A day of reckoning awaits the housing market

Next week’s federal budget is unlikely to contain any surprises for the property market but budget cuts could shake investor optimism as consumer confidence tanks.

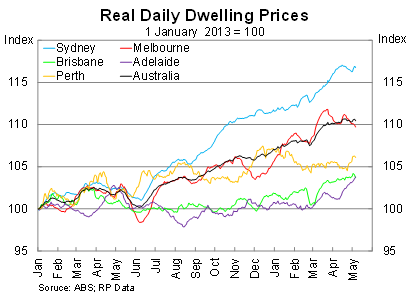

Real dwelling prices have continued to rise rapidly through 2014 but momentum may have slowed since the end of March. Growth continues to be centred in Sydney and Melbourne -- where investor activity has been strongest -- but there has been some recent strength in Brisbane and Adelaide.

Nevertheless, the housing market continues to cause trouble for the Reserve Bank of Australia. Housing remains the sole justification for higher rates -- a move the RBA is reluctant to make -- with the RBA expressing concern about the strength of growth earlier the year.

These concerns are certainly justified but the federal government may have come to the rescue, albeit unintentionally.

Budget leaks suggest that spending cuts will weigh on growth over the next few years. But the biggest concern for the housing market comes in the form of the proposed deficit tax, which will hit Australia’s upper and upper-middle classes with either a one percentage point or two percentage point increase in marginal tax rates.

The key question for housing is: how will this affect investor behaviour?

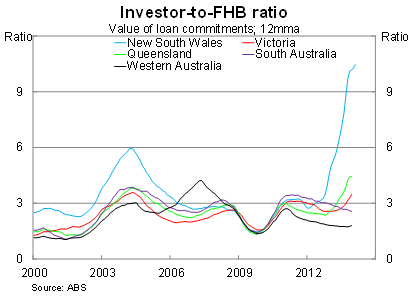

Since the recent boom has largely been driven by investors -- as opposed to strong income growth -- higher taxes on the wealthy could have a disproportionally large effect on the housing market.

Higher taxes will hit the market at the very top (since high income earners obviously purchase expensive housing), but also towards the bottom (since investors often favour cheap rental properties).

Since the budget leaks began, consumer confidence has tanked with the ANZ-Roy Morgan consumer confidence measure falling to its lowest level in five years. In my opinion, property investors are likely to be driven more by confidence or ‘animal spirits’ than the average consumer.

Property investors are betting on house price appreciation, but look at the mounting headwinds: higher taxes, budget cuts, lower consumer confidence, a high Australian dollar, a collapse in mining investment and concerns about China.

Any combination of these factors could be enough to spook investors, resulting in dire consequences for the Australian housing market. Investor demand is already running at an unsustainable pace and, if history is any guide, that typically results in prices falling.

The Sydney downturn in 2004 offers insight into today’s episode. Then, like now, there was a rapid rise in Sydney house prices that was primarily driven by speculation. When investor demand subsided, house prices declined to such an extent that it took a decade before Sydney prices returned to their previous peak.

The problem for the housing market is that there is nothing to replace investor activity if it does deteriorate. Owner-occupiers are already struggling with many of the same headwinds, while first home buyer activity has rarely been weaker.

The housing market and house prices are driven by demand for housing and if investor demand declines, then prices will soon follow suit. I have argued previously that the biggest threat to the housing market comes from the elevated level of investor activity; the market can only shine that bright for so long.

The proposed deficit tax and associated spending cuts may not be enough to spook investors but it could bring forth the day of reckoning. When a market is driven by speculation, it often doesn’t take much for conditions to sour. Households across the country will be tightening their budgets this year as higher taxes and welfare and spending cuts take their toll.

Combining these factors with a soft economic outlook suggests that the recent boom in house prices could soon be a thing of the past.