Are you invested in an ASX zombie?

If this doesn’t send a chill through your investment bones, it probably should.

Believe it or not, around one-in-five of the companies listed on the Australian Securities Exchange are now classified as "zombies".

What's a zombie company, you ask? They're companies that are just limping along, barely alive financially, and probably should either be dead or in administration were it not for the hapless shareholders who have funded them via repeated capital injections, or because highly accommodative banks have been reluctant to kill them off.

The ASX knows they exist, but there's little it can do on a regulatory level until they start breaking its listing rules.

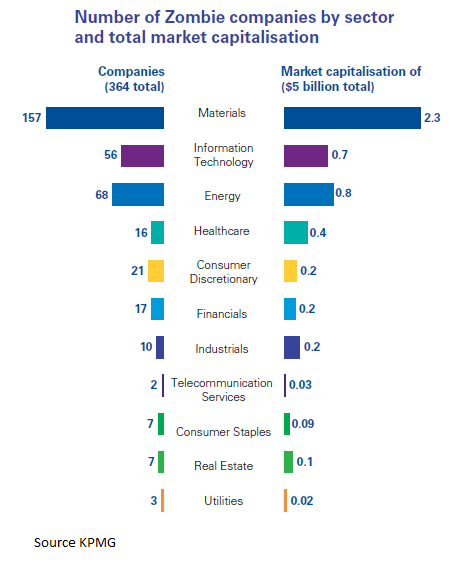

Make no mistake. Zombies are a serious problem, and make up about 20 per cent of the total population of enterprises listed on the ASX. That's pretty scary. Collectively, according to new research by global financial consulting firm KPMG, these zombie companies account for about $5 billion in shareholders’ capital.

But, to put that into perspective, the total market capitalisation of the ASX is almost $2 trillion, so we're talking about 0.25 per cent of the market's value. Yet, it's certainly not a trivial amount, and there is a high probability those funds will be lost permanently unless the enterprises in question take some form of remedial action. Worse still, zombie companies do have a direct impact on healthy ones and other parts of the economy (see the OECD's research below).

Where are the zombies?

As an investor, it certainly pays to be informed about zombies, the areas where they’re more likely to be lurking, and how to spot them. Of course, if you’re invested in one, you probably already know it. You're wearing a heavy loss on your initial investment, and may not be able to exit your position.

These companies have typically experienced a high degree of stock price volatility, and their market value has fallen sharply over time. Their listed market value is likely to be below the value of their net tangible assets, and their cash flow is either negative or is only just servicing debt repayments.

KPMG’s analysis is based on a scoring system it has devised called Distance to Default (D2D), which works on a scale of zero to five. Companies with a score below one have a much higher likelihood of defaulting, while those scoring above three are considered to be furthest from default.

Of some 1,900 ASX companies analysed, 618 have a score below one, and 364 of them have been at this precarious level for three or more half-year periods. The average D2D score of Australian zombies was 0.62 at June this year, a higher level than last December.

So, where are most of the Australian listed zombies? If you guessed the mining and mining services sectors, you would be on the money, with minerals explorers being the biggest cohort.

A large percentage of small cap miners are reliant on capital raisings rather than debt to continue their operations and exploration. But this sector stands out, accounting for 43 per cent of the total number of zombie companies. Energy stocks make up a further 19 per cent, and information technology stocks – software and hardware manufacturers – another 15 per cent.

Over the first half of 2018, 60 per cent of IT stocks had an increase in net debt, 45 per cent had negative operational cash flow, and 40 per cent had lower earnings.

So what’s actually going on, and what are the wider implications and risks for investors?

The zombie apocalypse

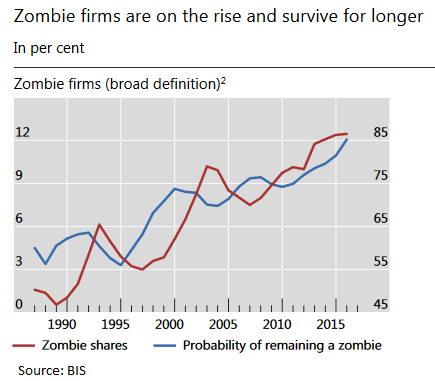

The Swiss-based Bank for International Settlements released its own research on zombies in September, pointing to higher corporate debt levels and a reluctance by companies to pay down their debt.

Alarmingly, BIS has estimated that 12 per cent of all companies globally are now zombies, holding $US1.6 trillion in outstanding debt liabilities.

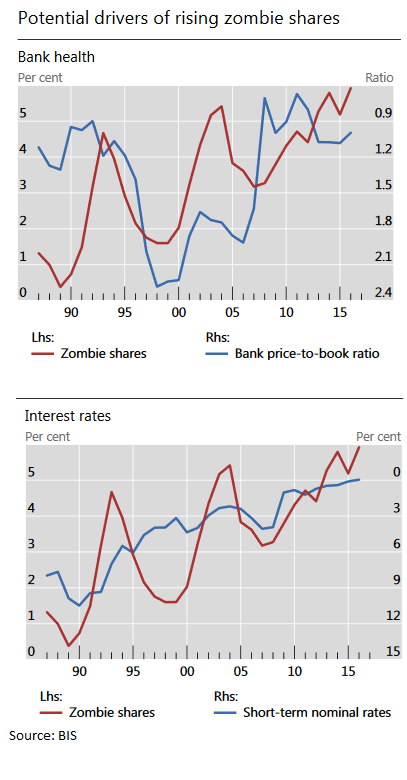

BIS notes there has been a slowdown in asset disposals by companies to help improve their financial positions, and also refers to the role of “weak banks”.

“When their balance sheets are impaired, banks have incentives to roll over loans to non-viable firms rather than writing them off. Formal evidence suggests that weak banks indeed played a role in the wake of the GFC,” BIS says.

This is a theme supported by the Organisation for Economic Cooperation and Development, which suggests “there are reasons to suspect that non-viable firms may also be increasingly kept alive by the legacy of the financial crisis, with bank forbearance, prolonged monetary stimulus and the persistence of crisis-induced SME support policy initiatives emerging as possible culprits.”

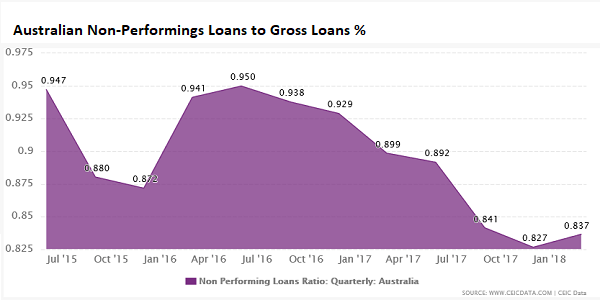

If that’s the case, we should all be watching the balance sheets of Australia’s big four banks, specifically by looking at their loan books in detail.

One way of measuring potential problems would be to examine the level of the banks’ non-performing loans to total gross loans. Data on this from economic analytics firm CEIC Data shows that in the Australian context, bank non-performing loans to total gross loans are tracking at around 0.837 per cent. You can see there has been a slight uplift since January, but they are still very low.

That shouldn’t come as an enormous surprise given interest rates here remain at record low levels, which has obviously taken a lot of the debt repayment pressure off of even those companies with distressed balance sheets.

But watch this space as US interest rates continue to rise, because Australian companies needing to roll over debt obligations into new facilities will likely need to pay more for their funding. And if the banks are doing their job, they will be stress testing companies seeking traditional loan finance much more vigilantly and knocking the bad ones back.

When that happens the non-performing loans numbers will have to rise. More zombies will either have to go out to their shareholders with rights issues or other capital raising programs, because the banks probably won't lend to them. And more shadow lenders will likely emerge to fill the funding gaps.

But many zombies will need to be put into a grave permanently, or pushed into restructuring programs if they’re to survive. These will need to involve them removing costs, changing their operational models, improving margins, and selling off assets.

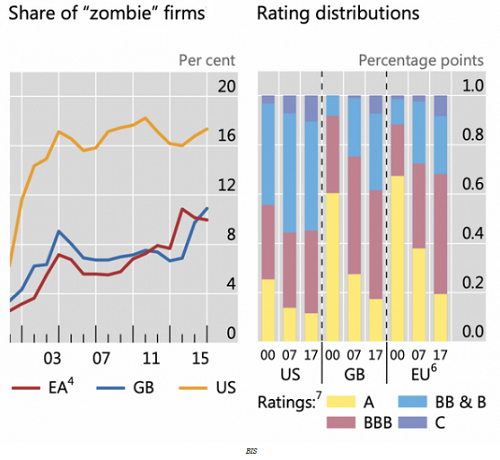

You would think that corporate credit ratings may hold some clues in terms of being able to spot zombies, but the BIS chart below covering the US, the UK and Europe shows that's not necessarily the case. The rating distributions chart on the right shows that some zombies are still holding investment grade credit ratings, right up to 'A'. So don't use credit ratings in your zombie company analysis.

Economic contagion is a threat

But there’s much more to zombie companies than just the companies themselves anyway. Zombiism is economically contagious, and that has much wider implications.

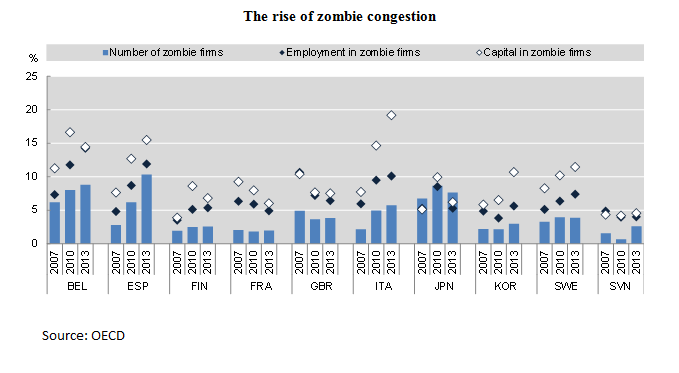

The OECD has also conducted extensive research on the rise of zombie companies around the globe and has found they are a key cause of reduced economic productivity in markets.

More specifically, the OECD says zombies are a drain on productive companies because distressed enterprises are more capital intensive.

“Zombie firms represent a drag on productivity growth as they congest markets and divert credit, investment and skills from flowing to more productive and successful firms and contribute to slowing down the diffusion of best practices and new technologies across our economies,” the OECD says.

It argues for the need for policy changes to revive productivity growth by improving the design of insolvency regimes to accelerate the restructuring or exit of weak firms. The OECD says there is equally a need for more aggressive policy to resolve non-performing loans and to avoid distortions in the banking sector.

The role of regulators

The ASX has provided data showing 71 companies have been delisted from the local market so far this year for a range of reasons, including for voluntary reasons such as a merger or acquisition, to reduce their costs, or because a company has relocated its headquarters.

How should our regulators respond to containing zombies, and does the ASX have any role in the process in terms of protecting the interests of shareholders?

We asked the ASX whether it is able to be proactive in dealing with zombie companies, or whether it has to let financial nature take its course. Here's its response:

|

“As you know, we supervise and monitor all listed entities, and treat each on their individual merits," an ASX spokesperson said. "Rarely are circumstances the same. Some will be suspended for failing to lodge accounts or after appointing administrators and/or receivers. “From some, ASX will seek director solvency assurances. If it’s discovered that some have traded while insolvent, ASIC becomes involved. Once suspended, some companies will work towards being reinstated. “Others will delist voluntarily or at the insistence of ASX. Those suspended continuously for three years will be automatically removed. ASX plays a varying role in each scenario.” |

The difficulty in forcibly winding up distressed listed companies is obvious, and investors are usually well down the queue of creditors and are unlikely to recoup their funds. There’s also an argument that even zombie companies have the right to restructure or to be restructured to get back into a positive financial position.

Purely from an ASX listing perspective however, it seems the barriers to entry may need to be reviewed, particularly in certain sectors such as mining with a higher density of zombies.

Should companies seeking a listing have a minimum financial track record that meets specific hurdle rates over three or more years? These hurdles perhaps need to be much higher than they are now. And those that fail those financial tests, whatever they end up being, should be denied an ASX listing. For that matter, the same hurdle rates should be applied across secondary exchanges such as the National Stock Exchange.

Lots to consider, and watch out for zombies!

Have a good weekend.