Australian CleanTech Index performance - Q2

ACT Australian CleanTech Index outperformed both the S&P ASX200 and the S&P ASX Small Ordinaries for the month of December and over the second quarter of financial year 2014.

The ACT Australian CleanTech Index rose from 38.5 to 39.9 over December, recording a 3.6 per cent gain.

This compared to the S&P ASX200 gain of 0.6 per cent and the S&P ASX Small Ordinaries Index gain of 2.3 per cent.

The Australian CleanTech 20 had a slightly better performance with a gain of 4 per cent.

Over the second quarter of the 2014 fiscal year, the ACT Australian CleanTech Index significantly outperformed its benchmarks and recorded a healthy gain of 12.7 per cent, well ahead of the S&P ASX200 's gain of 2.6 per cent and the S&P ASX Small Ordinaries' 0.6 per cent loss.

Over the first half of the 2014 fiscal year, the ACT Australian CleanTech Index also significantly outperformed its benchmarks and recorded a gain of 28.9 per cent compared to the S&P ASX200's gain of 11.4 per cent and the S&P ASX Small Ordinaries' 12.8 per cent gain. The 12-month figures are also well ahead of the wider market with the returns for the ACT Australian CleanTech Index recording a 25 per cent gain, more than 10 per cent ahead of the S&P ASX200.

The market capitalisation of the 66 stocks in the ACT Australian CleanTech Index is $12.4 billion , after its rebalance, falling from its peak of $16.3 billion in July 2007 but up from its trough of $6.2 billion in July 2012.

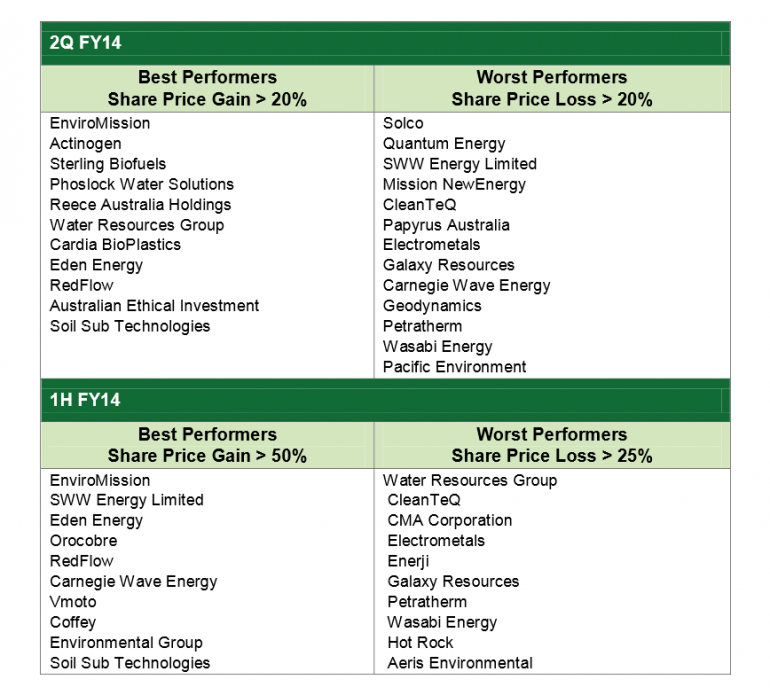

Best and worst stocks

The best and worst performers in terms of share price performance over the month, and the second quarter and first half of the 2014 fiscal year are shown in the table below.

The month’s performance was driven by 10 companies with gains of more than 10 per cent.

The greatest gains were recorded by the Water Resources Group, Algae.Tec, Actinogen and Aeris Environmental.

These gains were partially offset by 13 companies recording losses of more than 10 per cent led by Mission NewEnergy, Electrometals, Papyrus and Greenearth Energy.

The quarter’s performance was driven by 11 companies with gains of more than 20 per cent.

The greatest gains were recorded by EnviroMission, Actinogen, Sub Soil Technologies and Cardia Bioplastics.

These gains were partially offset by 13 companies recording losses of more than 20 per cent led by Petratherm, Mission NewEnergy, Wasabi Energy and Papyrus.

The six month performance was driven by 10 companies with gains of more than 50 per cent.

The greatest gains were recorded by Sub Soil Technologies, SWW Energy, EnviroMission and VMoto. These gains were partially offset by 10 companies recording losses of more than 25 per cent led by Galaxy Resources, Petratherm, Electrometals and CMA Corporation.

Index rebalance

The ACT Australian CleanTech Index underwent its quarterly rebalancing at the end of December which took account of recent share issues and other corporate activity. The changes that were made to the index constituents at this rebalancing were:

Additions to the index

– Meridian Energy Ltd (ASX: MEZ ) generates electricity from hydro and wind resources and provides electricity to more than 270,000 customer connections including homes, businesses and farms in New Zealand. It is New Zealand’s largest electricity generator, operating seven hydro stations and four wind farms in New Zealand and one wind farm in Australia. It has also successfully built renewable energy projects offshore including in Australia, Antarctica, the United States and Tonga. It completed a $NZ1.9 billion IPO to jointly list on the NZX and the ASX in October 2013. www.meridianenergy.co.nz

Removal from the index

– Carbon Polymers Ltd (ASX: CBP) following its lapse into administration and agreement to sell its assets to Giacci Global Ltd in December 2013

– Greencap Ltd (ASX: GCG) following its acquisition by Wesfarmers in November 2013.

– Greentech Flagship (SIM: GTF) following its suspension from the SIM VSE for failure to lodge its annual report as required.

A watching brief is being maintained on the following companies in the index that are changing the focus of their operations

– Petratherm Ltd (ASX: PTR) following its application for Petroleum Exploration Licence (EL3/2013) covering approximately 3900 sq km, north of Hobart in central Tasmania to explore for shale oil and gas.

– Novarise Renewable Resources International (ASX:NOE) which is negotiating a privatisation proposal from its majority shareholder.

The ACT Australian Cleantech Index is published each month on the Australian CleanTech website at www.auscleantech.com.au, in the Ethical Investor magazine, WME’s Environmental Management News, the Clean Energy Council website, the SIM Venture Securities Exchange website and the London-based Cleantech Investor.

Monthly results can be emailed directly to interested parties by signing up to the distribution list at http://www.auscleantech.com.au/Pages/cleantech.html.

For a full listing of all companies included in the ACT Australian CleanTech Index, please email your request to index@auscleantech.com.au.

John O’Brien is managing director, Australian CleanTech.