A lesson from Bond and Metcash

Summary: We can learn a lot from the experiences of Alan Bond and Metcash. In the 1980s Bond's rise and fall was all about unlimited credit from banks and seductive profits from high leverage. After the 1987 share market crash and the introduction of dividend imputation, however, Australians began seeking shares in companies that paid tax and issued dividends from their profits. Now Metcash has paid out too much in dividends rather than reinvest capital into its business – something it sorely needed to do. |

Key take-out: Our banks are now more vulnerable than has been the case over the last decade. While they aren't facing a Metcash situation because they are leaders in their field, they need to invest heavily into technology and get their costs down. |

Key beneficiaries: General investors. Category: Strategy. |

Our markets are moving roughly in line with expectations and I will make some brief observations at the bottom of this week's comment.

But what I think is more important is to see what we can learn from both the Bond and Metcash experiences. Alan Bond's death had us all harking back to those amazing 1980s. In a strange way Metcash is part of the sequel to the Bond saga although I can't underline strongly enough that the two are not linked.

The Bond rise and fall was all about two events: First, unlimited credit from banks (mainly overseas) and second, the seductive profit sums that could be concocted with very high leverage.

Basically in the 1980s a whole series of Australian businesses were taken over by entrepreneurs who, thanks to almost unlimited bank credit, geared themselves to the eye balls. That stopped the payment of any tax. Later, high borrowing sent many of the groups they acquired into receivership.

The 1987 crash stopped those practices but they would have arisen again, at least in the Australian market place, but for dividend imputation. Dividend imputation ended double taxation of those profits paid in dividends and it meant that companies paying Australian tax were much more valuable to Australian shareholders because they could pay dividends that carried franking credits.

And so instead of chasing the most highly leveraged vehicle they could find, Australians began buying shares in companies that paid tax and paid dividends from their tax paid profits.

International companies continued to invest in Australia with hopelessly leveraged assets with the clear aim of not paying Australian tax, but that is another story.

The combination of the big slumps that followed the 1987 share crash and dividend imputation changed the way we fund a great many of our listed companies.

Over time the Australian stock market rose by 15 to 20 per cent on the back of dividend imputation. But in the current decade came an era of lower and lower interest rates and increasingly investors began using high yielding shares as a key income source because bank deposit interest rates had fallen so low.

And so companies came under great pressure to pay out as much of their tax paid profits as they could. Senior executives whose packages were linked to the share price of a company worked ‘overtime' to justify as high a dividend as possible so as to boost the share price and their bonus.

As a result Australian companies pay out a much higher proportion of their profits in dividends than most of their counterparts overseas.

In a strange way Metcash is an example of how this can go wrong. In the four years to 2013 Metcash paid an average of around 27.25 cents a share a year in dividends. The so called “underlying ” profit in those four years averaged around 33 cents a share. So on a “underlying” basis the company's payout ratio was just under 83 per cent but the actual earnings (what the auditors thought was the profit) averaged only around 24 cents a share in those four years and did not cover dividends.

Quite clearly Metcash was boosting its share price by paying too much in dividends. I can't think of a company that needed to reinvest more in its business than Metcash which found itself in the middle of two vicious wars. The first was the Coles/Woolworth/Aldi supermarket war where all three companies were looking to strip market share from Metcash's IGA chain.

But Metcash through Mitre 10 and other brands was also in the middle of the hardware war between Bunnings and Masters. The company did its best to try to make its operations efficient but it faced a wall of efficiency investments from its rivals in the two wars. And in supermarket wars and via Bunnings that level of investment is going to increase. Increasingly the supermarket war is going to be about customer data bases and mobile phone marketing. IGA are not big players in that race. Moreover, they papered over their problems by selling goods to their supermarkets at too higher price which boosted the warehouse profits but was unsustainable. Metcash has now stopped dividends and will try to fix the problem with the cash that it can generate. However, with hindsight, it should have acted much earlier. Of course, had Metcash faced the music earlier, the share price would have slumped so dividends were left at high levels.

The lesson from Metcash is that in any investment you make you need to look around and see what the rivals are doing and if those rivals are giving your company a hard time or disruptive technologies are beginning to be fired at your company. If this is happening then be on the alert.

As I have written in these columns many times, our banks are now more vulnerable than has been the case over the last decade. I have no doubt that the fall in bank shares is closely linked to market fears that disruptive technology will reduce bank profits. And banks have done exactly what Metcash did by boosting their share price by paying out a high proportion of their profits in dividends. Banks are not facing a Metcash situation because they are the leaders in their field. But they will need to invest heavily in technology and get their costs down. Westpac is giving itself ten years to reduce its cost by about 50 per cent. Other banks will have the similar targets. The banks clearly recognise the danger and it is a question of how much time they have.

I will be surprised if bank dividends are boosted substantially in the next few years because the companies need to invest.

Market brief

As we have known for some time the Greek crisis will go to the wire and my guess is it will be settled on the last possible day. There is a least a 40 per cent chance the Greeks will fall over and be forced out of the Euro so we could have a turbulent time. But I think there is a good 60 per cent chance that Greece stays in the Euro and will face penalties that will not be enforced. If they are forced out (and again in my view that's a less likely course) Europe is far better placed to isolate the problem and prevent contagion than it was two or three years ago.

Elsewhere, the American recovery is proceeding on track although perhaps much more slowly than many thought. Unfortunately many of the jobs being created are lower paid and that slows the momentum but we are very likely to see higher interest rates in the US before 2015 is out. But the rate rises will not be big.

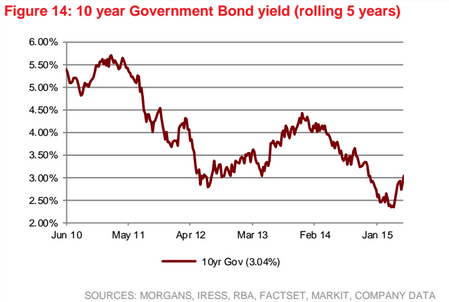

Meanwhile, the increase in the Australian ten year bond rate from 2.25 per cent to around 3.1 per cent in the last four months has clearly affected the Australian share market.

The remarkable aspect of the bond yields rise to date has been the divergence of markets here and overseas: In Australia as bond yields have inched up above 3 per cent, shares have fallen significantly in recent months: In the US bond yields have also risen but their share market continues to advance. One of those markets has got its pricing wrong.