Billionaire Buffett takes an active swipe

Summary: Outperforming the market is never easy, and most active fund managers who try tend to underperform more often than not, at least over the short term. |

Key take-out: With the exodus of investment capital into low-cost index products such as exchange-traded funds showing no signs of slowing down, many active fund managers are repositioning their products to be more price competitive. |

Key beneficiaries: General investors. Category: Exchange-traded funds. |

When multi-billionaire investor Warren Buffett talks, people tend to listen.

So when Buffett, also known as the “Oracle of Omaha”, used his annual letter to Berkshire Hathaway shareholders this week to comment on the fees being collected by fund managers, you can bet his words were taken seriously.

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients,” Buffett exclaimed.

He's correct, to a point. Most active fund managers have underperformed the markets they have invested in over recent times. But as a consequence, rather than making “outsized profits”, many investment groups have actually reported lower profits.

Chronic underperformance

In their quest to outperform, analysing reams of complex data and economic signals to build portfolios of premium stocks, most active investment managers have been falling short of the mark.

Why? In some cases, fund managers have simply invested into areas that haven't paid off as well as others. Other fund managers have been investing the right way, but their fees have negated the returns.

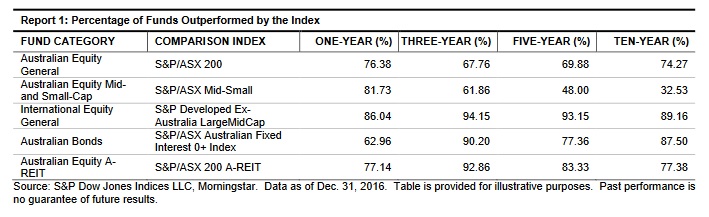

The latest analysis of active fund managers just released by S&P Dow Jones Indices, which tracks the performance of more than 1100 actively managed equity and bond funds in Australia, found the majority of managers have consistently underperformed against their respective benchmarks.

For example, around eight out of 10 active managers of funds trying to beat the S&P/ASX 200 Index in the trading year ending on December 30, 2016 underperformed, achieving an average return of 9.2 per cent against an 11.8 per cent gain by the index.

Last year was characterised by a series of unexpected events that confounded global markets and fund managers alike, including Brexit, two yuan devaluations, and the US election result upset. There was also a constant overhang around the future of the European Union, which also caused weak returns across the Continent.

Large locally listed funds management groups with globally focused products, such as Magellan Financial Group and Platinum Asset Management, have both suffered at the hands of fickle financial markets.

For them, and others, that has translated into lower performance fees, revenues and ultimately profits, and that in turn has eroded their share prices. Other unlisted active managers have also been feeling the performance fees pinch, because they too haven't been performing.

But this trend has been going on for years. The same research shows most active fund managers have been underperforming over three, five and 10 years.

And that's one of the driving reasons why more and more investors are questioning the fees being charged by active managers consistently underperforming the market, and for the growing wave of retail and institutional capital being shifted out of managed funds into exchange-traded funds.

The surge to ETFs

Head of ANZ ETFS, Kris Walesby, says the broad range of opportunities available through index-tracking ETFs on the Australian market, their low costs, and the ability for investors to trade in and out of them at will, is proving a big attraction.

He also notes that more investors are using ETFs tactically, to take short-term positions in overseas markets and different asset classes – something that's much harder to do through a standard managed fund structure.

Olivia Engel, deputy chief investment officer of State Street Global Advisor's active quantitative equities team, doesn't dispute the fact that ETFs are giving active managers a run for their money.

“Often investors want to shoot for the rafters and pay up for a really high-quality active manager to deliver them a really differentiated return outcome from what they could get by buying an ETF or from buying an index fund,” Engel says.

“The hurdle and the onus on us as the active management team is to differentiate ourselves from an index outcome and prove that it's worth paying for. So we think that traditional benchmark-hugging active management which has high management fees is probably a bit of an endangered species.”

The new battleground for product providers is unquestionably fees, and fund managers are working to cut them down.

The drive to lower fees

Vanguard's Asia-Pacific Head of Investments, Rodney Comegys, agrees that in what has been, and will continue to be a lower return environment, investors are paying much more attention to cost.

“At a macro global level there's been absolutely no question that there is a preference for global investors to use and move into specifically lower-cost index fund products, and often the vehicle of choice has been the exchange-traded fund.

“The trend has already been going on for a while, but has accelerated in recent times. There are a number of things causing that but one of the biggest is cost and fees, meaning now is a very challenging time for active managers.”

While some active managers actually do outperform the market, high management and performance fees often destroy whatever alpha (excess return to the market) that can be generated.

It's also hard for active managers to consistently outperform an index, so they might have a year or two when they outperform and then a year of poor performance where they give back the alpha they've generated.

“At any given point a specific, more niche, strategy can do very well on the performance tables,” Comsyg adds. “I would say to investors, be very careful and thoughtful as to whether that investment performance can continue.”

Actively managed, high-conviction funds often can deliver very polarising outcomes. These are funds that take a concentrated bet, or position, in terms of a particular market direction, a specific sector, or even in single stocks.

“When we looked at the 2015 high-conviction managers and then contrasted that with the 2016 high-conviction managers we found that the best and worst performers were at opposite ends of the spectrum. Lots of them outperformed in 2015, but most of them underperformed in 2016,” Engel says.

“The consequences of being wrong in these concentrated high-conviction funds is much larger than if you have a wider strategy. I think you can still have a high-conviction investment portfolio without having concentration in it. It can be a very large number of small high-conviction bets rather than a very small number of large high-conviction bets.”

For investors, it's worth noting that even the best active managers will underperform the market at times. The key is to have the patience and discipline to stay with their investment strategy and the belief that they will outperform over the longer term.

If you can tap into a low-cost investment fund strategy that better manages the risks associated with equity investing, then that is definitely something worth paying for.