Can smart grids save us from the death spiral? - Part II

This is the second article in a two-part series. For part one, click here.

The electricity demand 'death spiral' is not really a new phenomenon, nor is it restricted to electricity. New technologies in telecommunications have seen a similar pattern over the past 20 years, impacting the ability of telcos’ to recover fix line network costs. This trend was, and continues to be, irresistible as the delivery costs of new services decline.

The 'death spiral' and its causes

So how does this and the smart grids (covered yesterday) relate to the death spiral? This death spiral is not with us just yet, but is forecast based on the fact that electricity demand in the National Energy Market has been declining and some expect it to continue to decline. The demand decline in has been observed since 2008 and is believed to have been due to:

1. Growth in PV panel installations, now at 2.5GW and rising, albeit more slowly perhaps.

2. Response to rapid increase in retail electricity prices, domestic and SME.

3. Decline in manufacturing attributed to the Global Financial Crisis and the high Australian dollar.

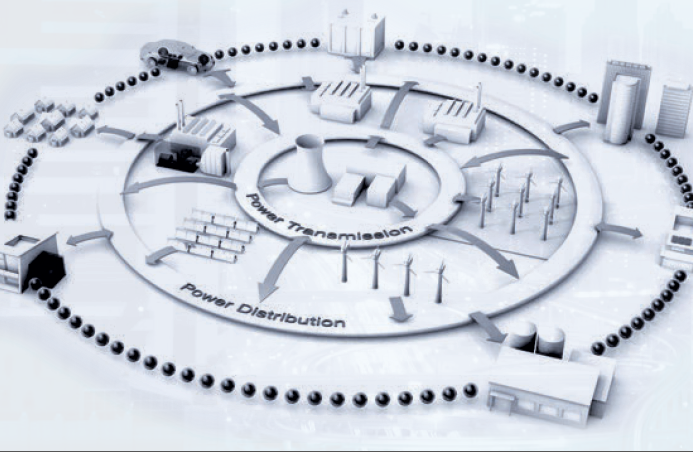

Mike Sandiford of Melbourne Energy Institute documented the energy decline nicely in several articles. This decline poses a problem because electricity provision is mostly a capital fixed cost business. As much as 90 per cent-plus of the cost of electricity delivery is made of capital costs of generating power, and maintaining and upgrading distribution and transmission networks. This means the costs of electricity delivery remain largely fixed even when energy throughput declines.

Smart metering business models

First, there is the matter of smart meters and their rollout in Victoria. The rollout was rather a messy affair and has given the whole smart grid space a bad reputation. This is unfortunate as smart-meters are a crucial enabler of the smart grid, as they are needed for constructing new tariff pricing structures by helping regulators and utilities identify more precisely how much each consumer contributes to the cost of providing electricity.

There are two commercial models that the way forward for utilities and, particularly, distribution network service providers and point us to the answer to the death spiral question.

1) First is the model whereby the utilities continue to own their meters which form a part of their regulated asset base, allowing them to earn an almost risk-free return on this new infrastructure. The trouble with this model is that it fits long-lived assets where the technological change is slow – such as poles and wires and substations – the technologies behind which have changed minimally in nearly 100 years.

2) The alternative is the contestable services model chosen by the Victorian government and which will begin by the end of 2016. That is, the installation and management of smart meters services will be open to the free market. Retailers and others will be able to compete and interface directly with the customer in offering metering services. This puts smart meters in the same realm as retail tariffs and packages such as bundled solar panels and electricity contracts provided by AGL, Origin Energy and others.

Solution? Back to the future…

So, we now return to smart grid. What can it offer utilities and consumers by way of a solution? Can it stop the potential death spiral?

The answer rests in the nature of the business model chosen by distribution businesses, and is relatively straightforward. If the customer-side of the smart-grid works as promised, the demand shape will flatten leading to the increase utilisation of the grid, but only if demand grows again. If it does not, then there is the risk of stranded assets. Therefore the most prudent risk mitigation strategy for utilities seems to be to hedge their bets and start a contestable smart grid business.

New tariff structures are also a key part of the answer. Particularly critical peak pricing or, my personal favourite, a mixture of kWh and demand pricing. In demand pricing, a portion is made up of a peak demand charge, which sets a price on the highest half-hourly demand (in kilowatts) over a period such as a week. This means that they are charged according to their highest need, not for volume.

Will this save them from the death spiral? Yes and no. Yes if they can fit the essentially open market nature of customer-side smart grid technologies into their business model, and if demand still goes up. And no, if they don’t, and demand doesn’t go up t. Electric vehicles are the key wild card in this equation. They could also save the utilities.

What about consumers? Well, their prices are intimately tied to distributors' costs and volumes. So lower costs means lower pricing for a given volume. But volumes can also mean consumer peak (kilowatt) demand we use demand pricing. If we switch to demand pricing, it is harder for consumers to avoid the costs. This is fair if as there would be times when their smart grids cannot deliver the capacity they need.

Can we quantify the benefits of demand control? Yes. Enernoc, the provider of demand response, commissioned Carbon Market Economics (CME) to quantify the benefits of demand response. CME found significant saving potential if even a relatively small portion of peak demand, or the last 3000MW of NEM demand, which occurs for about 100 per year. The present value of avoided capital expenditure across generation, transmission and distribution assets was found to be around $15.8 billion, which would mean electricity prices would be 9 per cent lower than they would otherwise be.

In this very early stage of the development of the smart grid, it is hard to know how things will evolve. However, future outcomes depend on decisions made, or avoided, right now. The federal government through the Australian Energy Markets Commission, has the opportunity to help the transition to new technologies be as smooth as possible while protecting consumers.

As we pointed out yesterday, inaction is not an option. The market will still do its thing. We don’t really want our energy industry to be another Blackberry or Nokia.

Dr Ariel Liebman is a senior research fellow and director of Energy and Carbon Programs at the Faculty of Information Technology, Monash University. Monash is running an industry focused Smart Grids short course in November. For more info click here.