Are bonds the market crash 'shock absorbers' they once were?

Summary: Conventional wisdom suggests any fall in shares is largely offset by a rise in bonds, but there are signs that bonds and shares might move in the same direction. Investors could make sure their portfolio combines listed and unlisted assets, and shorten the duration of any bond portfolio as shorter dated bonds are less susceptible to capital loss if bond rates keep rising. |

Key take-out: Keep a diversified share portfolio and consider a conservative trend or momentum trading strategy, which works better than an active strategy except in a flash crash. |

Key beneficiaries: General investors. Category: Shares. |

Both bond and share markets are presently transfixed on when the US Federal Reserve will raise its official cash rate because that would mark the end of historically low yields.

Bond markets have already anticipated this move by falling in price since the end of March. And the share market has also slumped causing speculation that bond and share markets might from here on move in the same direction.

Should that happen, the conventional wisdom that a balanced portfolio ensures that any fall in shares is largely offset by a rise in bonds goes out the window and market timing the share component becomes critical for safeguarding the total portfolio.

There are disturbing signs that bonds and shares are becoming positively rather than negatively correlated. This last happened in May 2013 when financial markets had a “taper tantrum” in response to the US Federal Reserve's announcement that it planned to end “quantitative easing” (i.e. printing money to buy bonds on its own account).

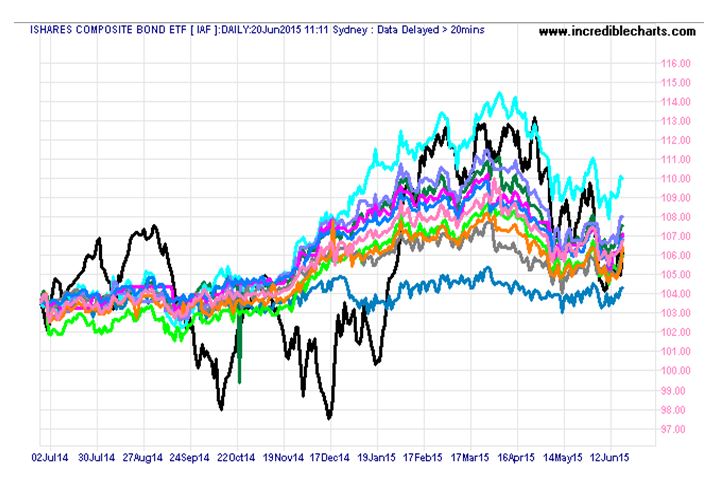

Observe the following chart which shows how Australian bond funds (shown in colour) and the All Ords share index (shown in black) have both trended down since early April this year.

According to 2013 Nobel Laureate in Economics, Professor Robert Shiller, bond market crashes have been relatively rare and mild. Since 1857 the biggest fall in US bond market total returns was12.5 per cent in the twelve months to February 1980. By contrast the US stock market, on average, crashes every eight years with a capital loss of 41 per cent.

In Shiller's view any future share market or housing bust will have little to do with a bond market collapse. That's because the worst share market crashes of the last century (1907, 1929, 1973, 2000 and 2007) and the biggest US housing busts of all time (1979, 1989 and 2006) were not associated with bond market crashes.

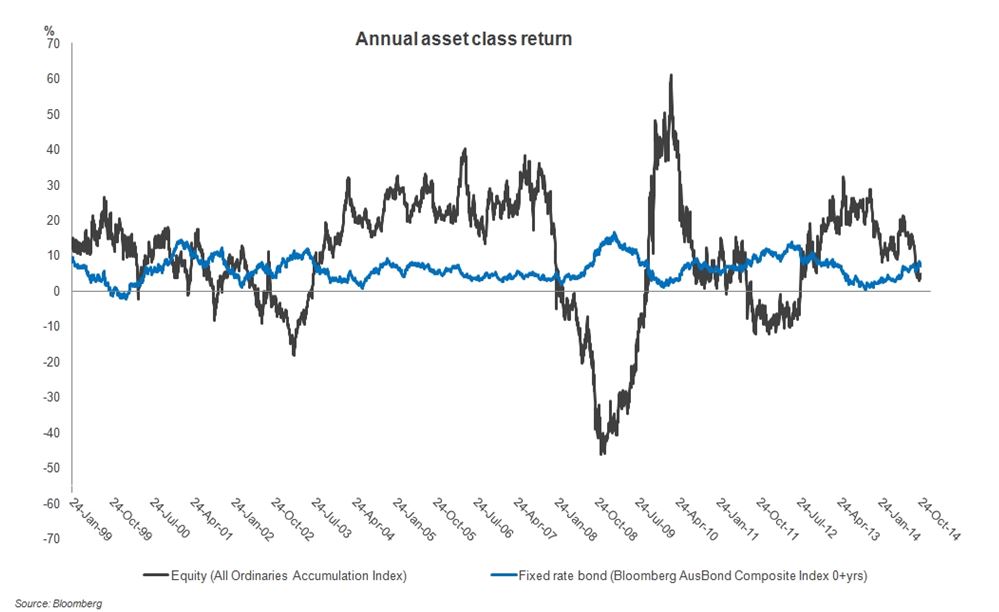

The normal relationship between shares and bonds is shown in the next chart. Note how bond prices usually jump when share prices slump, thereby helping to cushion an investment portfolio during a bear market. Likewise when bond prices fell, share prices rose.

Source: The Wire, FIIG

But as Shiller acknowledges: “It is true that extraordinarily low long-term bond yields put us outside the range of historical experience. But so would a scenario in which a sudden bond market crash drags down prices of stocks and housing. When an event has never occurred, it cannot be predicted with any semblance of confidence.”

According to JP Morgan the positive correlation between global bond and stock returns is now 30 per cent, the most it's been since May 2013. One prominent market commentator remarked last week: “that's not good news for investors who think owning government bonds is a hedge against shares”. The above chart includes government, semi-government, corporate and composite (meaning mixed) bond funds. As one can see the story is the same for all of them.

So what can an investor do to ballast their portfolio if this inbuilt safeguard has ceased?

Here are four ideas:

1. Adopt a diversified asset allocation for your investment portfolio that combines both listed and unlisted assets. Listed assets include shares, bonds and properties listed either individually or as a pooled fund on the Australian Securities Exchange (ASX).

Unlisted assets include real property (residential dwellings or unlisted property syndicates), private equity funds (that invest directly in unlisted businesses), mortgage funds (secured against first mortgages), over the counter bonds (through bond brokers) and of course cash and term deposits.

Unlisted assets being illiquid are hard or impossible to trade, but since their market prices are not posted on a daily basis they are less nerve-racking to hold. Being less subject to the cycle of investor emotions there is less temptation to sell them in a market trough, which is the most common mistake of investors.

2. Shorten the duration of any bond portfolio since shorter dated bonds are less susceptible to capital loss than longer dated ones should bond rates continue rising. Also rely more on floating-rate and inflation-indexed bonds, the prices of which will rise if interest and inflation rates drift up in future.

3. Keep a widely diversified share portfolio to minimise individual stock risk. The easiest way to do that is to buy a share fund such as an exchange traded fund (ETF) or a listed investment company (LIC). Generally these have lower management expenses than unlisted managed funds.

4. To manage general market risk, trend or momentum trade the ETF or LIC using a proven market timing system. This will keep you on the right side of the share market's direction thereby minimising any losses in a crash and maximising any gains in a boom.

My preference is a conservative (i.e. slow) trading system because it works better than an active (i.e. frequent) one except in a flash crash. Flash crashes exceeding 10 per cent are rare with only two occurring in the history of the New York Stock Exchange: October 1929 and October 1987. A sophisticated conservative strategy shifts to an active mode when the share market exhibits excessive price exuberance as happened before each of these events.

Slow trend and momentum strategies for staying out of share market crashes were explained by me last month (see Sell in May and go away? The Australian story, May 13).

I'm sticking with my market timing strategies for most of my share market exposure since my bond holdings may no longer be the shock absorber they were during the GFC.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds see www.markettiming.com.au.