An East-West ETFs strategy

PORTFOLIO POINT: Rather than second-guessing the resources boom versus bust debate, a better strategy is blending the economic growth stories of East and West.

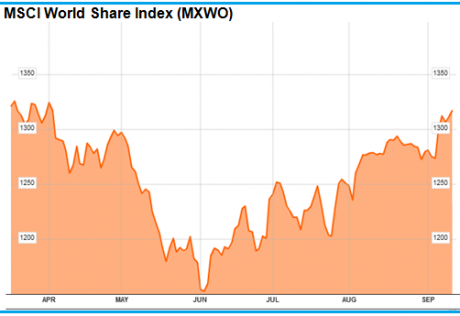

Earlier this year the world worried whether the Eurozone could survive. More recently it’s agonised over the US fiscal cliff. But most sharemarkets have enjoyed a strong rally since June because investors have come to believe that while politicians are divided about what to do, central bankers are united in their determination to avoid another financial and economic meltdown like 2008, let alone a Great Depression like the 1930s.

Two weeks ago the European Central Bank vowed to bail out Eurozone governments such as Spain and Italy by buying their short-dated bonds, provided they adhered to winding back their deficits and reforming their sclerotic economies. Only the German central bank dissented, but the German Chancellor Angela Merkel caved in because she is now worried that austerity is pushing Germany into recession. The decision of Germany’s top court to reject a raft of challenges against German ratification of the European Stability Mechanism (ESM) swept aside the last obstacle to massive money printing by the ECB.

Last week the US Federal Reserve announced the much anticipated QE3, but this time it will buy mortgage-backed securities rather than treasury bonds, no doubt to signal to Congress that it needs to fix the Fiscal Cliff before the Fed further underwrites government borrowings. The Federal Reserve governor, Ben Bernanke, was moved into action by America’s jobless recovery and its stubbornly high long-term unemployment rate.

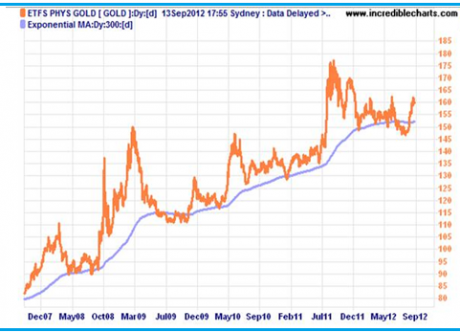

The expectation that “Big Ben” would restart the money printing presses explains the breakout in the gold price recently; speculators now think the future is inflationary rather than deflationary.

At present the market is “risk on”, so for as long as it’s trending up I will remain on buy. September is usually a bleak month for shares, but to date it’s been sunny.

The only major stockmarket still sliding is China, a country with 8%-plus annual economic growth and supposedly the best hope for pulling the west out of its misery. But if its share index is any sign, China is in deep trouble, which explains why Australia’s resource exporters are worried that the mining boom may be over. Commodity prices for iron ore and coking coal have crashed below consensus estimates. Concern is now shifting from Europe and America to the sick man of global sharemarkets; China.

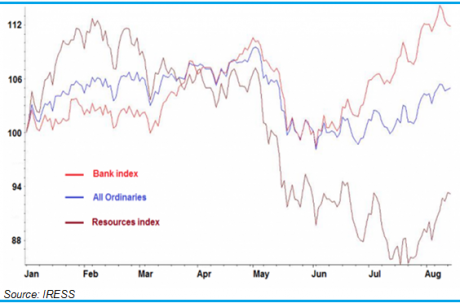

Australia’s metals and mining share index has followed China’s down, while our bank share index has followed America up. The only reason the resources index has shown some life since August is that LNG exports are still strong.

The tug of war between the miners and the bankers explains why Australia’s All Ords (green index) is torn between a wake (China’s red Shanghai Compensate Index) and a waltz (America’s blue S&P 500).

Shaw Stockbroking’s in the current edition of its Equity Market Outlook sums up China’s demand for iron ore and coking coal as follows:

“Demographics and urbanisation trends suggest a slowing of residential construction. Implies serious overcapacity in steel manufacturing. Reduction in steel making implies lower demand for iron ore and met coal. Hence the cutback in expansion plans.

“Bulls hope for US-like GDP per capita, urbanisation rates and floor space per capita measures. Realignment of growth towards domestic consumption is significantly less metal-intensive than fixed asset investment.”

Shaw finishes by citing Resources Minister Martin Ferguson’s comment “The resources boom is over. We have done well.” which earned him the moniker, “Minister for Undermining”. His candour brought home to Australians the new reality that mining companies are scaling back their expansion plans. The days of easy money from mining are over.

Yet there are still fans of mining stocks who say the resources sector is a screaming buy since large resource companies like BHP Billiton and Rio Tinto are now trading at prices last seen in 2009.

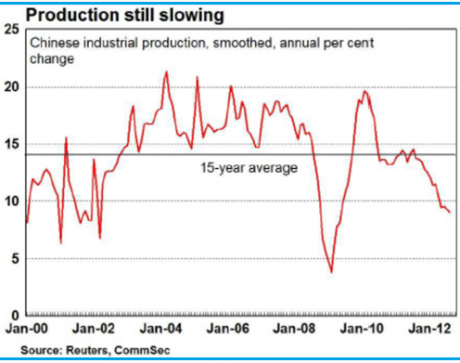

Monty Agarwal, a US hedge fund portfolio manager, who recently toured China to gauge the opinions of industrialists and officials, concluded: “the (Chinese) government is not going to let industrial production drop too much, as it would lead to rising unemployment and, what they really fear, a civil uprising. We can expect Chinese GDP and manufacturing data to be supported, which puts a floor under commodities like grains and metals. (Source: Uncommon Wisdom, 12th Sept 2012)

Essentially the debate about Chinese fundamentals comes down to two viewpoints.

The pessimists say that the ratio of the working age to non-working age population has peaked and as it falls it will put a brake on economic growth.

Chinese production is falling, with no sign of a turnaround.

Also apartment construction has run ahead of population growth creating ghost cities. The optimists say that the population drift from the countryside to cities continues unabated at 15 million a year and this requires continued housing construction, which requires lots of steel (the end product from Australian iron ore and coking coal). Indeed a Chinese urban household has 10-15 times more steel intensity than a rural family.

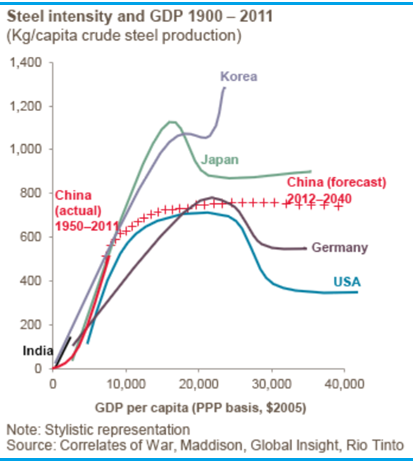

Furthermore, if China goes through a similar path of steel intensity to GDP as America, Germany, Japan and Korea experienced its demand for steel has further to rise.

And the bright lights of Chinese cities are not dimming, but intensifying. Finally they argue that investment has bottomed and will surge once a new leadership team takes over China at the end of this year.

I don’t know whether resource stocks are now a bargain or a trap. What I do know is that no one else knows either. That’s why I prefer a portfolio of shares exposed to the top 50, 200 or 300 Australian listed companies through exchange-traded funds like SFY (50), STW and IOZ (each 200) or VAS (300) so I can hedge my bets.

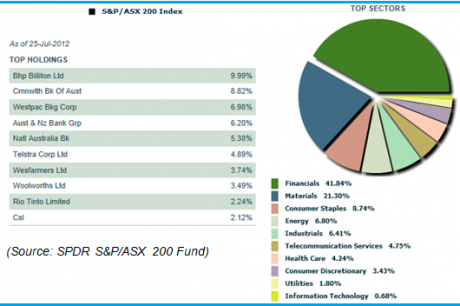

The top 10 shares in STW are shown below – a nice mix of miners, financiers, retailers, a utility and a bio-tech firm. For the STW portfolio as a whole, note how the financials and materials dominate with other industries comprising about 37%.

With a ready-made ETF basket of shares I can time the overall market to ride it up when it’s rallying and sidestep it when it’s correcting. History shows that trend-trading an indexed fund works far better than buying and holding it indefinitely, both in terms of total investment returns and providing a shock absorber to periodic crashes.

So I suggest avoid taking sides in the resources boom-versus-bust debate. Instead, time the market as a whole using either or both active and conservative strategies. Having a diversified ETF means you can blend the impact of the East (i.e. China) and the West (i.e. America), because neither can be written off. And most importantly you are investing in Australia, which no longer suffers a tyranny of distance but instead is embedded in the fastest-growing region on earth.

Percy Allan is chairman of Market Timing Pty Ltd. For a three week free trial of its services go to www.markettiming.com.au

vvvvvvvvvvvvvvvv