A green light for growth portfolios

Is it time to jump back into the share market? The news from wealth management firm Vanguard is that retirees may be disappointed if they are hoping for the same growth levels of the recent past. But those who are prepared to increase their holdings in shares might finally see things pick up.

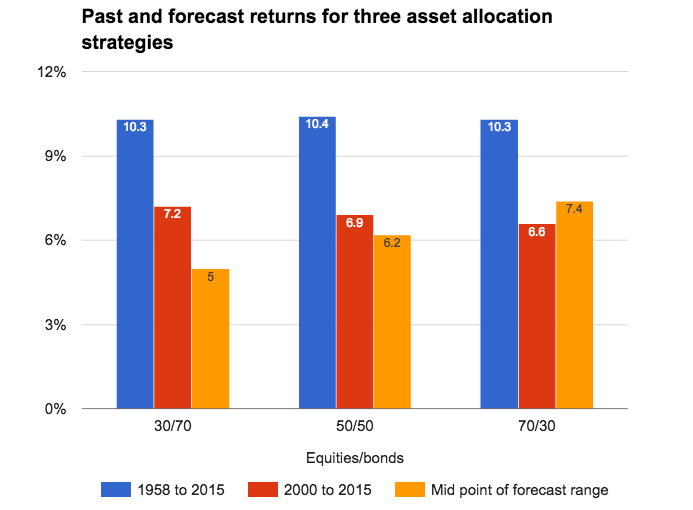

For the next 10 years the researcher predicts a portfolio split 70/30 between shares and bonds will do better than it has for the past 15 years.

A conservative portfolio made up of 30% equities and 70% bonds is expected to do worse, according to its predictions.

The chart shows Vanguard’s mid-point estimate of returns for the next 10 years, compared with annualised returns for 1958 to 2015 and 2000 to 2015.

The strong bull markets of the 1980s and 1990s which contributed to average returns above 10% between 1958 to 2015 may never be repeated. However, investors who were scared away from equities by the devastation to capital during the global financial crisis and have stayed away ever since might want to think again — the research shows portfolios weighted towards equities may be better off.

BETWEEN THE NUMBERS

No one can say with any certainty how markets will perform next week let alone over the next 10 years and quoting a mid-point for Vanguard’s expected range of returns isn’t that meaningful, so let’s have a look at the range of expected outcomes*.

For a portfolio split 30/70 between equities and bonds

With 50% certainty, returns between 3.8% and 6.2% are expected.

With 90% certainty, returns between 2.0% and 8.0% are expected.

For a portfolio split 50/50 between equities and bonds

With 50% certainty, returns between 4.3% and 8.2% are expected.

With 90% certainty, returns between 1.5% and 11.0% are expected.

For a portfolio split 70/30 between equities and bonds

With 50% certainty, returns between 4.7% and 10.1% are expected.

With 90% certainty, returns between 0.8% and 14.2% are expected.

If Vanguard’s forecasts can be relied on to be right half the time (50% certainty), then the case for conservative investors to rebalance their portfolios towards equities looks like a sure bet.

FEAR LESS, NOT FEARLESS

Too often investors are distracted by the worries of today, many of which will come to mean nothing as time rolls by. These headline issues often lead to volatility in the markets, but it is bad strategy to respond to every fear and concern in the media. With investing, what matters most is the long-term trend.

Vanguard’s research shows growth strategies can be expected to do better in the next 10 years than they have in the past 15 years and conservative strategies may do worse.

The future for the share market might be better than you think.

THOUSANDS OF GUESSES

An explanation of Vanguard’s methodology is required if investors are expected to seriously consider rebalancing their life savings.

The Vanguard Capital Markets Model takes data from the past and runs a vast number of simulations where a multitude of possibilities are allowed to “virtually” happen, almost like parallel universes. “The model generates a large set of simulated outcomes for each asset class over several time horizons,” the researcher says, allowing for randomness and estimates of inter-relatedness between investment classes.

It’s very heavy work, even for computers, but the range of outcomes it produces has been reasonably accurate in the past.

* The equities component of the portfolios is 50% Australian, 50% global ex-Australia. The bonds component is 40% Australian, 60% global ex-Australia.

Frequently Asked Questions about this Article…

According to Vanguard's research, it might be a good time to consider increasing your holdings in shares. While past growth levels may not be repeated, portfolios weighted towards equities are expected to perform better over the next 10 years.

Vanguard predicts that a portfolio with a 70/30 split between equities and bonds will perform better than it has in the past 15 years. With 50% certainty, returns are expected to be between 4.7% and 10.1%, and with 90% certainty, between 0.8% and 14.2%.

Vanguard's research suggests that conservative portfolios, with a 30% equities and 70% bonds split, may perform worse in the next 10 years compared to growth portfolios, which are expected to do better.

For a 50/50 portfolio split, Vanguard estimates returns with 50% certainty to be between 4.3% and 8.2%, and with 90% certainty, between 1.5% and 11.0%.

Vanguard's forecasts indicate that growth strategies are likely to outperform conservative ones in the coming decade. This suggests that rebalancing towards equities could be beneficial for investors seeking better returns.

Vanguard uses the Vanguard Capital Markets Model, which runs numerous simulations to predict market outcomes. While no forecast is guaranteed, their model has been reasonably accurate in the past.

Investors should focus on long-term trends rather than reacting to short-term market volatility. Vanguard's research emphasizes the importance of a long-term growth strategy over responding to daily market fears.

In Vanguard's forecasts, the equities component is 50% Australian and 50% global ex-Australia, while the bonds component is 40% Australian and 60% global ex-Australia.