An apartment construction boom chaser

The June quarter might be old news but it will dominate this week’s economic discussion. Net exports are set to subtract around 0.9 percentage points from real GDP but the overall effect will be offset by greater inventory accumulation.

But while one source of growth has subsided, another continues to firm. Residential construction picked up further in the June quarter and building approvals may have received a second wind. If that can be maintained then the impending residential construction boom may be more persistent than initially believed.

Building approvals

Building approvals rose by 2.5 per cent in July, beating market expectations, to be 9.4 per cent higher over the year. After a sluggish start to 2014 -- which explains why the trend measure continues to decline -- building approvals have improved somewhat over the past three months.

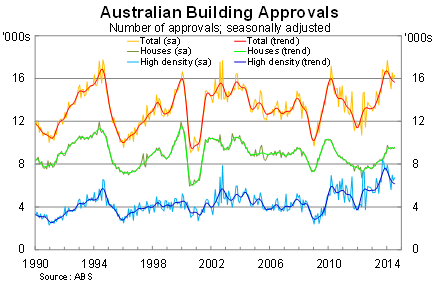

Approvals for housing -- which have historically been less volatile -- rose moderately in July but the action in recent years has been centred on units. In fact, the impending construction boom figures to be primarily in the construction of inner-city high density living. Construction of detached housing has certainly responded to low interest rates and rising house prices but to nowhere near the same extent.

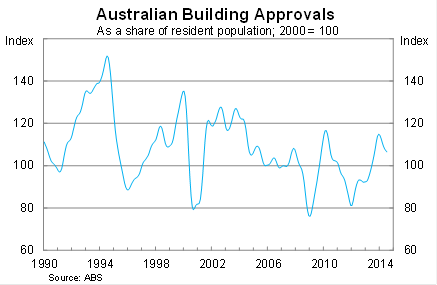

From a construction standpoint, apartment projects typically take longer to complete and should support residential investment and the Australian economy over the next couple of years. Nevertheless, compared with previous construction booms the current rise in approvals appears relatively soft.

It is also worth noting that these projects are somewhat riskier -- from a construction or development standpoint -- and are more likely to be postponed or even cancelled if economic conditions slow. Not saying that this would happen but it’s simply worth bearing in mind.

Approvals for apartments also provide a good indicator of investor activity -- on those occasions when investors purchase new rather than existing properties -- so the recent uptick over the past three months may indicate that investor loan approvals will not deteriorate as quickly as I initially believed. It is certainly a trend worth keeping an eye on and one that will inevitably shape the housing market over the remainder of this year.

International trade

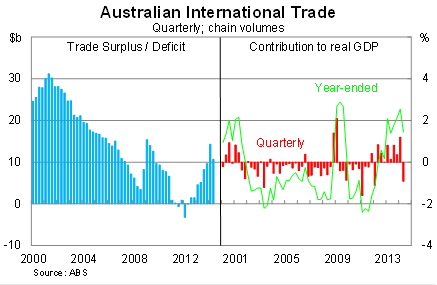

According to the ABS, net exports will subtract about 0.9 percentage points from real GDP in the June quarter (released tomorrow). This was slightly weaker than expectations.

In addition, the data indicated that the contribution from net exports in the March quarter was revised down by 0.2 percentage points. To a large degree though, the decline in net exports in the June quarter and the downward revision for the March quarter will be offset by greater inventory accumulation.

But the real impact of net exports won’t be felt on real GDP, which only measures the volume of trade. The real story is the sharp fall in export prices, which won’t make a dent in the headline data -- at least not yet -- but it will certainly be felt in estimates of nominal GDP.

The RBA’s commodity price index fell by 9.5 per cent over the June quarter and is down about 15 per cent since the beginning of the year. The iron ore spot price has plummeted to $US87, putting pressure on Australian miners to cut costs and slash jobs.

Recently, the RBA offered a damning assessment of the resource sector, noting that “at current prices, there is a sizable amount of coal and iron ore production that is unprofitable”; furthermore, “the outlook for prices will depend on what proportion of these mines is shut down” (Prepare for more Australian miners to crumble; August 11).

The short-term impact of these developments is that the federal budget is unlikely to meet its ambitious revenue target and state budgets, particularly Western Australia, are set to take a decent whack as well.

In the longer-term, a decline in commodity prices and the terms-of-trade will weigh on income growth and the purchasing power of that income. Household balance sheet will take a hit and we will discover than our incomes don’t go quite as far as we have become accustomed to.

The outlook for exports remains strong and should recover somewhat but there’s little reason to believe that iron ore prices and commodity prices more generally will improve materially and that clearly poses a considerable risk to Australia’s mining sector.

Overall the data out today was relatively mixed but with the poor exports data largely expected and the solid approvals data unexpected, the market should view these developments positively. Building approvals are holding up a little better than expected -- and have rebounded somewhat over the past three months -- and that provides tentative evidence that the residential construction boom may be more persistent than initially believed. That said, it will all be for nought if low commodity prices cause a number of mining firms to go belly-up.