A confusing set of economic data

|

Summary: While on the one hand residential building approvals are falling, it's evident that property lending demand remains fairly strong. Add to that the ongoing declines in retail sales, outside of food, and investors have a lot to digest. |

|

Key take-out: The latest economic data from the Australian Bureau of Statistics is somewhat at odds with the optimistic forecasts in the latest Federal Budget. |

|

Key beneficiaries: General investors. Category: Economy. |

Last week Australian markets and investors were primarily focused on the Federal Budget and how that would impact the economy, the markets, households and businesses.

But the week also contained a raft of important economic data that will shape how the economy will develop over the remainder of this year.

How about we start with something that many readers have a financial interest in: residential property?

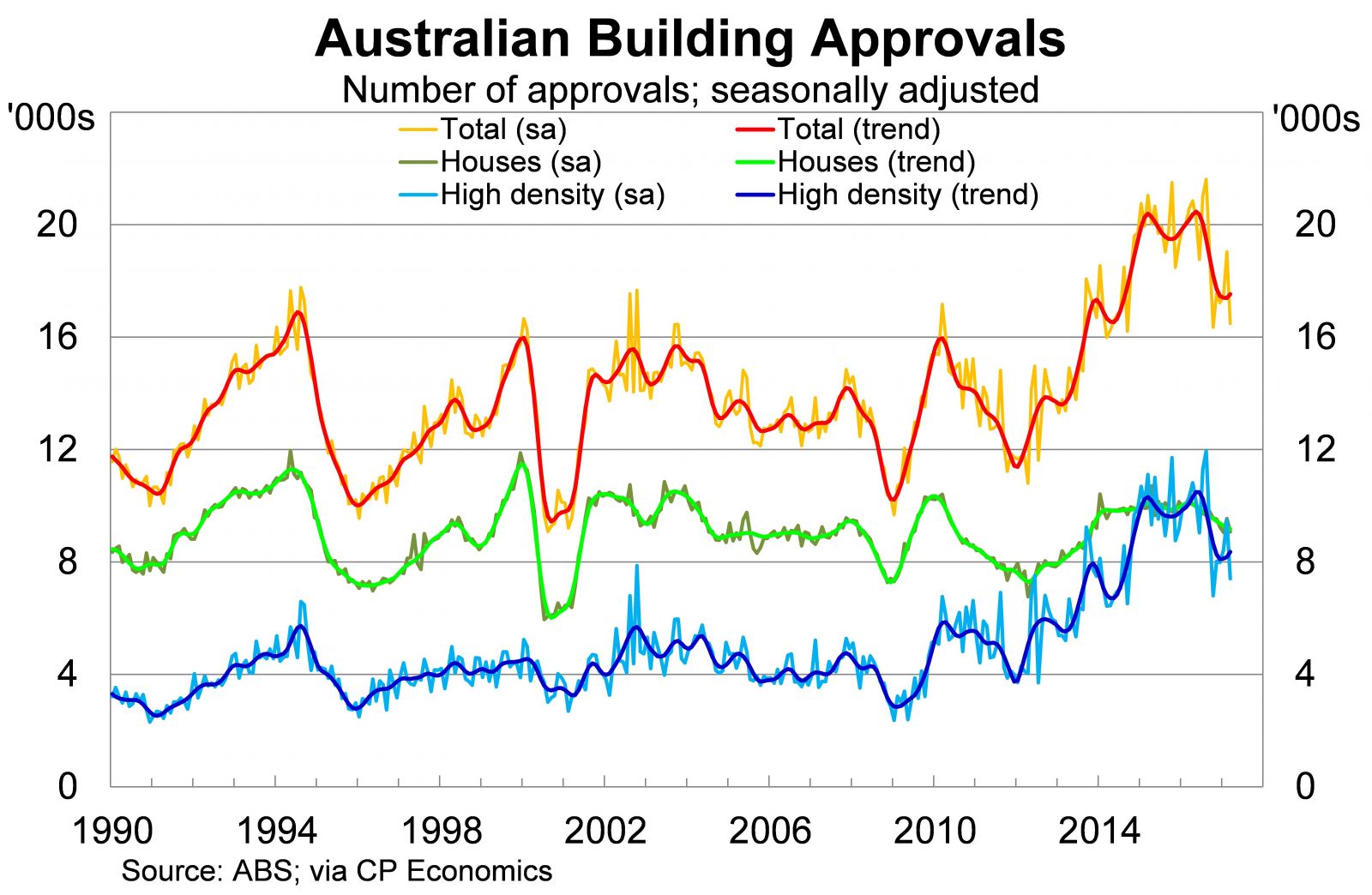

The Australian Bureau of Statistics (ABS) released new data on residential building approvals. The ABS data has been volatile of late, making it difficult to separate the signal from the noise, and March was no exception.

According to the ABS, residential building approvals fell by 13.4 per cent in March, which more than offset an almost 9 per cent rise in the previous month. Building approvals are 14.3 per cent below their peak on a trend basis, and that suggests that residential construction has either peaked as a share of economic activity or will do so within the next three to six months.

Most of the recent decline in residential building approvals has been concentrated in the higher-density apartment sector. This sector drove the construction boom and has now fallen 20 per cent from its peak in June 2016.

Nevertheless, construction activity remains elevated by historical standards, creating opportunities for property investors. However, new risks to residential construction emerged in the aftermath of the Federal Budget, with the Federal Government announcing a plan to restrict foreign ownership of new developments (How the Federal Budget will really impact property; May 11).

If that goes ahead it could certainly jeopardise some building projects. Other projects may be delayed or prices could fall as foreign demand falls away.

The retail sales slip

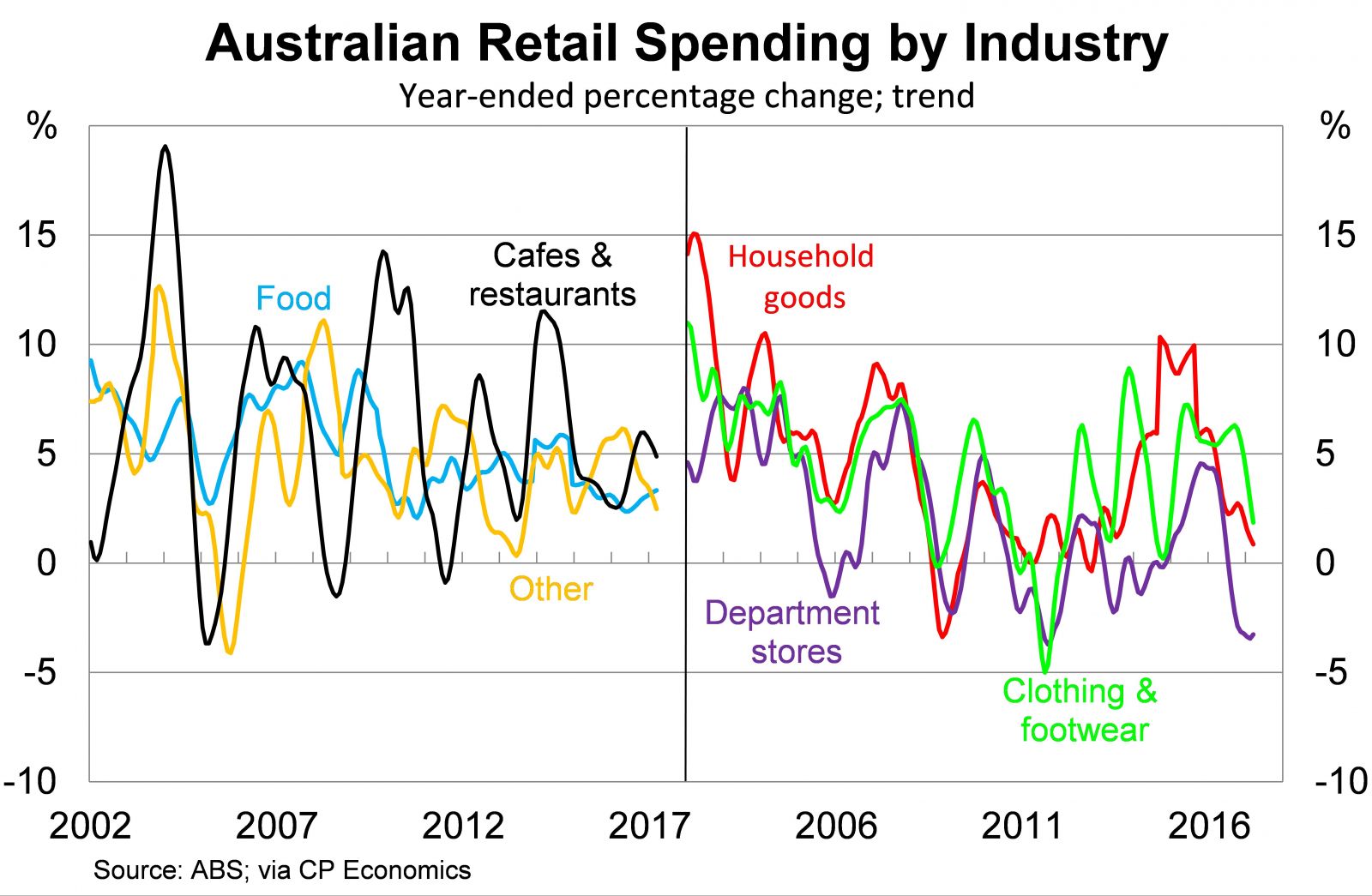

New data on the retail sector, however, was arguably the more important economic development. One of the key trends that we have followed over the past 12 months has been the gradual slowdown in retail trade activity. This trend continued with the release of new data for March.

According to the ABS, retail sales fell by 0.1 per cent in March, missing market expectations, to be 2.1 per cent higher over the year. It was the second consecutive monthly decline in retail turnover and annual growth is now at its lowest level since June 2013.

Most industries, outside of food and cafes and restaurants, are experiencing lacklustre growth. Department stores, however, are in outright decline due to combination of poor volumes and low prices.

Quarterly turnover, which adjusts for changes in retail prices, was also quite weak. Turnover rose modestly in the March quarter and has increased by just 1.2 per cent over the past 12 months.

Household spending accounts for 57 per cent of economic activity and retail sales accounts for around one-third of household spending. So almost one-fifth of the economy was almost unchanged during the March quarter, which puts economic growth at a distinct disadvantage.

The main reason for such subdued growth is the ongoing weakness in wages and income. Household wages and incomes are stagnant, or close enough, and that is making things difficult for the retail sector. Remarkably, annual growth in retail sales and household spending continues to exceed wage growth, which suggests that conditions will only deteriorate further for retailers.

Home loans remain hot

Finally, I wanted to draw your attention to the latest set of data on new mortgage activity. These data have important implications for dwelling prices and will be of keen interest to policymakers and investors over the remainder of the year.

According to the ABS, new mortgage lending has increased by 11.3 per cent over the past 12 months. Lending to investors has increased by 18.5 per cent over this period, which has easily outpaced the 5.3 per cent growth in lending to owner-occupiers.

The property market is clearly hot right now, and that is reflected in the strong growth in lending commitments. It has been enough to raise concerns among our financial regulators and the Australian Prudential Regulation Authority has taken steps to soften demand and tighten lending standards.

Whether this works or not will be observed in these data over the remainder of the year. So far we only have data for March; so we don't have any data that covers the period after the introduction of restrictions on interest-only loans and the decision by our major banks to hike mortgage rates.

Collectively the data released over the past week paints a fairly mixed picture of the Australian economy.

Residential construction remains strong but is expected to subtract from economic growth over the next year or two. Meanwhile, retail sales and the associated weakness in wage growth presents a more immediate concern.

Against that backdrop we have an increasingly indebted household sector that doesn't seem at all perturbed by lacklustre wage growth.

It is a complicated environment which will challenge policymakers for the foreseeable future. It also sits in stark contrast to the rather optimistic economic narrative described in last week's Federal Budget.