Sandfire's time to shine

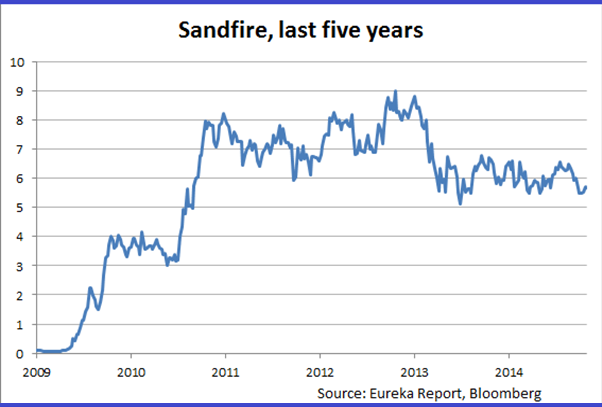

Two principles rule the mining industry: ore grade and cash. To have both is an advantage shared by few companies but grade and cash are why the share price of Sandfire Resources has rocketed up from five cents to more than $5 in just over five years.

Whether it can continue to perform strongly is a question for investors to consider and for analysts, such as EurekaReport's David Gilmour, to answer, which he has done in the valuation section of this article.

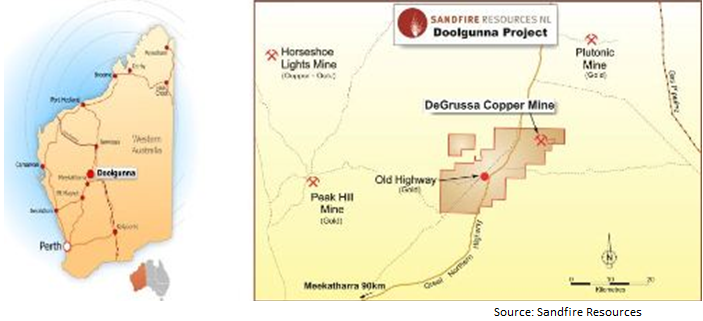

Ore grading a world-class 5% copper from the DeGrussa mine in Western Australia is what's driving Sandfire's cash flow, though a brief look back in time shows that the company is lucky to still be in business let alone paying a dividend and planning its future expansion.

The turning point came in May, 2009, when an exploration team led by a 25 year-old geologist, Margaret Hawke, struck the first of several copper-rich structures which were quickly recognised as being part of a geological formation known as a Volcanogenic Massive Sulphide, or VMS.

In simple terms VMS-style deposits often occur as clusters. Where there is one you generally find another, which is what's happening at DeGrussa, with Sandfire now mining several “pods” of ore and hunting for more across WA's Murchison district.

Remarkably, Sandfire at the time of the discovery was down to its last $3 million and just starting a cost-cutting drive while management considered whether to persevere with exploration at DeGrussa on the abandoned Doolgunna cattle station located about halfway between Meekatharra and Newman.

Working in such a remote location is both expensive and tough. In the summer of 2009 Sandfire couldn't even afford air-conditioning for the Doolgunna homestead where the exploration crew were based.

I got my first taste of DeGrussa about six months after the discovery hole was drilled, flying in a light aircraft to Doolgunna with the company's effervescent chief executive, Karl Simich, on a bumpy journey as the aircraft weaved around a series of thunderstorms.

The demands of the trip were soon forgotten when trays of drill core were displayed, including some of highly-enriched chalcocite grading more than 25% copper.

It was the chalcocite which kick-started DeGrussa as a business because it could be mined in a relatively simple open-cut and exported as direct shipping ore (DSO) without any costly processing, generating critical early cash-flow for Sandfire.

Sales of chalcocite boosted Sandfire's bank balance to the point where it had the luxury of being fussy when choosing a debt provider (ANZ won the bank beauty parade) for the major underground phase at DeGrussa which is now extracting ore from several VMS pods.

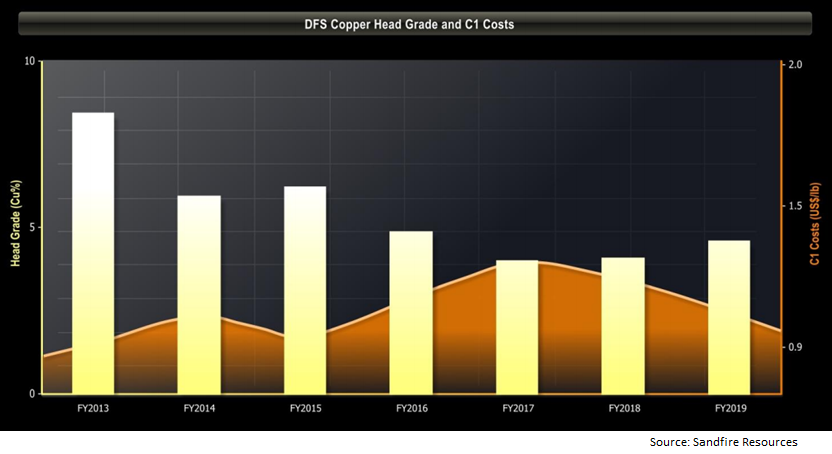

To put those pods into perspective, their grade of close to 5% copper is roughly 10-times the global average for big copper mines which are extracting ore which assays around 0.5%.

The discovery of DeGrussa was more than a case of good luck. The area selected by Sandfire's seasoned exploration director, John Evans, has a history of reluctantly revealing its mineral wealth which is often buried deep below any surface indications.

My introduction to copper in the Murchison was as far back as 1966 when I first visited the Ilgarari cattle station where rich ore was being extracted by lone prospectors using simple pick and shovel methods (after blasting) before driving the DSO material in the back of a Holden Ute for export from Port Hedland.

Other copper mines have been developed close to DeGrussa, including the historic Horseshoe Lights project to the north-west, and Thaduna to the east.

Sandfire, however, is the first modern and highly mechanised development in a region which has always had potential, but which has also been a victim of its remoteness and the vagaries of the copper price.

Simich is keen to do more than the old-timers with his high-grade copper discovery, and that's where the cash and the DeGrussa ore-processing facility are critical because the cash is being used to acquire access to adjoining exploration tenements, and the processing plant offers a way of “monetising” other copper resources which do not have access to a plant.

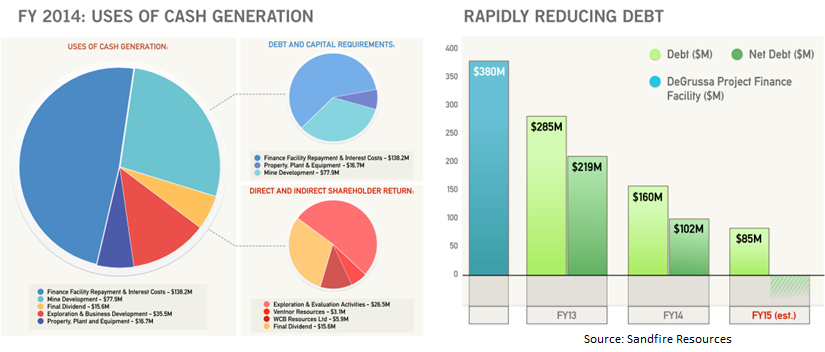

DeGrussa is playing multiple roles for Sandfire. It is generating enough cash ($1 billion so far) for the company to retire mine-development debt, pay a dividend, fund exploration for additional pods of high-grade VMS ore, and extend the company's reach into other regions.

If there is a weakness in the Sandfire story it is the life-expectancy of DeGrussa. Simich is quick to say that the mine started two years ago with a seven year life and still has a seven-year life thanks to underground exploration stretching the size of the VMS pods as drill crews get closer and material with an uncertain classification is upgraded to ore grade.

It is the life expectancy issue which explains the company's intense exploration effort which I saw on a return visit in August to the exploration camp at DeGrussa which has morphed from a tin shed in the outback into a facility which has more in common with a university laboratory.

The challenge for the scientists working at DeGrussa today is to see whether they can do better than a 25-year-old geologist did five years ago and extend the life of her discovery – a question which investors should also consider.

Valuation

Our approach to valuing the company is based solely on the underground mining project, without any consideration for exploration success.

The core proposition for investors is Sandfire's alluring free cash flows in the near term thanks to production at full capacity and the grade of the ore. This has allowed management to repay $125 million in debt during 2013-14. The remaining $160 million should be retired by the end of 2015-16 – increasing the returns to shareholders.

A maiden dividend of 10 cents a share ($15.6 million) was declared at the end of 2013-14. While there's no dividend policy in place yet, chief financial officer Matt Fitzgerald says the company will continue to attribute a percentage of cash generation to dividends. We estimate a dividend payout of 20 cents in 2014-15 – representing a 3.5% yield at current share price levels.

Steady-state production has been achieved, with underground mining and milling rates of approximately 1.5 million tonnes per annum and recovery rates of 90%-plus. Sandfire is guiding for production of between 65,000-70,000 tonnes of contained copper in 2014-15, compared to 67,690 tonnes of contained copper the year before.

Management forecast a strong pickup in production in the second half of 2014-15 after a soft first quarter where milling recovery rates were at 89.4% and the mill grade came in at 4.9% compared to the average of 5.2% in 2013-14.

This resulted in production of 16,064 tonnes of contained copper and cash costs of $US1.24 a pound – at the upper end of full-year guidance for $US1.15-1.25 a pound.

A better performance in the second half appears likely. Firstly, the milling rate in the first quarter was affected by two major shutdowns aimed at improving the facility. More shutdowns are planned for the second quarter as the company installs a pebble crusher, a grinding mill and column flotation cell. This is expected to lift recovery rates to least 92%.

Secondly, the change-out for a new mining contractor occurred during July, impinging on production until midway through the quarter. The milled grade was diluted by lower grade surface stock during the mining ramp up and should return to 5%-plus.

The contractor, Byrnecut, was hired over a three-year term for $200 million and is expected to save the company 10% in gross mining costs for 2014-15.

Looking more closely at costs, we anticipate a C1 cash cost off $US1.24 for 2013-14, at the top of guidance. As Sandfire gets to its targeted recovery rate and improves costs, the C1 cash costs reduce (as shown in the table below)

Given Sandfire derives around 90% of its revenue from copper concentrate mined at DeGrussa (with the remainder made up of gold and silver credits), the copper price is the biggest influence to the valuation.

Our copper assumptions are based on consensus forecasts of $US6,900 a tonne in 2014-15, around $US7,000 a tonne in 2015-16 and 2016-17 and then $US7,200 a tonne in 2017-18. For the remaining three years of mine life we assume a conservative $US6,500 a tonne.

Demand for copper remains strong, but so does supply, with the result being a metal trading comfortably around the $US6800 per tonne ($US3 per pound), which is where it has been for much of the past 12-months.

We also estimate an AUD/USD exchange rate of US90 cents throughout the life of the mine. If the Australian dollar were to fall further – as the market forecasts – more value would be unlocked.

Exploration

The biggest risk to Sandfire is that it proves unsuccessful in discovering a significant ore body in the future. While this is the case with any mining company, the short mine life of seven years makes this a far more pressing concern.

That being said, Sandfire is engaged in a number of exploration initiatives, the first of which is testing for extensions to clusters of deposits at DeGrussa.

DeGrussa's mine life reflects Sandfire's mineral resource and ore reserve estimates. Generally, mineral resources are defined as the concentration of material in the ground, while ore reserves are the parts of a resource which can be economically extracted.

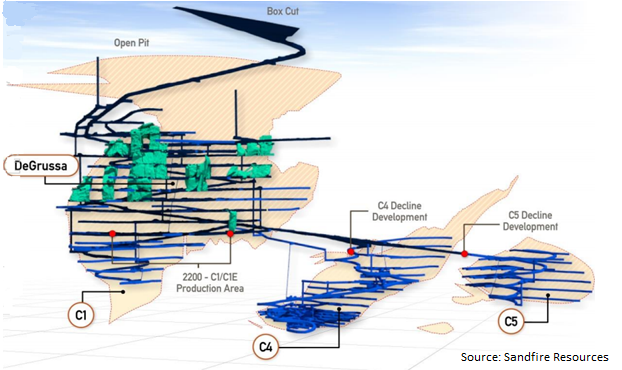

How Simich has been able to keep DeGrussa at a seven-year mine life is by increasing DeGrussa's mineral resource estimate and converting resources to reserves via extensive exploration. Sandfire now mines from one deposit through cut-and-fill stoping, but has total underground development of over 22km.

As of March 2014 the mineral resource estimate stands at 588,000 tonnes of contained copper and 764,000 ounces of gold from the conductor 1, 4 and 5 deposits.

Management expects to update the mine life in late 2014 or early 2015 from upgraded resource and reserve estimates as it continues drilling into the deeper portions of conductor 1 as well as the deeper conductor 4 and conductor 5 deposits.

Sandfire is also exploring across the broader Doolgunna region for additional VMS deposits, including in a joint venture with Talisman Mining (TLM). Under the arrangement Sandfire can earn up to a 70% interest in three of Talisman's projects in the area by spending at least $15 million on exploration over five and a half years.

Other interests with exploration potential include Sandfire's 36% stake in Vancouver-based Tintina Resources, which it spent $C16 million for, and a 38.38% interest in Toronto-listed WCB Resources, a copper-gold explorer.

Summary

We have a “buy” recommendation on Sandfire Resources, with a discounted cash flow valuation of $6.27 on the stock. Compared to its copper peers, Sandfire can better withstand weaker prices and is well exposed to further upside. Net debt is being removed, costs should remain low and its high-grade ore keeps revenues high.

To see Sandfire Resource's forecasts and financial summary, click here.