A new grey area for retailers

Australia's ageing population has made the outlook for retailers especially bleak. Research by the Reserve Bank of Australia shows that older Australians spend significantly less than younger households, with a higher share of that spending allocated to essential services rather than retail goods.

For decades, economic growth in Australia has been boosted by favourable demographics. We were, on average, at a highly productive age and we also experienced a sharp rise in female participation in the workforce. Everything from housing to tax revenue to retail spending to growth benefited from these developments.

But in recent years, that process has begun to change and our demographics are beginning to work against the Australian economy. We are now a little too old and female participation is at a high – but not improving – level. An increasing share of Australians are now retired.

Regular readers of my columns will have read a fair bit about the ageing population. It is, in my view, one of the most important structural issues facing the Australian economy (Ageing pension policies will cripple Australia’s growth, November 22; Australia’s irrevocable, inevitable growth challenge, November 15).

But I’ve mainly focused on areas such as GDP growth, labour market participation, health and aged-care spending. The RBA has added to the discussion by conducting research which allows us to consider the impact that an ageing population might have on household spending.

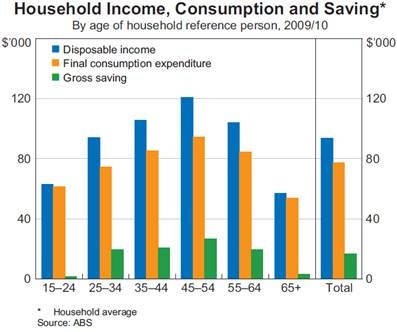

It will come as little surprising that our income and spending patterns differ as we get older. Older Australians naturally earn and spend less than the average person. They also save a lot less as well, perhaps because retirement is what most people are saving towards.

Older households spend a lot less of durable goods than younger households, probably because they have already accumulated these goods. They also spend far more on essential services (such as healthcare) than younger households. By comparison, younger households spend a lot more on discretionary services such as travel, hotels and restaurants.

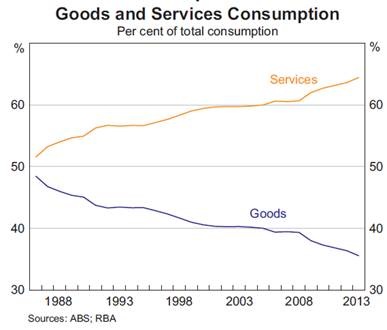

The past three decades have shown a sharp rise in spending on services compared with goods. The rise in services has been driven by dwelling and essential services, while the relative decline in goods spending has been driven by durable goods.

So what are the implications?

Older Australians spend less than younger Australians. They spend less on durable goods but more on essential services such as healthcare. The obvious implication is that the coming decades will be difficult for the retail sector.

As the share of the population retired increases, household spending growth will slow, with most of that growth in services. Spending on health will obviously be quite strong, which will also put pressure on the Australian budget. Soft consumption growth means soft growth in GST revenues, contributing to a further deterioration of government budgets.

Online sales will be no refuge for Australian retailers, with most developed countries suffering the same (if not greater) ageing problems. Ageing demographics aside, it is not clear that Australian retailers would perform well against cheaper competition anyway.

The domestic retail sector already faces considerable challenges from online retail but I wonder to what extent retailers have factored in the impact of an ageing population on their business models. Retailers are lobbying the government to lower the GST threshold for online purchases, but what are they doing to get ready for this structural shift in the economy?

Naturally some retailers will weather the storm better than others. The big concern, in my opinion, must be for retailers that focus primarily on selling durable goods. They perhaps don’t face the same level of online competition, but the demographics will clearly be working to their detriment. I envision an environment where a lot of retailers either close or are bought out, with economies of scale offsetting soft sales growth.

There is perhaps no sector of the Australian economy that will not be affected by the ageing of the Australian population. The retail sector is no exception and the potential changes could be devastating for Australian retailers. But are they aware of the impending challenges and do they have any strategies to deal with them? Unfortunately only time will tell.