Another budget bounty for the Lucky Party?

Virtually everyone knows of the description of Australia as “The Lucky Country”, but far fewer know that the reference was actually derogatory: Donald Horne, who coined the phrase, commenced the last chapter of his book of the same name with the phrase “Australia is a lucky country, run by second-rate people who share its luck.”

Of course, such a put-down would never do in Canberra, where both major parties are forever trying to convince us that, without their skillful management, we would be truly cactus.

Yeah, right. My money’s on the wisdom of Horne’s acerbic wit, rather than the relative merits of either party. It’s luck, far more than management, that determines who looks good and who looks bad in retrospect. And the two types of luck -- good and bad -- have fallen unevenly on Australia’s political parties to date, with the roll of the dice thus far favouring the Liberals over Labor.

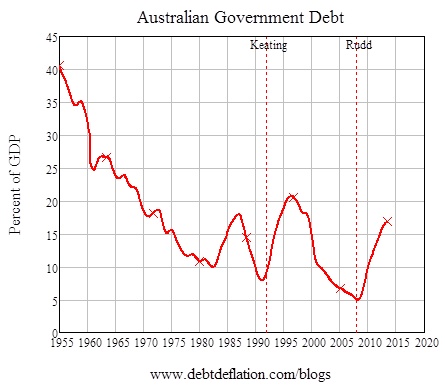

But that’s not how the incumbents see it of course: they believe their own spin. And today it’s the Liberal Party’s turn yet again, with its narrative based on the belief that it’s the party of government surpluses, whereas the ALP is the party of deficits. Why, just look at the government debt ratio in figure 1: it always blows out when the ALP is in charge! And look how much it fell when the economy was in the steady hands firstly of Menzies, and then his acolyte Howard!

Figure 1: Declining debt Under the Liberal Party?

This narrative exploits the sub-text of Horne’s derisory remark: he wanted Australia to stop relying on luck and become clever instead, because “the alternative to being a clever country is to be a stupid country”. And it’s stupid to just look at this simple chart and attribute the decline in government debt under the Liberals to good economic management alone, because that ignores the role of good luck. The Liberals have been the Lucky Party in the Lucky Country: lucky to be in office when inflation (before the 1980s) and booming private debt (after the 1980s) made it easy for the government to reduce its debt, and lucky to lose to Labor when economic circumstances turned sour and government spending inevitably had to rise.

So will their luck hold out in this budget, with the strategy that dominates it of getting back to a government surplus by 2017-18, maintaining a surplus of “well over 1 per cent of GDP by 2024-25”, and achieving about a 5 per cent rate of growth of nominal GDP from 2015 on?

Working this out in a hurry (I’m in the budget lock-up writing this, with four hours to finish my copy -- so this has to be a “back of the envelope” analysis), I’ll lean on my own work on the sources of growth in nominal output in a credit economy, plus the sectoral balances approach pioneered by Wynne Godley, and apply the combination to the question “where’s the money going to come from?”

(I might look like I’m channelling Milton Friedman here by relying on the velocity of money, and ignoring changes in it -- but again, give me a break here: a four-hour deadine forces some compromises.)

In a nutshell, the velocity of money is defined as nominal GDP divided by the money stock -- where (contra Milton Friedman) the money supply can be increased by private bank lending, as well as by government deficits and a trade surplus. That leads to the deduction that change in nominal GDP will equal (ignoring changes in velocity, which -- again contra Milton Friedman -- do happen and are large and pro-cyclical): the velocity of money, multiplied by the sum of the government deficit, the current account surplus, and the growth in private debt.

Reworking this expression leads to this equation for bank lending:

Bank lending p.a. = Nominal GDP growth / Velocity of Money Government Deficit Trade Surplus

The budget papers let us put some numbers in this equation. Their target for nominal GDP growth over the next decade is roughly 5 per cent of GDP; they’re aiming for a 1 per cent surplus (so a deficit of minus 1 per cent of GDP); and they expect a current account deficit of roughly 3.5 per cent of GDP. So we can then work out what rate of growth of private debt will be needed to make all these numbers fit (depending on the velocity of money).

If velocity remains at its current level of roughly 3, we get this numerical outcome (where all figures are percent of GDP):

Bank Lending = 5%/3 1% 3.5% = 6.2%

If velocity plummets as it did in the US after the GFC and hits 1, then a higher rate of growth of private debt would be required to balance the government’s projections -- roughly 9 per cent of GDP per annum.

So could Tony Abbott and Joe Hockey be that lucky? Could private debt grow by roughly 6 per cent or 7 per cent of GDP per year for the next decade, when nominal GDP is expected to grow at 5 per cent per year?

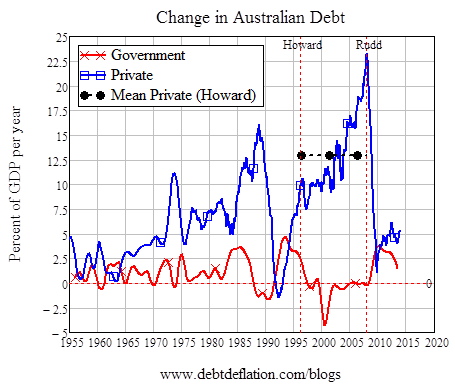

Well the first thing to say this rate of growth of private debt is well within the bounds of historical experience -- in fact, that’s below the minimum rate of growth of private debt that occurred when Abbott’s hero, John Howard, was prime minister of Australia. The average rate of growth of private debt during Howard’s term was 13 per cent of GDP per year (see figure 2).

Figure 2: Private debt grew at an average of 13 per cent of GDP per year under the 11 years of the Howard government

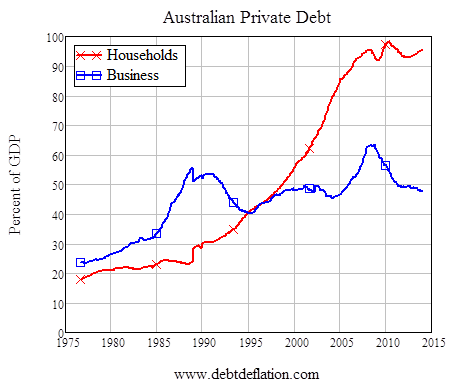

But the second thing to say is that this required rate of growth of private debt sits on top of a much bigger private debt pyramid than the Howard years commenced with. When John Winston Howard came to power, private sector debt in Australia (the sum of household plus business debt) was roughly 85 per cent of GDP. When Tony Abbott took over, it was roughly 145 per cent of GDP.

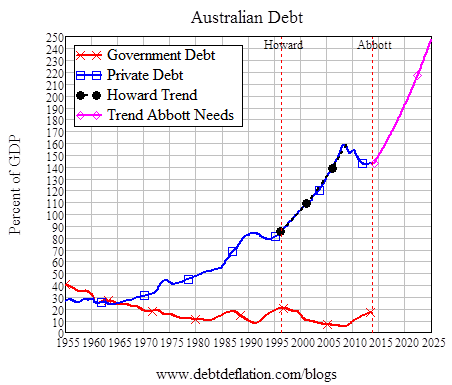

So for private debt to grow at 7 per cent of GDP per year when it is currently about 1.4 times GDP means an annual growth rate of private debt of about 10 per cent per year -- 5 per cent faster than the expected rate of growth of nominal GDP.

So for Joe Hockey’s budget books to balance, how high would Australian private sector debt need to be by 2025? On the back of the envelope calculations here, it would need to be about 250 per cent of GDP (see figure 3).

Figure 3: The Hockey Stick -- how private debt has to rise to balance the 2014 budget books

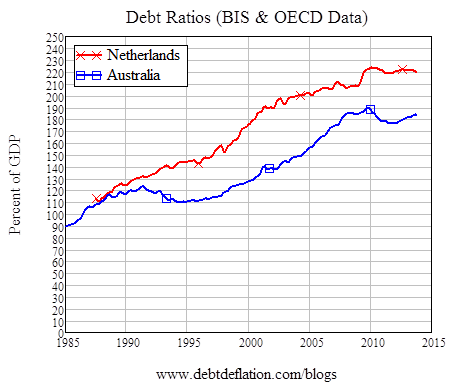

That again is not an off-the-planet outcome: Holland’s debt level right now is about 220 per cent of GDP. But it’s just about the most indebted OECD nation on the planet, and to make the budget forecast become reality, we need to beat its current ratio by a substantial margin (figure 4uses BIS debt figures here rather than the RBA’s -- where the BIS data is substantially higher and gives Australia a private debt ratio of almost 190 per cent of GDP in 2014).

Figure 4: Comparing Australia's private debt to that of the most indebted OECD nation

That means that the success of Joe Hockey’s budget depends on a continuing bubble in Australia’s private debt, and especially household debt -- since it’s households that have overwhelmingly driven borrowing in the past, and the corporate sector shows a very prudent reluctance to exceed a debt ratio of 70 per cent of GDP (see figure 5).

Figure 5: More than 100 per cent of the growth in debt since 1990 has come from household borrowing

So borrow up big Australian households: Joe Hockey needs you to do it if the Liberals are to hang on to the mantle of Australia’s Lucky Party. But my money is on this gambit failing, and the books balancing instead by a much lower rate of growth for Australia than the budget anticipates.