Ageing pension policies will cripple Australia's growth

Australia’s future: a budget blowout and slow economic growth. That’s what the Productivity Commission had to say in a report released earlier today.

The Productivity Commission released a new report on the impact of an ageing Australia and the outlook is not good. I touched on the labour market implications of population ageing last week (Australia’s irrevocable, inevitable growth challenge, November 15) but the Productivity Commission goes further, touching on the budgetary and health/aged care impacts.

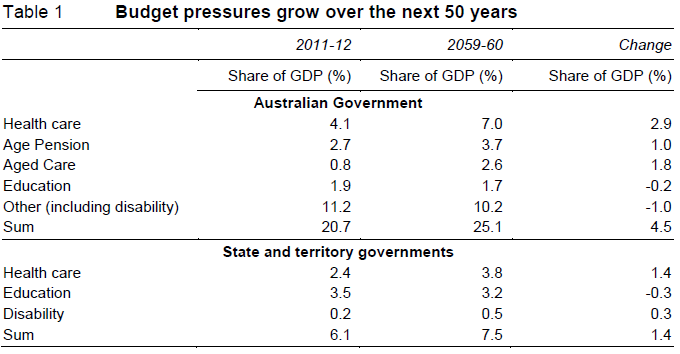

The report makes for some uncomfortable but necessary reading. The Productivity Commission says that, without major changes to policy, state and federal governments face “inexorable and major impacts”. They project that Australian governments face additional pressures on their budgets equivalent to around 6 per cent of nominal GDP by 2060, which largely reflect increased expenditure on health, aged care and the age pension.

Based on its findings, the Commission has proposed increasing the eligibility of the age pension to 70 years of age, while finding cost savings in the health care sector and allowing retirees to remove equity from their homes to help fund aged care costs.

As the participation rate declines, Australia’s tax base will shrink. At the same time, health and aged care expenditures will rise rapidly. The result is a budget emergency of much greater importance than the one commonly debated by politicians.

According to the table above, government expenditure will increase by 6 per cent of GDP. However, without policy changes, revenue will also decline due to a smaller tax base. Consequently, the total budgetary effect will be larger than the 6 per cent estimate.

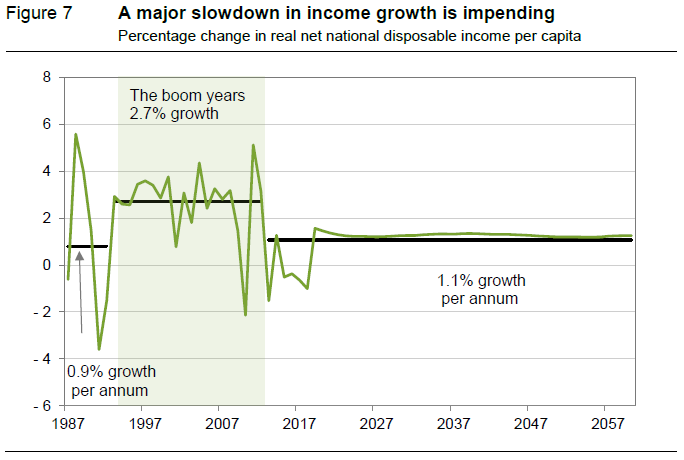

Economic growth is expected to slow on the back of lower labour force participation and slower labour productivity. With economic growth, productivity is the key. Clearly, if productivity growth exceeds the estimates provided by the Productivity Commission, then the budget shortfall will be less than estimated.

So beyond productivity, how can we mitigate the effects of an ageing population?

The Productivity Commission recommends lifting the pension age to 70 years old. Given the rising life expectancy of the population, this policy change is inevitable. A male born in 2012 is expected to live until 92 years of age, while a female is expected to live 94 years.

In light of rising life expectancies, 65 as a retirement age is an archaic remnant from a time when people often lived only a few years past the retirement age.

But lifting the retirement age has its issues. Is it practical for physical labour? And how do we change the attitude towards older workers?

There is still significant age discrimination in the workplace that has to be addressed. These issues though seem far from insurmountable.

The Productivity Commission says that we need to examine new ways to help fund government-provided services. One thing they mention is using equity release schemes targeted at older Australians. This involves individuals contributing part of the annual real increase in their home values towards aged care services.

The main issue with this is that it assumes rising home values. As the US found out only too recently, prices do not always rise. Sydney real house prices, for example, have not increased over the past decade. With trend income growth expected to be much lower as the population ages, I suspect that the income generated by equity release schemes may be less than the Productivity Commission expects.

To address rising age pension expenditures, I’d recommend a couple of things.

First, the asset test for the pension should be extended to include the value of your principal home. It seems absurd that households can receive the full age pension while sitting on million-dollar properties. Housing wealth accounts for almost 60 per cent of household wealth and excluding a great chunk of it when determining the pension is negligent.

Second, reverse mortgages can be used in some cases to alleviate the cost of aged care. Reverse mortgages can free up a lot of liquidity that is typically locked in the family home. Though in some cases, it might be better for retirees to downsize to free up cash (and free up premium homes).

Third, superannuation needs to be reformed, with more of the concessions directed towards those who rely on superannuation the most. The 15 per cent flat tax on superannuation income provides massive concessions to the wealthy who don’t need these concessions. Instead, a progressive superannuation tax system should exist, which redistributes wealth across the superannuation system. A higher tax for the wealthy can be used to improve the superannuation of the poor and relieve the pressure on the age pension and aged care services.

As mentioned in my article last Friday, Australia’s ageing population is arguably our greatest economic challenge. The Productivity Commission report makes for uncomfortable reading but it is also the beginning of a new discussion, which will hopefully be embraced by politicians from both sides of the fence.