Budget brings small cap winners and losers

| Summary: The National Disability Support Scheme and additional funding to infrastructure stand to benefit some small caps, while cuts to foreign aid green initiatives will put others on the back foot. |

| Key take-out: The overall number of small cap budget beneficiaries is low, and very few will be substantial winners in dollar terms. |

| Key beneficiaries: General investors. Category: Growth. |

There would have been more than a handful of small cap chief executives who stayed up last night to mull over the federal government’s budget.

You might not have suspected this given that the sharemarket has typically greeted budget week with little more than a yawn, thanks to selective leaks, with the average return on the ASX All Ordinaries hovering close to zero over the past decade.

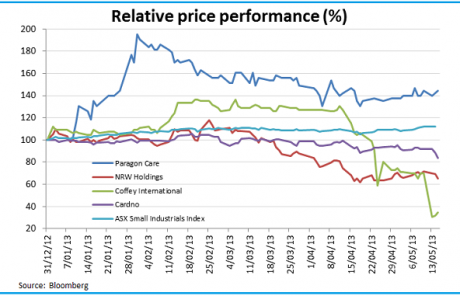

But budgets always create winners and losers, even at the junior end of the market; and there are a few emerging companies that are worth keeping an eye on in that they are directly affected by how Treasurer Wayne Swan allocates government resources for the year ahead.

I’ll start with some winners, even though identifying these stocks is like trying to find loose change behind the dresser: there are precious few, and those you find are generally not material beneficiaries, with the government wielding an axe to spending to plug a gaping $18 billion budget hole.

National Disability Insurance Scheme (NDIS)

However, the grin on the face of Paragon Care’s (PGC) chief executive, Mark Simari, was a giveaway.

The company is arguably the best placed Australian listed company to benefit from the fully funded $14.3 billion National Disability Insurance Scheme, as Simari suspects the scheme will drive demand for the company’s medical equipment, such as wheelchairs, shower trolleys and home care beds and mattresses.

“We will benefit materially from the NDIS,” he said. “We currently supply equipment [to families] through the Department of Human Services, and the $1 million to $2 million [revenue we get from this business] we think might grow to $2 million to $4 million.”

The federal budget is the second tailwind for Paragon Care. The Victorian state budget (released last week) also put the company in the winner’s circle.

The Victorian government reaffirmed its commitment to build the Bendigo Hospital and the Monash Children’s Hospital, and has undertaken a number of new regional medical facility initiatives.

Simari believes the company will hit the top end of its 2012-13 revenue guidance. Paragon Health is forecasting full-year revenue of between $16 million and $17 million compared with last year’s $15.8 million, and net profit of $700,000 to $1.2 million versus a loss of $100,000 in 2011-12.

This puts the stock on an attractive price/earnings multiple of around nine times for the current year, which is three times below other global hospital equipment providers.

The company has undertaken a cost cutting drive, which helped it post a 164.7% surge in net profit to $564,000 for the December half, although sales dipped 7.1% to $9.2 million.

The $9.7 million market cap stock closed flat at 30 cents on Tuesday.

Infrastructure development

Another rare direct beneficiary from the federal budget is NRW Holdings (NWH). Swan is tipping another $3 billion into infrastructure development around the country, which will be used to build new roads and rail networks.

This takes total government spending to $24 billion over the forward estimates, and NRW is probably the most exposed small cap engineering contractor to this given that its civil division contributed around 60% to total revenue in the first half of 2012-13, with the balance coming from mining-related work.

While it is hard to quantify the benefit for NRW at this stage, the group is in seen to be in a good position to at least secure some of the new infrastructure work given its good reputation in executing projects. This might be particularly so in its home state of Western Australia, which has been promised more than $400 million for infrastructure by the federal government.

Any improvement in the outlook for infrastructure development is good news for NRW, as the industry faces a marked slowdown in mining projects due to volatile commodity prices and high domestic costs.

While the budget won’t spark a positive re-rating for the stock or assuage investor fear that it is next in line to issue a shock profit warning, a lot of the bad news is currently priced into the stock after it collapsed 64% over the past year to $1.26 a share.

Consensus estimates is forecasting a 29% plunge in adjusted net profit to $69.7 million from 2011-12 to 2014-15, but the current share price seems to indicate that the market is expecting its bottom line to crash by around 60% over the time period.

Foreign aid

On the flipside, the government’s move to defer the increase in foreign aid could not come at a worse time for Coffey International (COF).

Shares in the professional services consultancy suffered its worst one day sell-off on Monday of 57% to a record low 10 cents when it issued a shock profit downgrade due to a surge in resource project cancellations and delays in just the past two months.

Coffey, which has a market cap of $29 million, cannot count on foreign aid work to provide much of an offset to the slowdown. Around 40% of Coffey’s underlying earnings before interest, tax, depreciation and amortisation (EBITDA) comes from aid work, with AusAID making up a quarter of the division’s fee revenue. The balance comes from US and UK foreign aid work.

A company spokesperson told Eureka Report that Australia’s decision to postpone its commitment to lift foreign aid to 0.5% of gross national income by another year to 2017-18 will not have an impact on earnings, but the news will nonetheless be a further drag on sentiment.

What is alarming is that Australia may continue to step back from its aid target if the budget continues to struggle to get back into the black. Cutting overseas aid is one of the most politically palatable ways to squeeze extra savings for a government running a deficit, and the US and UK governments are probably thinking along the same lines.

Its larger peer, Cardno (CDO), will also feel the impact of any changes to foreign aid spend. But the $820 million market cap company is probably in a better shape than Coffey as it has a more diversified business and can count on its Americas business to offset some of the weakness in Australia.

Further, Cardno’s chief executive, Andrew Buckley, has not noticed any sudden deterioration in business conditions since his company issued a profit downgrade late last year. If anything, there is light at the end of the tunnel.

“For me FY14 looks better than FY13,” he said. “I think things are getting better but they are getting better painfully slowly [and] the people who make decisions on capital projects will probably be sitting on their hands until after the September election.”

Clean energy and carbon solutions

Those running green energy or carbon offset solutions companies are probably looking forward to the election too.

Swan’s sixth budget may have cut funding for a number of green initiatives, but industry is lamenting the missed opportunity for the government to instil a greater sense of confidence about the future for green solutions in this country.

“The more critical issue for us is certainty around government policy,” said the chief executive of CO2 Group, Andrew Grant.

“That is the biggest driver [for our business] and large carbon emitters are just waiting to see the outcome of the federal election and there is no deal flow at the moment.”

Large carbon emitters are CO2’s key clients. The $36 million market cap company’s core business is the establishment and management of carbon offset forestry projects.

This lack of certainty is forcing companies like CO2 to diversify into other areas. The company recently added a tiger prawn farming business and has also expanded into carbon trading, while its smaller $3 million market cap rival, Carbon Conscious (CCF), is also looking at developing alternative businesses.

However, until the sector proves it has at least one viable business to stand on, most investors are likely to shy away.