A positive reason for gearing into shares

Summary: Now is one of those rare times when the average gross yield from shares is higher than the average cost of borrowing. It's definitely an opportunity, but there are obvious investment risks. |

Key take-out: Historically low interest rates mean borrowing money has never been cheaper. But even positive gearing carries risks if the market was to hit another speed hump. |

Key beneficiaries: General investors. Category: Shares |

In the midst of market downturns often comes opportunity. For example, those share market investors who held their nerve after the volatility of the 1970s experienced a tremendous period of returns – the average return from holding shares from July 1, 1975 to June 30, 1990 (15 years) saw $10,000 turned into $116,467.

Those investors who were prepared to invest for the 15-year period after the 1987 market crash, starting from July 1, 1988, saw $10,000 turned into a more modest but still very impressive $35,753.

| Market downturn | Starting date of portfolio | Value of $10,000 portfolio 15 years later |

| Early 1970s | July 1, 1975 | $116,467 |

| 1987 | July 1, 1988 | $35,753 |

With the Australian share market index still around 20 per cent below its November 2007 peak of 6828.70, it's interesting to consider if we will be able to look back in 20 years' time and say there was an opportunity missed in the years following the Global Financial Crisis.

In the current investment environment, not only are the value of shares lower than they were nine years ago but we have record low interest rates. So is now the time to be taking advantage of these record low interest rates?

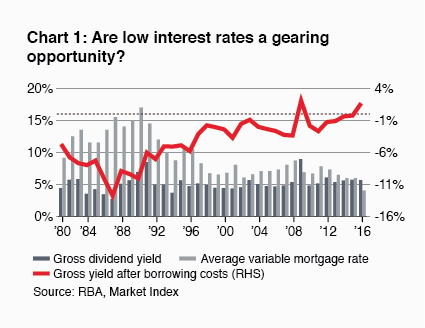

Over the past 36 years or so, since January 1980, the average gross yield from shares (including franking credits from when franking credits were introduced in 1997) has been 5.12 per cent, a little below the current gross market yield of 5.655 per cent.

The average mortgage rate over the same period has been 9.37 per cent, perhaps a reminder in this very low interest rate environment that borrowing rates have often been much higher than they are now.

That means that on average, if you have borrowed to invest in shares, the difference between the interest you have paid (assuming you use an average mortgage) and the gross income from the shares has been -4.25 per cent. That is, your interest cost has been higher than the income that you receive.

However, the reverse is currently true. At the moment you can borrow to invest in shares and your interest cost (at an average 4 per cent) is less than the gross dividends that you can expect to receive. That is, the gross borrowing cost is a positive 1.66 per cent.

This has only happened on one other occasion over this 36-year time period, in January 2009, when the gross borrowing cost was positive 2.08 per cent. This was around the low point of the GFC, when the ASX indices were in the low 3000s. Since then, shares have almost doubled and have provided good income returns.

We hear a lot about positively geared investment properties – currently we also have the opportunity to put together a 'positively geared' share market portfolio.

The maths of gearing with current rates and yields

Let's look at the maths of a $100,000 Australian share market investment using borrowed money and current average yields, franking levels and mortgage costs.

So, $100,000 invested into an average portfolio of Australian shares will provide a cash income of 4.35 per cent, or $4350. The cost of borrowing, assuming a 4 per cent interest rate (and I suspect most people can access a better rate than this) will be $4000. So, after paying interest you will be left with $350 per year of cash. However you also receive the benefit of franking credits. Assuming an average franking rate of 70 per cent for dividends, you will also receive $1200 in franking credits. These are just as valuable as cash as they will allow you to offset tax or receive a tax refund.

This is a pretty attractive result: $350 in your pocket and a $1200 tax credit or refund.

A word on the risks

There remains three variables:

- future dividend growth

- future interest rates, and

- future capital growth.

These are, of course, all unknowns. They are where the longer-term risks to the strategy lie.

The bottom line is a strategy of borrowing to invest is always a high volatility strategy – you effectively magnify the ups and downs of the market. A 50 per cent fall in the value of shares, as happened in the 1970s, 1987 and at the start of the GFC would see you with a loan of $100,000 and a share portfolio valued at $50,000. A very poor position to be in.

Borrowing to invest, in property or shares, has a variety of risks. These need to be well thought through before proceeding.

The final word

Historically low interest rates and a market that is still well below its high of nine years ago have combined to provide an opportunity to borrow and invest in shares in a way that actually creates a positive cash flow for you.

It is important to note the risks of borrowing to invest remain. However, for those people comfortable with high levels of risk, borrowing to invest is currently an interesting proposition.