ETF boom on Wall Street and in Australia

What’s going on in the exchange-traded funds sector globally is nothing short of phenomenal, and Australian investors are joining the party in droves.

Now, you wouldn’t have seen them, but there were celebratory fireworks over Wall Street a few days ago and they had nothing to do with the Independence Day holiday on July 4. Rather it was fund managers, financial advisers and traders celebrating: 2017 is turning out to be their best-ever year — at least so far.

While the US doesn’t rule off its end of financial year books on June 30 like we do, the end of last month marked a new milestone for the exchange-traded funds sector as investment records tumbled yet again.

The latest trading data shows that, in the first six months of 2017, just under $US250 billion ($329bn) of global investor funds were ploughed into ETFs. That’s more than double the rate of the previous two years, and around $US45bn of those new investment funds came through in June alone.

Most of the money went into the US — the epicentre of the ETF market — but there was also a strong flow into European funds.

And a portion of those inflows came from Australian investors too, because ETFs are really taking off here as well.

So, given there were 22 market trading days in June, the total inflows work out to more than $US2bn per day. That equates to lots of fees for the fund managers, and don’t forget the huge online brokerage fees that are being generated too. And it turns out, in the US at least, that about half of all new inflows are going to just four ETF issuers. Blackrock, which offers its products under the iShares banner, is the undisputed ETF king with a whopping $US1.7 trillion of ETF assets under management globally. Vanguard is now sitting on about $US735bn in ETF funds, State Street has $US540bn and Invesco $US124bn.

Some experts are describing the ETF sector as an unstoppable juggernaut.

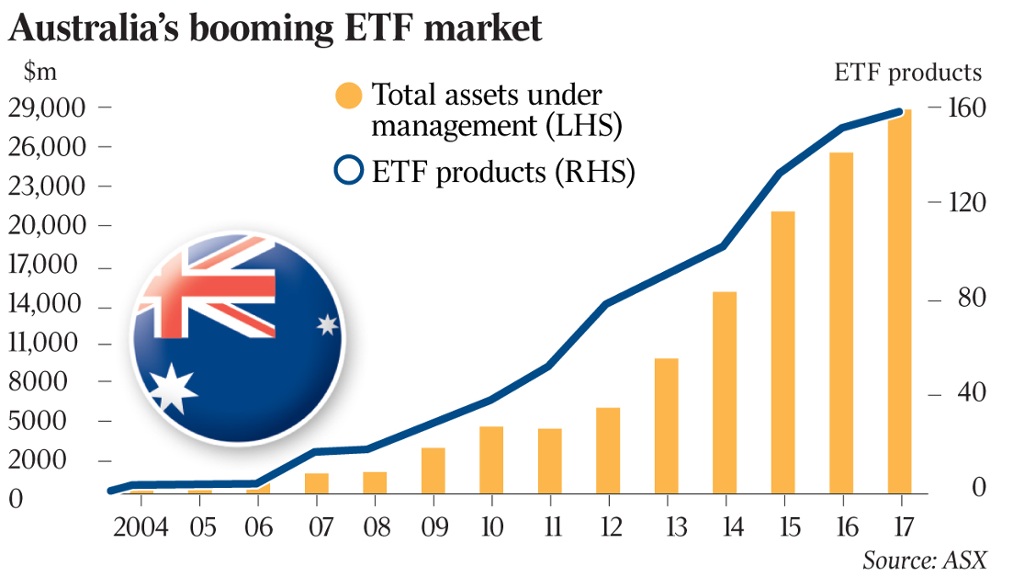

Our own ETF market is now worth close to $30bn, and it’s clear that number will continue to grow strongly. New ETF products are being added to the ASX boards about every month. If we look over the past five years, the Australian ETF market has recorded a compound annual growth rate of 35 per cent.

Craze hits home

So what are the factors driving the Australian ETF market? We’re just a microcosm of what’s happening on the global market.

Investors globally are now using ETFs as an essential component of their stocks portfolio. In a single stockmarket trade, an investor can effectively buy one security that covers off a whole market index, a specific sector or an asset class. They’re very low cost, too. The iShares Core S&P 500 product, for example, charges fees of just 0.04 per cent.

Increasingly, ETFs are being used to complement more active stock-picking strategies, so investors can effectively have a foot in both camps. They may hold one or more ETFs as a passive index investment strategy, and use unlisted managed funds or listed investment companies as their active strategy to outperform the market.

Also, rather than just being used as a long-term strategy, more investors are using ETFs for short-term plays across commodities, currencies and other thematics.

In Australia, investors are primarily buying ETFs that cover the S&P/ASX 200 or the whole Australian market, the S&P 500, and ETF products that generate a regular income stream. Many are also buying a blend of different ETFs through tax-effective structures such as separately managed accounts that align with their diversified growth and income strategies.

ETF assets under management in the US are now just shy of $US3 trillion. That represents about 6 per cent of the total US stockmarket’s value. In a report this week investment bank Goldman Sachs said that ETFs were one of the major forces behind the US market’s solid gains this year.

Which is sort of what some market commentators are alluding to when they raise concerns about the pace of inflows into US ETFs. They’re saying this is heightening the prospect of a price bubble being formed on the US stockmarket.

But I wouldn’t put too much credence on that. The fact is that investors are also buying shares directly and through managed funds and other products. The demand is already there, so ETFs are just another mechanism. What happens on the US market will relate to other factors, not to the growth of ETFs.

We won’t know the full Australian ETF figures for 2016-17 for another week or so, but several of the key ETF players in the Australian market I have spoken to are very upbeat. No real surprises there. We can expect to see solid funds growth recorded over the last financial year. The actual number of new ETF funds added here will come close to $6bn.

One thing is certain. Expect that inflows figure here to increase substantially in 2017-18 as more investors board the ETF bus.

Frequently Asked Questions about this Article…

The growth of ETFs in Australia is driven by their low-cost nature and versatility. Investors are using them as essential components of their stock portfolios, allowing them to buy a single security that covers a whole market index, specific sector, or asset class. This makes ETFs an attractive option for both passive and active investment strategies.

In the first six months of 2017, just under $US250 billion was invested in ETFs globally. This represents more than double the rate of the previous two years, highlighting the rapid growth and popularity of ETFs among investors worldwide.

The major players in the global ETF market include Blackrock, Vanguard, State Street, and Invesco. Blackrock, under the iShares banner, leads with $US1.7 trillion in ETF assets under management, followed by Vanguard with $US735 billion, State Street with $US540 billion, and Invesco with $US124 billion.

ETFs are considered a low-cost investment option because they typically have lower fees compared to other investment products. For example, the iShares Core S&P 500 ETF charges fees of just 0.04 percent, making them an affordable choice for investors looking to diversify their portfolios.

Australian investors are primarily buying ETFs that cover the S&P/ASX 200, the whole Australian market, and the S&P 500. They also favor ETF products that generate a regular income stream and often use tax-effective structures like separately managed accounts to align with their diversified growth and income strategies.

Some market commentators have raised concerns that the rapid inflows into US ETFs could heighten the prospect of a price bubble. However, it's important to note that investors are also buying shares directly and through managed funds, so ETFs are just one of many investment mechanisms. The growth of ETFs alone is unlikely to cause a market bubble.

ETF assets under management in the US are now just shy of $US3 trillion, representing about 6 percent of the total US stock market's value. This highlights the significant role ETFs play in the US investment landscape.

The outlook for the Australian ETF market is very positive, with expectations of substantial inflows in 2017-18. As more investors embrace ETFs, the market is anticipated to continue its strong growth trajectory, building on the solid funds growth recorded in the previous financial year.