InvestSMART Portfolios: 5 years in, concept confirmed

Why the 5-year is the most important timeframe is that five years is considered a ‘cycle’ in the market. In a five year cycle your portfolio should have seen falls, rises and possible market shocks. It, therefore, will have been ‘tested’ thoroughly and will confirm if the portfolio’s thesis is not only sustainable, but can thrive.

This January, our diversified portfolios hit its 5-year performance mark. Our thesis has been to provide the correct level of diversification for those with risk profiles of ‘Conservative’, ‘Balanced’, ‘Growth’ and ‘Assertive’ (High Growth) at the lowest possible fee.

Even before the Banking Royal Commission, our research had shown that the biggest impactor on overall performance is the funds’ fees. When you break this down, if you continuously take 1 per cent or more out of performance, it significantly impacts the compounding effects in your portfolio.

This is what we wanted to rectify. History has shown us that the average return of a Balanced portfolio is approximately 5 per cent per annum. Taking 1 per cent out of this annual performance is significant and as this chart shows, the underperformance it creates is glaring.

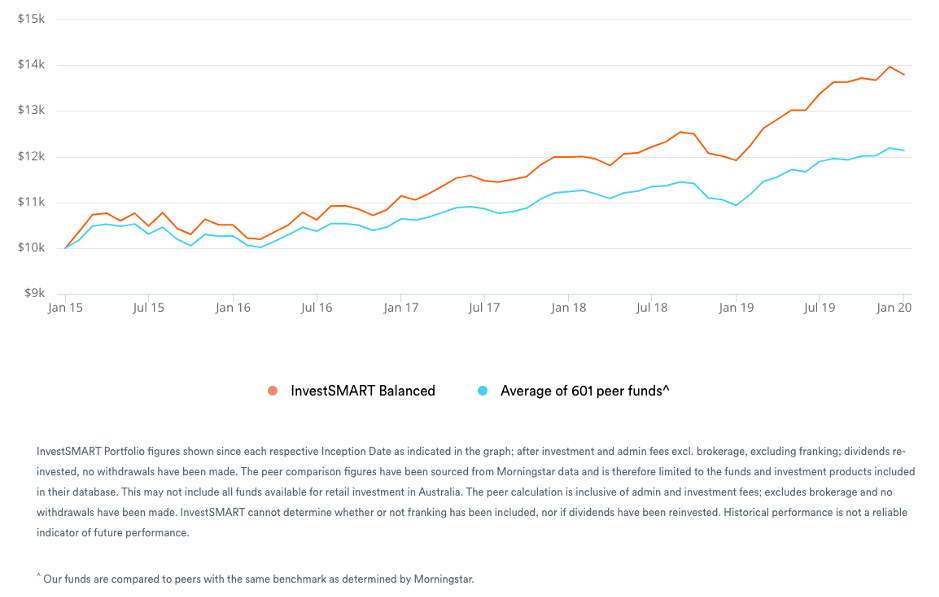

InvestSMART’s Balanced Portfolio versus ‘Balanced’ Peers over five years.

Over time the Balanced Portfolio is now outperforming our peers by over 13 per cent, a theme that is replicated in all four portfolios.

This confirms our portfolio concept of offering the ‘market’ with the lowest fees possible. It confirms our thesis that we can and will outperform our peers on performance over the longer term and it confirms that portfolios can withstand five years of market cycles.

So, here's to the past five years of performance and here is to the next five years, long may it reign.

Click here to view the InvestSMART capped fee portfolios.

Frequently Asked Questions about this Article…

A 5-year timeframe is crucial because it represents a full market cycle, including rises, falls, and potential shocks. This period tests the sustainability and resilience of an investment portfolio, confirming if it can thrive over time.

InvestSMART's thesis is to provide the right level of diversification for different risk profiles—Conservative, Balanced, Growth, and Assertive—while maintaining the lowest possible fees to enhance overall performance.

Fees significantly impact portfolio performance by reducing the compounding effects. For example, consistently taking 1% or more out of annual performance can lead to noticeable underperformance over time.

Over the past five years, InvestSMART's Balanced Portfolio has outperformed its peers by over 13%, demonstrating the effectiveness of their low-fee, diversified approach.

InvestSMART focuses on offering market-level portfolios with the lowest fees possible, which helps in maximizing returns by minimizing the impact of fees on compounding growth.

InvestSMART offers portfolios tailored to various risk profiles, including Conservative, Balanced, Growth, and Assertive (High Growth), to cater to different investor needs and preferences.

InvestSMART's portfolios have consistently outperformed their peers over a five-year period, confirming the effectiveness of their investment strategy and low-fee approach.

Investors can expect continued strong performance from InvestSMART portfolios, as they have been designed to withstand market cycles and deliver superior returns over the long term.