BUDGET 2013: Who framed the budget bloopers?

In many ways Wayne Swan is taking a spanking at this budget for sins he committed while Kevin Rudd was still in the Lodge.

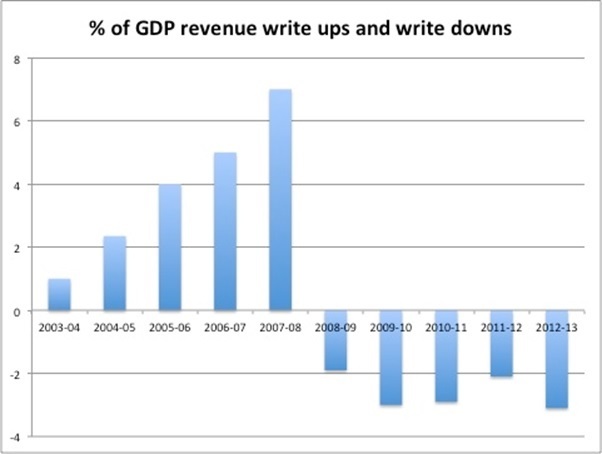

A striking chart accompanying this year’s budget (see below) shows what rotten luck the pair had in inheriting a once-in-a-generation turnaround in Treasury’s forecasting errors – one minute Treasury estimates were quite wrong on the downside, the next minute they were wrong on the upside. Any Treasurer would prefer the former kind of error.

Treasury’s modelling firepower, though considerable, is directed at a thankless task – trying to model domestic economic developments in a wild and unpredictable global environment. It’s a mug’s game, no matter how many economics PhDs you have in the room.

Some commentators, and no doubt many figures within the Coalition, think Treasury’s economic forecasting ability is, well, hopeless. That makes it likely that many heads, starting with Treasury Secretary Martin Parkinson’s, will roll if Tony Abbott forms government in September. But will that make Treasury’s forecasts any more accurate? We shall see.

Either way, Swan and Rudd definitely got the wrong set of numbers. Their mistake was to go on trusting that things would get better. As the chart below shows, they did not – forecast revenues were written down each year, not up.

This has lead ‘progressive’ think tank The Australia Institute to complain that Rudd and Swan’s error was to continue a series of planned income tax cuts originally set in motion by Peter Costello.

In a pre-budget briefing paper, Australia Institute senior economist Matt Grudnoff said: “The impact of the Howard/Costello income tax cuts on the federal budget has been huge. They were delivered at a time of strong economic growth, ignoring what would happen when that growth slowed.

“Costello chose to take the windfall generated by the mining boom to fund large and permanent cuts to income tax. What he didn’t say at the time was that he was funding a structural change to the budget with a cyclical boom. This was simply unsustainable.”

This is not a new story. However, Grudnoff has used the same economic modelling tool used by many government forecasters, NATSEM, to work out how many more billions would have flowed into government coffers had Swan and Rudd just said ‘No’ to the Costello cutting program.

Grudnoff found that not only would the budget likely be into the black by now, but that the cuts disproportionately benefited higher socio-economic groups. He found that “income tax cuts between 2005-06 and 2011-12 have taken a massive $169 billion out of the federal budget, meaning the deficit announced by Prime Minister Gillard might not have eventuated”.

He adds: “Had the tax cuts not taken place, the 2011-12 budget would have been $38 billion better off. Instead, the top 10 per cent of income earners gained $16 billion. This was more than the total benefit to the bottom 80 per cent of income earners.”

You might have expected, therefore, that a Labor government would have done its sums, worked out that the cuts didn’t further the cause of ‘fairness’, and stopped the madness of rolling tax cuts that were funded by an unexpected mining-revenue windfall at the start, and during the GFC, funded by issuing billions of dollars worth of government bonds.

But they didn’t.

The sins of Swan-Gillard today are largely the sins of Swan-Rudd. And oh look, Swan’s name is there both times!

But Swan bashing aside, there is a more sinister aspect to the chart above, given that it’s likely to be Treasurer Hockey giving next year’s budget speech.

Think for a minute what would have happened to the economy, and tax receipts, if Rudd and Swan had tried to balance the budget not by ending the Costello tax-cut program, but by cutting spending.

Had they been cutting spending to the bone from 2008 to the present, the mistakes of the European austerity programs would have been repeated here, albeit in milder form. That is, by cutting into a downturn, many more businesses would have collapsed, GDP growth would have slowed or gone backwards, and tax receipts would have plunged lower still.

But that is exactly what Tony Abbott and Joe Hockey have planned for next year. Their hope is that business, buoyed by the scrapping of the carbon and mining taxes, red tape reductions and less regulation, will create a new surge of economic activity that will start to refill the coffers.

It’s not impossible, and we’re certainly not in Europe’s dire predicament. But it does seem like a gamble as big as some of the punts Swan and Rudd took during the GFC and which, thankfully, mostly worked out.

The federal budget may be $19.4 billion in the red for 2012/13, but the economy is still growing, unemployment, inflation and interest rates are low. That may be a scenario we look back on with some nostalgia if the Abbott/Hockey punt doesn’t work out.