A look ahead

Wall Street is rising as President-Elect Joe Biden prepares for power, but so is the Australian dollar.

It's easy to get depressed as you look around the world at COVID-19 infection rates, political skirmishes and the spectacular rise in debt. But the swirling cash is boosting asset values like shares, and markets are looking ahead.

So let’s step back and think.

We have a unique situation in Australia which we do not fully appreciate. In due course, it will be reflected in market values although in the medium term we will move with the rest of the world.

Australia has achieved a COVID-19 infection rate that is the envy of all developed countries.

Along with New Zealand, Taiwan and China we are one of the few countries that have successfully taken the hard steps necessary to bring the virus under control.

When Joe Biden talked with our Prime Minister one of his first questions was: “How did you do it?”.

That sentiment is being talked about around the world and it is going to mean that, in due course, people will come here, lifting demand for migration, tourism and education.

Right now, such an event doesn’t seem possible, but the vaccine will begin its full impact in 2022 and that’s when the international benefits of what we have done will flow through.

One of the outcomes of the COVID-19 experience is that we now have a lot of tasks that will require migration including a widening of our skills base.

Many highly skilled people in the US, Europe or Hong Kong will look down at Australia and think what a wonderful place to live.

We are currently expanding our infrastructure and engaged in major investments in manufacturing and energy. These and other thrusts forward will require a skills base that unfortunately we don’t have but we should be able to attract the people we need.

Leaving aside COVID-19, the political situations in Europe, the US and Hong Kong make these regions much less attractive than they might have seemed a few years ago.

We are also going to be a country that meets its climate obligations but with ALP changing its policy, we now don’t look like being one that is prepared to sacrifice its standard of living on the climate front.

If this optimistic view turns out to be correct, then we will tend to see the continuation of a higher Australian dollar and strong property and share markets. I have edged up my equity holdings.

And of course, we will need a strong economy because both federal and state governments are going deeper into debt and need strong growth, including population growth, to maintain momentum to service both interest bills and any required repayments.

Interest rates will remain low in the short to medium term but we are seeing US bond price falls (rising yields). The 10 year US bond market may be giving an early warning. I watch it every morning.

At the moment when we look forward to the post-COVID-19 era, the first Australian roadblock we see is relations with China – our largest customer.

On this front, there may be continued skirmishes but I see the first signs of good news. Our Prime Minister Scott Morrison is for the first time addressing the issues that China has raised.

At this stage, he says that there has been a misunderstanding and that we have many common interests. But the tone of his statement indicates that he is responding to the issues and not heading into an all-out brawl with China. In particular, he is differentiating Australia from the US.

At the same time, China will be seeing that Australians are not kowtowing to the middle kingdom and with each China blow, the Australian anti-China sentiment rises. If anything, it is becoming counter-productive to China’s long-term strategy because they need Australia’s raw materials.

The recent signing of the Regional Comprehensive Economic Partnership (RCEP) agreement was heralded in the press as a forerunner to lower tariffs. That might be true longer term but in the short term what that treaty is about is synchronising supply chains.

China wants to use its technology and artificial intelligence to make the supply chains for its exports and imports much more efficient. And of course, Australia as an important supplier to China and the region, will need to have systems that are also advanced and compatible with China. If there is a long-term trade war between China and Australia, that goal will become much more difficult to achieve.

Fascinatingly, after Scott Morrison left Japan after visiting Prime Minister Yoshihide Suga, the Chinese Foreign Minister Wang Yi also made a visit.

Almost certainly, the Australian PM’s discussions would have covered the Australia-China dispute and the supply chain ramifications and that may have been followed by top level Japan-China discussions on the same subject.

I might be wrong, but I think in time (not immediately) we will return to some form of normality in this area. That would be great news for Australia.

And finally, I want to explore with you an aspect of the Callaghan report on superannuation which tells us about people’s expenditure after retirement.

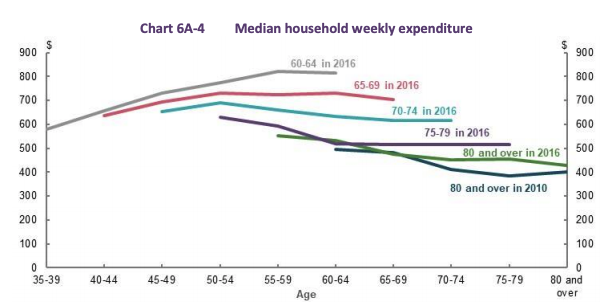

I have taken two graphs out of the report which shows that irrespective of your income, your maximum discretionary spending level is in your 60s and early 70s and after that, it declines quite rapidly.

What happens is that, as people get older, major overseas trips and other adventures become more taxing and they do it less often – at least on average.

One of the graphs is for higher-income people and it shows that irrespective of income, the trends are the same.

So in your planning for retirement, take note that once you get to 80 you are likely to substantially reduce your discretionary spending. And of course, at that time your health needs can rise quite sharply.

People in their 60s often assume their discretionary expenditure rate will continue well into your 80s but on average it is simply not true. Of course, some people in their 80s and 90s continue to set a fast pace – we are talking about averages.

Source: Callaghan report

.png)

Source: Callaghan report

While my optimistic scenario makes people who have investments feel good about the long term, it is important to make sure our children and grandchildren understand that this a much better place to live than most other parts of the world.

They are currently being bombarded with depressing scenarios rather than the traditional Australian optimistic view of the world.

I am of course conceding that in the next year or two, plenty of things will go wrong, but on a comparison basis we are fortunate to live in one of the best parts of the world

Frequently Asked Questions about this Article…

The article explains that Australia’s low COVID-19 infection rate makes it attractive compared with many developed countries. As vaccines take full effect (the piece points to 2022 for wider impact), the country could see increased migration, tourism and international students arriving — which the author says will lift demand and help keep the Australian dollar higher.

The article argues that if Australia’s favourable COVID-19 outcome and returning international demand materialise, this should support a higher Australian dollar and continued strength in property and share markets. The author notes they have edged up equity holdings and cautions that government borrowing will need strong growth and population increases to service debt.

The article highlights China as Australia’s largest customer and acknowledges ongoing skirmishes but also signs of thawing, with the Prime Minister addressing Chinese concerns. It points out the Regional Comprehensive Economic Partnership (RCEP) focuses on synchronising supply chains using technology and AI — meaning long-term trade tensions could make supply-chain compatibility and export efficiency harder to achieve.

The article says short-to-medium-term interest rates are expected to stay low, but notes falling US bond prices (rising yields) — especially the 10-year US bond — may be an early warning signal for markets. The author personally monitors the 10‑year US yield daily, implying investors should watch yields as a market indicator.

Drawing on the Callaghan report, the article notes that discretionary spending typically peaks in people’s 60s and early 70s and then falls sharply after that — especially by age 80. Overseas trips and big adventures tend to reduce, while health needs often rise, so retirees should plan for lower discretionary spending in later years despite assuming spending will continue at earlier levels.