Budget tinkering will worsen the long-term pain

The Commission of Audit has revealed that the outlook for Australia’s federal budget is bleaker than many believed.

But to create a long-term sustainable budget, the Coalition must look beyond short-term tinkering and address the underlying issues that will one day create a genuine budget crisis.

The Coalition’s Commission of Audit has revealed that budget savings of more than $60 billion a year will need to be found by 2023-24 for the Abbott Government to reach its surplus target. This is based on a much bleaker outlook for tax revenue than during Hockey’s Mid-Year Economic and Fiscal Outlook.

It is a stark reminder of the challenge facing the Coalition, though I’m far from convinced that they have an appreciation of the magnitude of that challenge.

The Commission downgraded the Coalition’s assumption for tax revenues by 2023/24 from 26 per cent to 25 per cent of nominal GDP. Both results would place tax revenue at elevated levels by historical standards.

This is mostly due to ‘bracket creep’, which is a process where inflation pushes income into a higher tax bracket. It effectively operates as a tax increase, though few people recognise it as such.

The Commission’s estimates of revenue are lower because they believe that it is implausible that there won’t be some tax cuts to at least partially offset the effect of bracket creep.

Certainly, tax revenue could shift upwards but without significant tax reform, those estimates from both the Commission and Coalition should be regarded as near the upper end of the plausible outcomes.

The Coalition is set to lay down its first painful budget in May but it is likely to tinker around the edges rather than promote genuine budget reform.

Cuts will be made here and there, but the big reforms necessary to create a long-term sustainable budget are unlikely to feature.

Budget experts will confirm that the long-run sustainability of the budget comes down to three fundamental factors: tax reform, healthcare spending and aged-care expenditure. Everything else is just window dressing.

It is entirely possible that the Coalition may generate a surplus by tinkering around the edges but it won’t be a sustainable one. The effects of rising health and aged-care expenditure will quickly swamp any modest savings from discretionary spending or even non-pension welfare spending.

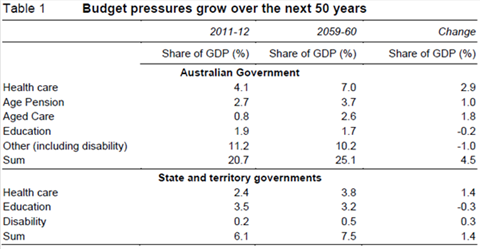

The Productivity Commission has made it abundantly clear that healthcare and aged care services are the two danger areas of the budget over the next fifty years. They estimate that these two factors, based on current legislation, will increase government expenditure by around 7 percentage points of nominal GDP by 2059/60. It will also act to narrow the tax base and reduce tax revenue, so the net effect could be larger.

Realistically there is no amount of cuts to discretionary spending that will offset the massive rise in health and aged care spending. It simply isn’t possible.

Instead the Coalition needs to take a big picture view of spending and taxation. It must assess ways in which they can reduce healthcare and aged care spending without compromising the quality of those services.

Efficiency gains can certainly be made and significant returns could be generated, even if these reforms may not generate significant budget gains in the near-term.

Tax reform needs to be part of the discussion. Former Treasury Secretary Dr Ken Henry produced a comprehensive discussion on tax reform and the Coalition should look to reform the system by relying more on efficient taxes such as land taxes and the GST and relying less on inefficient methods such as company and income taxes.

Massive gains can also be made by addressing a range of selective and differential tax policies.

Research by the International Monetary Fund found that no other advanced country forgoes more tax revenue through “differential or preferential treatment of specific sectors, activities, regions or agents” than Australia. Addressing policies such as negative gearing or the vastly lower taxation on capital gains could help put the Australian budget back in black.

In my opinion, the budget debate is too preoccupied by short-term fluctuations in spending and has lost sight of the structural issues that are of genuine concern.

None of the structural reforms will be easy and most will not prove politically popular. Compounding matters is the fact that most of the benefits of these reforms will be generated years or decades after the current prime minister has left office.

But they are the reforms that need to be made. It is the only way forward and it is time that the debate moved away from tinkering around the edges and instead focused on the more important issues of tax reform, health care spending and aged-care expenditure. If they don’t, then future governments will face a genuine budget crisis.