Upgrading Azure

We downgraded our Azure (AZV) recommendation from “buy” to “hold” on August 25, with the share price having increased to 45 cents from 30 cents at our initial “buy” recommendation in March. Since this time, chief executive Robert Grey has sold down about a third of his shareholding, and our confidence in Azure's long term growth potential has only increased.

Today at Azure's share price of 40 cents we are upgrading our recommendation back to a “buy” with an increased 55 cents valuation. The increase is a reflection of upgrades to our longer term forecasts, with greater confidence that 2014 was the beginning of a sustainable high-growth phase for the company.

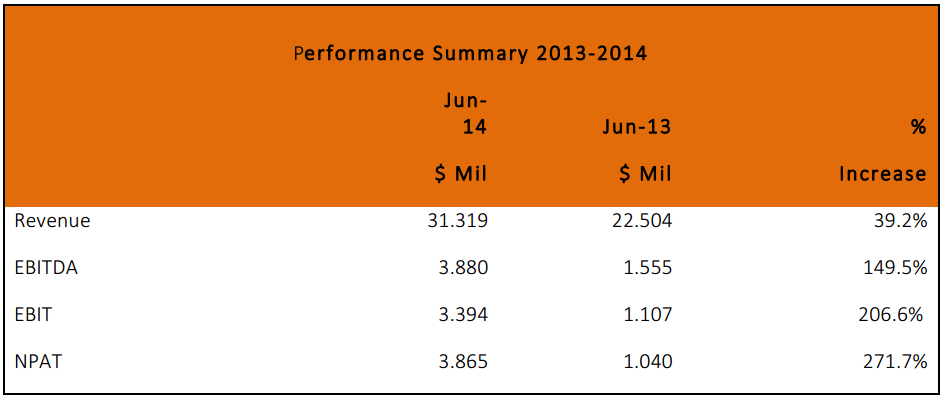

2014 was a transformational year, with 300% earnings growth and a new manufacturing facility established in North America. Demand for the company's services in the US is very strong despite it only having a very small market share in the region. The North American growth will be the main organic growth driver over the next few years, and as the proportion of earnings from software increases margins will continue to grow.

North America comprised 20% of revenue in 2014, with approximately 50% from Australia. The company already has a large proportion of the Australian market with 50% of aged care and 35% of acute care. Earnings outside of Australia will grow at a faster rate than domestic growth with any further decline in the Australia dollar a clear positive driver.

The “sticky” customer base of 8500 health care facilities adds to the rationale for acquisitions, but it also means Azure is likely to be a takeover target for a global company that could cross-sell its products. Along with the strong customer base, further reasons why it is likely to be a target include the high quality product offering, multiple barriers to entry and operating in a market that will continue to grow at least 20% per annum.

Although details were lacking, management announced a takeover offer in April this year when the stock was trading in the high 30 cent mark. Our suspicion is that it was a local competitor and, that being the case, we can understand why they wouldn't be able to justify the required price. With future growth focused outside of Australia, any successful takeover approach is likely to come from a global operator.

The CEO sell-down

In early September, Robert Grey sold down approximately 20 million shares – reducing his ownership from 29% to approximately 18%. The sell-down occurred a few days after a broker initiated coverage with a 69 cents valuation and buy recommendation.

A sell-down by the chief executive or any management selling is usually not a good sign, however, in this case we believe it is a net positive for Azure shareholders. The first reason is that the prior level of director ownership of 42% had a negative effect on stock liquidity.

We discussed on July 9 the fact that director and especially chief executive ownership has a positive correlation with long-term share price performance. However, we also noted that director ownership above 30% usually has a negative affect on stock liquidity, and also presents a potential conflict of interest between trying to maintain high control, versus a focus on decisions that will enable the best chance of earnings and share price growth.

The second positive is that we understand the stock went to a mix of institutions and high net worth investors. Prior to the block sale, the level of institutional ownership in Azure was very low. The increased institutional ownership now means it will be easier for the company to grow by equity funded acquisitions.

Grey commented at the time: “I continue to be confident about the company's future growth prospects, and this divestment was to further assist with the liquidity of the stock. I have no intention to sell further shares for the foreseeable future”.

It is not hard to see why Grey is confident in the company's prospects, as the mix of nurse call hardware and clinical workflow software is in huge demand, especially in North America.

Valuation

At 40 cents Azure trades on a 2014-15 price-earnings (P/E) multiple of 15 and 2015-16 P/E multiple of 10. Conservatively, management expenses just about all costs, including research and development (R&D) and the “one-off” costs to setup the US manufacturing facility. Therefore an argument could be made that Azure actually trades on lower multiples of normalised earnings.

For a stock to trade on an inflated short term P/E there needs to be clear evidence of long-term, high and sustainable earnings growth. We believe the evidence is now there to place Azure is this category.

With expectations that the healthcare market and specifically clinical workflow will grow at 20-25% per annum the company is clearly operating in a very supportive industry. The next factor to consider is the ability to maintain and grow its industry position with defendable barriers to entry.

The first barrier is the required US health and regulatory approvals. Azure has at least a one to two year head start on any potential new US entrant.

The next important barrier is the integrated nature of the hardware and software offering. Azure has been selling its hardware nurse call system for 30 years and has built up an excellent reputation with its customers. This creates a barrier for a larger software focused business that doesn't have the same track record servicing the healthcare industry.

Over recent years management has expensed a significant amount of capital on R&D to ensure its solution remains of the highest quality. Again it would take time and capital for a new entrant to develop a similar quality solution.

Our increased valuation to 55 cents is a reflection of our increased forecasts through 2016-17 to 2018-19 with no changes to the shorter-term forecasts. We are upgrading our recommendation to “buy” from “hold”.

To see Azure Healthcare's forecasts and financial summary, click here.