April enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

With an extensive oversupply of VEECs carried forward from the 2012 vintage, the spot VEEC market had been on the way down. Having settled at the $17 level for close to a month, recent weeks have seen a recovery ensue. Yet while many had been anticipating ongoing decreases in the number of VEECs being created by Standby Power Controllers, the figures for April suggest the methodology continues to flourish.

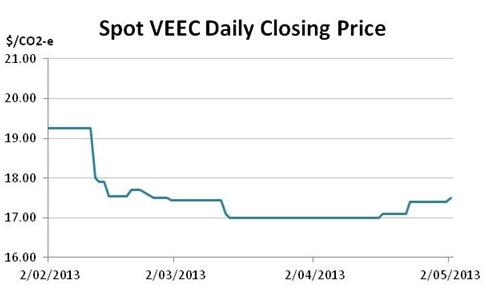

With only a quarter of the creation year gone and VEEC supply having essentially met demand for 2013 – owing primarily to the success of Standby Power Controllers (SPCs) – ongoing softness in the VEEC market was expected until such time that supply began to dry up. Yet having fallen to $17 in mid-March, the spot VEEC market proceeded to trade horizontally for a month before strengthening to $17.50 in recent weeks. The rationale behind the increase in prices appears to reflect the longer term view of some participants that once SPCs reach saturation, the next most viable technology will require higher prices.

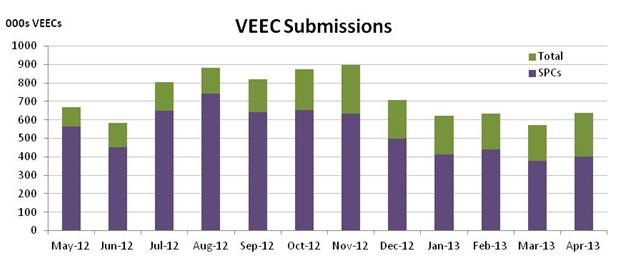

As it stands however, the dramatic drop in VEEC supply has been far more measured than initially thought. The chart below outlines VEEC submissions across the last year as well as the number of VEECs submitted from the SPC methodology. As can clearly be seen, 2013 has seen a reduction in both the number of VEECs being submitted from SPC installations as well as the overall number of VEECs submitted. Interestingly, the contribution from methodologies other than SPCs has remained fairly steady across 2013 at a level higher than that which was being submitted across 2012.

Perhaps the most important figures however relate to the overall level of the surplus. Following 2012 compliance (which passed at the end of April), there are now 4.6 million registered VEECs left un-surrendered, as well as another one million which are pending registration. With the 2013 target again in the region of 5.4 million VEECs, it appears the work has already been done to meet the 2013 target.

This simple arithmetic does not however, come without some qualification. It is important to note that the pending registration figure does not take account of any submissions which are eventually rejected by the Regulator. In the case of SPCs the rate of rejection has been rumoured at times to be between 10-30 per cent. Yet even if the average rate of rejections was 20 per cent, it does not dramatically alter the status quo, nor does it, on its own, significantly diminish the ongoing rate of submission.

Another issue to consider is the fact that the scheme’s Regulator has identified problems within the weather sealing methodology, particularly surrounding chimney balloons and door seals. Future VEEC supply from these methodologies, whilst constituting a relatively small proportion of overall submissions, has a big question mark hanging over it.

Hence while the spot VEEC price has begun a recovery of sorts, it appears that further decreases in the number of VEEC submissions from SPCs are needed.

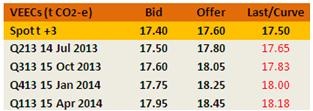

In terms of the forward curve, there was a time that very little carry was being paid across the curve, reflecting prevailing expectations (at the time) for further price decreases. In recent weeks however, some escalation has once again returned.

New South Wales Energy Savings Certificates (ESCs)

A recovery off recent lows is an outcome the New South Wales ESC market shares with its Victorian counterpart. And once again the reasons for the recovery appear not to be necessarily founded purely on supply. Meanwhile projections for the 2012 oversupply made earlier in the year by the scheme’s Regulator appear to be proving accurate.

With news that the ESC scheme’s Regulator believed the 2012 compliance year was likely to produce a surplus of ESCs in the region of 680,000-867,000, the ESC market had been in progressive decline across the early part of the year.

When trade kicked off in earnest in the 2013 vintage across March, it was via a raft for forward transactions for settlements across the year at prices generally between $22.45-$22.65. Such levels were well below where the market had been for most of the last two years, a reflection of the fact that buyers believed the ESC market was set to join its other environmental market siblings in oversupply.

The first spot transactions then followed at $22.45, however in recent weeks the market has tracked its way back to $23.

Interestingly, the recovery in the spot market has coincided with the announcement by IPART of a measure that would allow Accredited Certificate Providers (ACPs, or creators) to clear any backlog of 2012 ESCs by June 30 2013. The aim here is to allow ACPs to do what is described as a pre-registration audit, essentially a separate, once-off opportunity to create a large batch of ESCs outside of the ACP’s standard audit cycle, yet whilst still adhering to all other compliance requirements.

It isn’t exactly clear just how many 2012 ESCs exist in backlog, though anecdotal evidence suggests that it would likely be at least several hundred thousand. Were this to be the case, it would suggest that IPART’s projection of a 680,000-867,000 surplus for 2012 may just be proven accurate.

There are currently 940,000 ESCs which remain un-surrendered following the passing of the date for liable entities to have submitted their Energy Savings Statements. With 2.4 million ESCs having been created to date for the 2012 vintage year against an obligation which is expected to be around the two million mark the 2012 surplus carried forward currently sits around the 400,000 mark.

In terms of the spot price for 2012 compliant ESCs, it has now been some time since any demand has been seen for 2012 compliant ESCs, suggesting that any premium for 2012s above the 2013 price may now be gone. Whilst the submission date for the 2012 Energy Savings Statement has past, liable entities still have until June 30 to acquire and surrender ESCs for any shortfall they may have without paying the penalty.

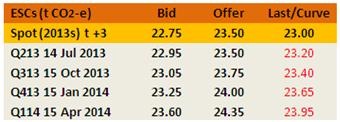

In terms of the forward curve which back in March appeared particularly flat, recent weeks has seen contango (escalation) return.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.