Saying goodbye to Specialty Fashion

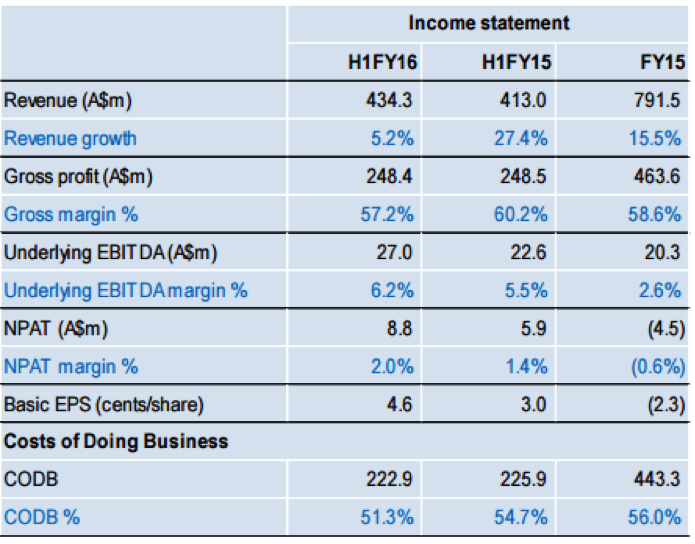

The low margin retailer released its half-year results on the February 23. The result came in line with market expectations with earnings before interest, tax, depreciation and amortisation (EBITDA) up 19.2 per cent on the prior corresponding period.

The group saw an increase of online sales of 58.9 per cent up to $39.1 million, up from $24.6m. Over the same period the group opened a total of 17 stores and closed 14 loss making stores. The plan going forward is for seven new store openings, and to give 27 existing ones a fresh coat of paint in the back half of FY16.

Gross margins have declined and this was primarily due to the strengthening of the US dollar against the Australian dollar, as well as competitive pressures.

The unknown coming into the result was how the return to profitability was tracking for the Rivers business and although this is still largely unknown there are some signs of progress. The underlying EBITDA loss for Rivers has decreased to $5.2m, much improved on the $11.2m loss in the comparable period last year.

The inherited inventory has been cleared and the Ballarat warehouse was to be closed in February, with a one-off $1.5m cost. Management commented they expect Rivers to start trading profitably sometime during FY17.

In our previous piece on SFH (read more here) one of the main drivers for our sell call was the acquisition of Rivers which was drowning in a sea of inventory. The 2013 acquisition was then, and still is now, taking a long time to bed down.

Result Details

At the group level we can see that the underlying EBITDA margin looks to have bottomed in the second half of FY15 going from 5.5 per cent in H1FY15 to 2.6 per cent at the full year for FY15. EBITDA margins have rebounded to 6.2 per cent in H1FY16.

The 5.2 per cent first half sales growth, reflects underlying comparable store sales growth (CSG) of 5.7 percent, including Rivers. This marks the fourth consecutive six-monthly period of positive CSG by the group.

Cash at the end of the half was $1.5m, but as outlined at the AGM in November 2015, the Board has decided to prudently retain cash reserves, rather than declare an interim dividend.

Gary Perlstein, SFH chief executive, said: “The improved performance by Rivers during this half is extremely encouraging. We are on track with the transformation of this iconic brand. There is hard work still to go, but the worst is now behind us”

Who would have thought such a cheap acquisition could cause so much pain? But Perlstein hasn't given up hope, stating “I remain confident that Rivers will start trading profitably during FY17, and will make a meaningful contribution to the groups profitability in future years alongside our other brands.”

Online sales and the digital strategy will remain important for all brands including Rivers. Thus far customer responses to the launch of new ranges across all brands and categories has been strong, with continued uplift in online sales.

The group's key priorities can be summarised as

- Rejuvenation of existing brands across the group

- Transformation of Rivers into the age of Omni-channel retailing

- Expansion into new markets beyond Australia for City Chic.

We have a $0.69 valuation for SFH, with relatively conservative assumptions. These include average revenue growth across the forecast period of 4 percent, and a group EBITDA margin increasing from 3.8 percent in FY16 to 4.2 percent in FY18. The company does have strategic initiatives that may provide growth above these assumptions. But the company is operating in a very competitive environment, with risks around brand performance, currency movements, cost pressures and general retail demand.

Our FY17 earnings per share forecast of 4.6 cents, places the stock on a PE of 14 times.

Summary

The low margin retailer has fallen and got back on its feet numerous times in the past, and looks to have at this point to be back on knees again. Maybe it will bounce back, but we are not going to wait around to watch it rise and stumble like a newborn giraffe. At a time when there is value in every direction you look on the market, you would be better served looking elsewhere in the retail space.

Although our final call is a hold, we can't see any catalysts to provide share price growth and as such we are ceasing coverage and boarding up the shopfront on Specialty Fashion Group.