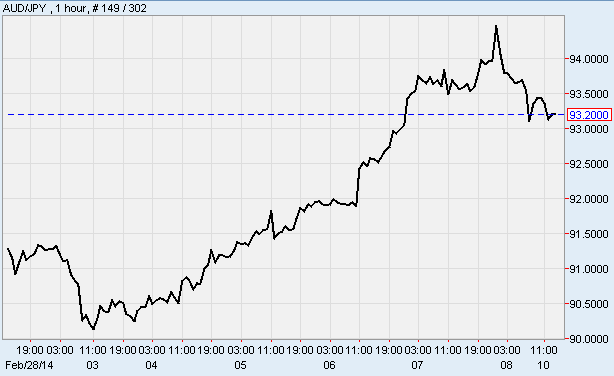

The situation in the Ukraine is generally seen as supporting a risk-off environment, with history telling us the US dollar and Japanese yen should go higher while the Aussie dollar goes down. Well over the last week not only has the Aussie dollar gone up 2.5 per cent against the US dollar, it is up 5 per cent in trade versus the yen, which has weakened considerably.

Source: ozforex.com.au

The AUD/JPY cross rate is considered to be a good barometer for risk appetite and a favourite for the “carry trade”. This is where investors and/or traders seek to take advantage of cheap Japanese denominated cash (borrowing in Japanese yen) to hold the higher-yielding Australian dollar denominated asset.

The Reserve Bank’s move to a neutral stance has seen a re-emergence in the carry trade as expectations of further interest rate reductions in Australia are hosed down, but there are some signs this trend is starting to reverse.

Not only do we have risks underscored by poor Chinese trade and inflation data out over the weekend, we also have Australian employment data out this week that could see sentiment toward the Aussie sway.

Even if these factors don’t prove to be negative, the market may just get a rude surprise in coming weeks -- especially if Putin keeps pressing on. The carry trade works best when there is a positive risk environment. In the absence of such sentiment, the carry trade may quickly lose its appeal.

Jim Vrondas is Chief Currency strategist, Asia-Pacific at OzForex, a global provider of online international payment services and a key provider of Forex news. OzForex Group Limited, is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".