Retail Food Group: Looking a whole lot better

The Retail Food Group (RFG) share price has been under pressure for much of the past 12 months: Declining from a high of $7.70 in March 2015 to a low of $4 in September last year. FY15 was a transformational year with three significant acquisitions, that have already performed ahead of expectations. But the markets fears have been focused on the performance of the existing brands, and to what extent acquisitions are hiding their weakness.

These brands include Donut King, bb's café, Michel's Patisserie, Brumby's, Esquires Coffee, Pizza Capers, Crust Gourmet Pizza and The Coffee Guy. The company was established in 1989 and listed in 2006. The history has included continual acquisitions with an excellent track record of extracting value through the franchise model.

The growth opportunities in retail and wholesale coffee are more robust than some of the traditional brands. In FY15, Gloria Jeans was the company's largest acquisition ($163 million), with Di Bella ($30m) and NZ based Café 2 U are also important purchases. There is ongoing opportunity to generate revenue and cost synergies through the expanded coffee wholesale and franchise network.

There was a trend of declining group return on equity (ROE) and return on invested capital (ROIC) from FY09 to FY14. But with the benefits of the recent acquisitions the group ROE and ROIC is moving back up again, with a 16 per cent ROE forecast for FY16, against the low of 12.8 per cent in FY14.

There are multiple group revenue and cost synergy opportunities, as well as efficiency improvement programs that can ensure RFG maintains decent returns despite weakness in some brands. The company remains on the lookout for acquisitions, and is expanding internationally.

The company has a history of successfully managing debt levels and the rate of expansion through acquisitions. Net debt at the first half was $194m, with a comfortable interest coverage of 10.8 times.

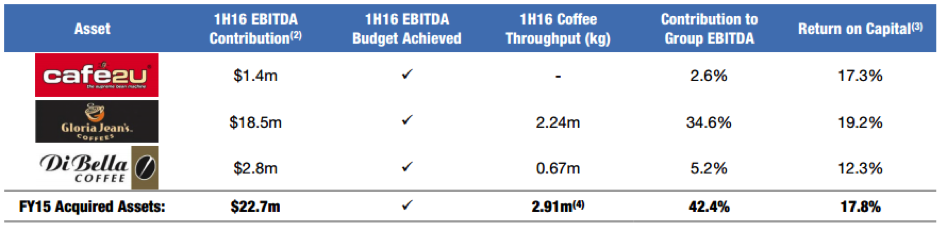

FY15 acquisitions contributed $A22.7m to 1H16 earnings before interest, tax, depreciation and amortisation (EBITDA), with $18.5m from Gloria Jeans, $2.8m from Di Bella and $1.4m from Café 2U. If you take out the benefits of acquisitions, it appears the organic business has gone backwards slightly. Moving forward we now believe there are enough growth opportunities to outweigh some of the organic brand challenges.

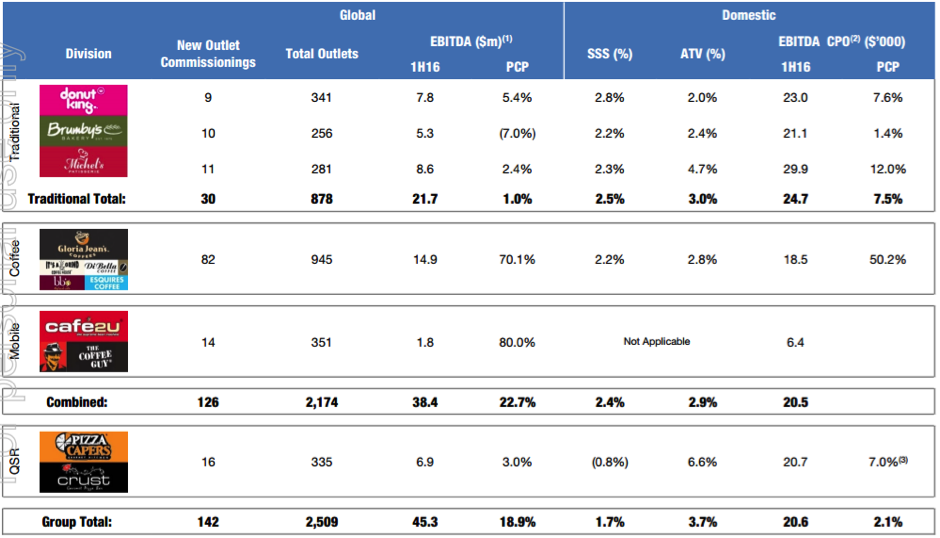

1H16 saw same store sales growth of 1.7 per cent and average transaction value growth of 3.7 per cent, but customer counts remain under pressure. This has been a trend for a number of years now and is one of the key concerns within the traditional brands.

Another reason RFG has been trading on discounted multiples is that with the transitioning structure of the business it has been difficult to forecast earnings for some parts of the business. With the international expansion, the company is shifting from being a franchisor to also being a master licensor of territories.

Coffee supply chain

After the coffee acquisitions in FY15, the group's upstream coffee roasting throughput increased from 1.5kg per annum to approximately 6m kg per annum, and the downstream outlet network has also been significantly increased.

The company operates four coffee roasting facilities supplying Australian and international markets through a suite of wholesale coffee brands.

Wholesale coffee EBITDA was up from $1.2m last year to $8.2m in the first half FY16.

After a strong year, “coffee and allied beverages” comprises 38 per cent of EBITDA, with more growth opportunities from expanding networks. The company has greater than 50 per cent spare capacity that can be leveraged through local and international networks.

1H16 Result

The first half result was in line with expectations with underlying net profit after tax (NPAT) of $32.1m ( 27.1 per cent), meeting company guidance of 25 per cent growth. Operating cash flow was up 71 per cent on the prior year, with cash conversion reasonable at 90.4 per cent.

Diversification – positive opportunity

Declining customer counts and challenges with traditional brand systems need to be monitored, but through diversification traditional brands now only represent 41 per cent of 1H FY16 EBITDA, down from 55 per cent in 1HFY15.

Domestic operations account for 83 per cent of EBITDA, but this will decline as management increasingly focus on overseas growth. Franchise operations account for 62 per cent of EBITDA.

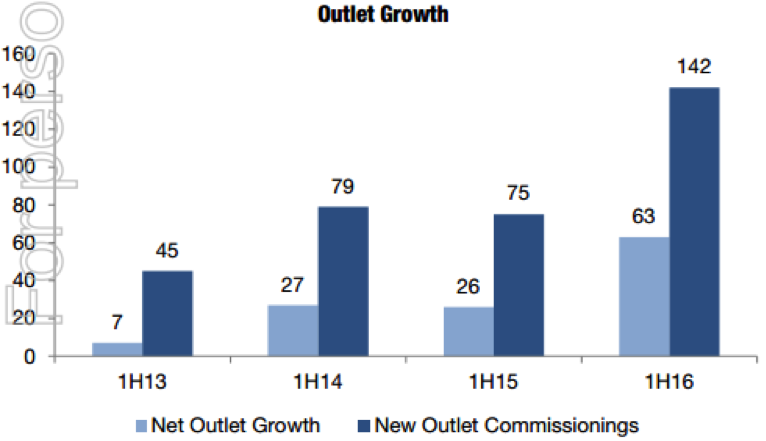

Breaking the trend of outlet decline

Until the recent half-year result, outlet growth had fallen every year since listing. In FY15 the decline (84 outlets) was due to the rationalisation of poorly performing outlets.

In the first half 142 new outlets were commissioned and 79 stores were closed resulting in net outlet growth of 63, mainly driven by Gloria Jeans. For FY16 the company has guided towards new outlet commissions of 250, with 130 of these from international outlets. By FY18, 70 per cent of new outlet growth is expected to be from international. The current network of 2509 outlets includes 745 across international markets. After Australia with 1764, next largest is New Zealand (135), USA (83), UK (77) and UAE (67). With new outlet openings in 41 countries during the first half, there should be continued benefits of diversification in years to come.

Project Evo

Thirty four per cent of the traditional network has converted formats to Project Evo: A proven efficiency program that includes menu extension, product innovation merchandising and equipment solutions. RFG continues to incentivise franchisees to convert to Project Evo as well as transition to the Michel's National Bakery Solution.

International master franchise

Master franchise and international JV arrangements enable a faster path to growth, with distribution hubs utilised to expand into new territories. For example, the Gloria Jeans China JV will be utilised to accelerate the company's presence in Asia and expand its brand systems into new markets. New licensing and master franchising agreements are being targeted for Asia, UK, US and Europe.

Management re-structure

Tony Alford will be transitioning to a non-executive board position and franchise chief executive Andre Nell will become managing director from the July 1 2016. Tony will continue to be involved in strategic projects.

Outlook

Positive outlook maintained for FY16 and beyond. Increasingly diverse global operations. Management view the Master franchise / Joint Venture agreements as a lower risk expansion framework, and look on track to deliver identified synergy, integration and restructuring benefits.

Another opportunity that has been identified is equipment rental services, but at this stage management hasn't guided towards how material this become.

Management maintain prior guidance of 20 per cent underlying NPAT growth, as well as 250 new outlet commissions.

Forecasts / valuation

At $5.21, RFG is trading on a FY16 PE of 12.7 and dividend yield of 5.2 per cent. With sustainable organic growth of at least 10 per cent per year, we believe there is valuation support and RFG will be re-rated as management deliver on their strategic initiatives. There is upside from international expansion, coffee supply agreements, coffee revenue and cost synergies, efficiency initiatives (eg EVO), M&A and master license agreements. There is also, however, downside risk from some brand performance that has displayed weakness in recent times.

We have a conservative $6.20 discounted cash flow valuation and a buy recommendation. We will be adding a six per cent position in the “Growth First” portfolio based on the open price Tuesday March 22.