A self-managed super hero for corporate Australia

Australia’s self-managed superannuation funds are set to become the fifth pillar of the Australian financial system. This represents the biggest change we have seen in the Australian capital market for decades.

And if the superannuation measures proposed by the government are passed by the federal parliament, the importance of self-managed superannuation to the Australian capital market will grow even faster.

The importance of self-managed superannuation as a provider of capital to the corporate sector is not news, but the investment management group, Elstree, which is dealing with a large number of self-managed funds, has added an entirely new dimension to self-managed super’s significance.

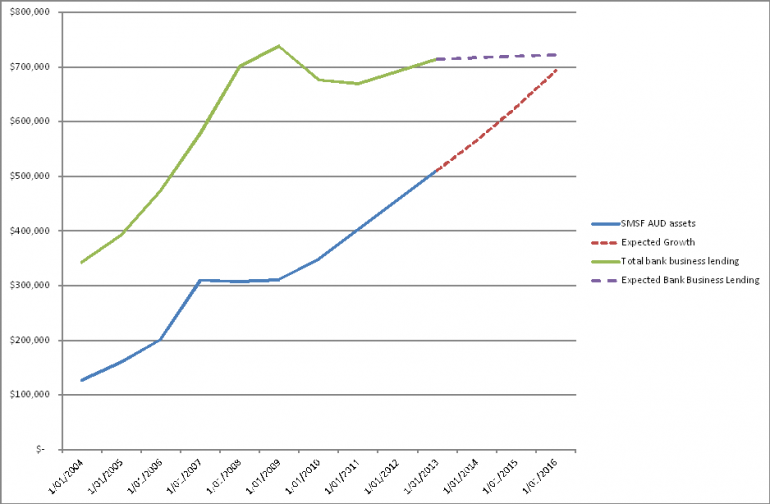

In June 30, 2012 self-managed funds had some $456 billion in Australian assets. On present growth trajectories Australian assets of self-managed funds should rise above $600 billion by 2016 (only three years away). Australian bank lending to the corporate sector is just under $700 billion but is not growing so by 2017 or 2018 self-managed super Australian assets are set to become equal to the entire business lending of the Australian banking sector. This morning’s graph from Elstree illustrates what is happening.

Source: Elstree Investment Management Ltd

The money in self-managed funds should exceed the entire Westpac Australian balance sheet within a few years.

Now, of course, it’s important to underline that comparing banks and superannuation funds is not comparing like and like, but it does help emphasise the importance of what is happening to the funding of corporate Australia and what will happen to the funding of infrastructure.

Research by Elstree shows that up to 80 per cent of some of the larger hybrid security issues was taken up by small holders, led by the self-managed funds. The big institutions have not been big subscribers. The self-managed funds have also been major buyers of high-yielding bank shares plus Telstra.

Research by Andrea Slattery, chief executive of the Self-Managed Super Funds Professionals' Association, shows around 50 per cent of Australia’s superannuation that is in pension mode is funded in self-managed funds.

It’s clear that a large proportion of Australia’s superannuation savings are paid out in lump sums on retirement but for those using superannuation to fund their retirement (the real purpose of superannuation) it appears one in two retirees undertake the task via a self-managed fund.

As more people move into pension mode and the complexity facing major funds trying to administer the proposed new changes becomes apparent and adds to their costs, I believe that the percentage using self-managed funds will rise. And in an ageing population the funds under management in pension mode is set to skyrocket.

Australian companies spend time with their banks and bow and scrape to the legacy superannuation fund analysts, who become so intoxicated with the adulation that they forget that they are losing market share even faster than newspapers. Few companies understand where the new money is housed.

However those issuing hybrid securities certainly do understand. There are now around $39 billion worth of hybrids on issue. Just over a year ago it was under $20 billion.

The legacy institutions cannot easily fund infrastructure because they are required to hold liquid assets in case of a run on their funds. Self-managed funds have no such problems and are crying out for good infrastructure because, if properly structured, it can provide funds in pension mode with good returns to fund retirement that are inflation protected.