Buyer beware of the house market bandwagon

Property investors are licking their lips. Interest rates are low, prices are booming and construction is on the mend. Should you get on board the housing market bandwagon?

You may have already missed the boat.

According to RP Data, dwelling prices rose by 1.3 per cent in October to be 7.9 per cent higher over the year. Growth has been particularly strong in Sydney, which is up by 11.6 per cent over the year. Auction clearance rates are through the roof and lending has picked up. Couple that with low interest rates, foreign investment and SMSFs, and you have a perfect storm for house prices.

Except it isn’t.

What investors and owner-occupiers need right now is a sense of perspective and a little bit of context. First, dwelling prices are effectively anchored to income and credit growth. Second, the Reserve Bank is likely to increase the cash rate in 2014. Third, foreign investment in Australian property is almost negligible.

Buyers need to ask themselves: is this growth is sustainable in the future? And if not, should they enter the market at all?

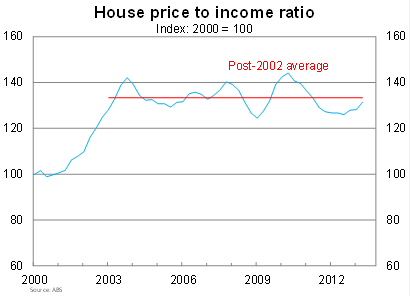

As the graph below shows, dwelling prices have increased by around the same pace as household disposable incomes for the past decade. Unfortunately for buyers, the outlook for income growth over the next couple of years is only moderate, reducing the probability of a sustainable house price boom.

For the index below to get back to 140 (roughly its upper bound) by mid-2014 requires further house price growth of around 7.5 per cent. Effectively, buyers are looking at growth of 7.5 to 10 per cent before prices stabilise and then rise at below income growth. For those looking to get in the market, the easy returns are almost over.

Without strong income growth, house prices will be reliant on credit growth to drive prices. But household credit outstanding as a share of gross disposable income has been largely unchanged since 2006. Despite low mortgage rates, the evidence so far suggests households are reluctant to take on additional risk.

Although Australia has not experienced a recession since the beginning of the 1990s, the global financial crisis remains fresh in our collective memories. Coupled with soft growth in the non-mining sectors of the economy, we should expect less credit growth than in previous cycles.

On the other hand, conditions can change quickly and there is always the risk that a lengthy period of low rates will prompt excessive risk-taking. But on balance, the Reserve Bank's cutting cycle is likely over and I expect them to begin hiking rates in 2014.

Moderate income growth and cautious borrowers point towards a temporary upswing in house prices. Rather than a boom, house prices are simply recovering after declining during 2011. To maintain this level of dwelling price growth in the long-term will require bank lending standards to slide, a faster than expected recovery in the non-mining sector, and the Reserve Bank to fail to notice that any of that occurs.

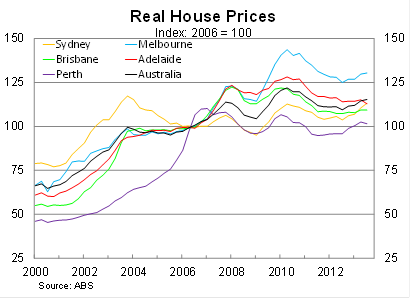

But if you are not yet convinced, here is some sobering data for those looking to get on the housing bandwagon. The graph below shows real house prices since 2000. Sydney real house prices are still below their level in December 2003, while other cities have barely increased since early 2008. They are not the kind of returns that fill buyers with joy.

Despite recent headlines, another house price boom is unlikely to eventuate. The glory days of the 1990s are long gone. Buyers should keep their expectations in check, while also recognising that prices can and do fall – and do so quite frequently.