PS&C: A hidden opportunity

PS&C (PSZ) is a Melbourne-based IT services company that listed at $1.00 in December 2013. The initial public offering (IPO) involved a roll-up of five businesses and a sixth was acquired in August 2014 called Pure Hacking.

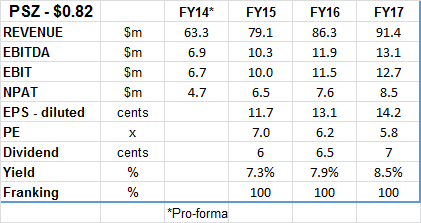

At a current share price of $0.82 (or at a $46m market cap) the stock is significantly undervalued and we have a “buy” recommendation with a $1.25 valuation and target price.

The company has three divisions – people, security and communications – with the security division likely to provide the largest growth opportunity. The businesses have a 7-18 year track record with a broad and largely secure client list.

Cyber security is currently a $2 billion-plus market in Australia and growing rapidly, especially after the changes to the Privacy Act in March 2014 that require organisations to publicly report any security breaches.

The group's current security services focus on penetration testing, assurance and “red teaming”. Or, more generally, isolating weaknesses in the clients IT environment and then implementing systems and improvements. We believe there is further opportunity to acquire additional IT security capabilities.

The vendors and founders are large shareholders with 54 per cent of the issued capital of PSZ. The acquisition model includes earn-outs and 1-2 year periods of escrow (restricted from selling). Management has full discretion to pay the deferred payments with a percentage of scrip ranging from 0 to 100 per cent. This means at current depressed share price levels they would want to pay more with cash or debt, but at higher levels it would be better to offer more scrip.

With PSZ currently having no net debt and a $9m available debt facility, we assume the payouts are an even mix between cash and scrip. Current estimates include a $12.8m deferred consideration in the next 12 months, and $6.1m of longer term deferred payments.

The nature of IT services acquisitions is such that it's critical to retain the key people. Consequently PS&C has focused on a structure that will align interests with the key stakeholders.

Cheap, high yield, high growth – Too good to be true?

The complicated structure with these deferred payments is most likely part of the reason why the stock is trading on a discounted FY15 price-earnings (PE) multiple of 7 and a fully-franked dividend yield of 7.3 per cent.

After considering the dilution from the payments the forecast FY15 PE is slightly higher but is still at a large discount to the market and IT services sector.

With conservative earnings per share growth forecasts of approximately 10 per cent for each of FY16 and FY17, the stock is trading at a 52 per cent discount to our $1.25 discounted cash flow valuation.

In the current dividend chasing environment it is also important to note that our high yield forecast assumes a conservative 50 per cent payout ratio.

Currently there are not many quality stocks with a low PE, high growth and yield, and trading at a large discount to valuation. The exceptions are often value traps or in the challenged mining services sector.

We are confident PSZ doesn't fit into this category, and as management builds a track record of successful execution we believe the stock will re-rate to more appropriate levels.

Other than the deferred payments, some other reasons the discount may be in place include the lack of free float, and stock liquidity. The company also missed its earnings target at the FY14 result. The prospectus stated an expectation of normalised earnings before interest and tax (EBIT) of $7.37m, but the company achieved $6.72m.

It certainly is a black mark, but after investigating the circumstances we are not particular concerned going forward. The nature of the communications division is that there will always be timing uncertainty for fourth quarter earnings. With this FY14 earnings miss, it was purely a timing issue and the additional revenue was achieved in the first quarter of FY15. Having said this, for a PE re-rating the market needs to see evidence that the company can execute on its targets.

Looking forward to the FY15 result this year, management has again flagged uncertainty with the timing of earnings in the communications division, but we believe our forecasts adequately account for this risk. Management has this time given no formal guidance for FY15 earnings.

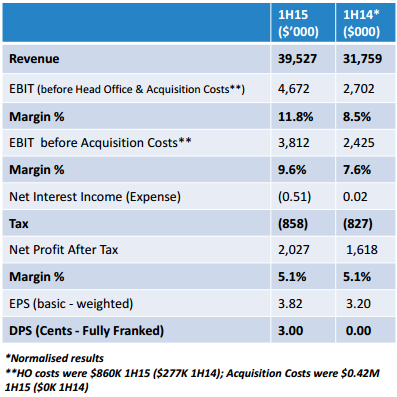

First half 2015 Result

Excluding acquisition costs the first half EBIT result was up 57 per cent to $3.8m.

With revenue growing at 25 per cent, the improved margins display benefits from increased scale.

We estimate approximately 14 per cent of the EBIT growth was organic. Earnings per share grew 19 per cent to 3.8 cents, and full year earnings will be largely skewed to the second half.

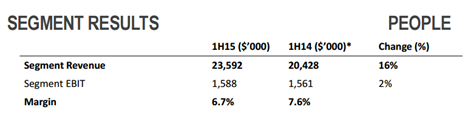

People division

This division comprises “systems and people” (SAP) which contributed a pro-forma $41m of revenue for FY14. This was sourced from diverse segments of the economy and was led by the telecommunications and IT, retail, mining and manufacturing sectors.

The focus is largely on contract management, sourcing and recruitment for customers using SAP. The customer base is largely a long term non-discretionary IT spend. As such this business is more immune to a downturn than a competitor, such as SMS Management & Technology (SMX), which has more exposure to general discretionary IT spend.

Although there is a stable client base, margins are low and growth opportunities are more limited in comparison to the security division.

Key clients include Toyota, Schweppes, Amcor, and Fujitsu.

In the first half around $300,000 was spent on additional sales capacity. This means that the 16 per cent growth in revenue only translated into 2 per cent EBIT growth. However, the additional costs should translate into growth next year.

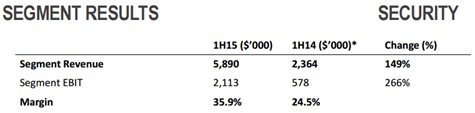

Security division

Securus Global Consulting and Hacklabs have been part of PSZ since the IPO, while Pure Hacking was acquired in August 2014.

The core of the work is around penetration testing of IT systems and providing preventative measures.

The “red teaming” depends on the customer, but generally can include testing for physical intrusion and network hacking. Basically, PSZ will get a contract to try and break into a physical site or IT network and will use whatever methods they can think of. If they can break in, then the next step is to provide solutions to upgrade the security.

Security comprised approximately 45 per cent of first half EBIT, despite only 15 per cent of revenue. Going forward this division will comprise a larger percentage of group revenue and as such will increase the overall earnings margins.

Key customers include the major banks, Coles, Telcos, Tabcorp and Westfield.

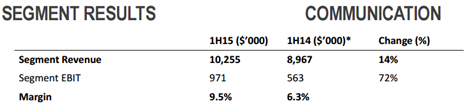

Communications division

This segment includes Allcom Networks and Allcom Consulting. The services provided include unified communications and IP telephony, network infrastructure, consulting and managed services.

It comprised 20 per cent of first half EBIT, with revenue up 14 per cent and EBIT up 72 per cent.

Approximately 40 per cent of this division is with Telstra, and 40 per cent is NSW based. Other than Telstra the next major customer is the NSW government and local governments.

Management

Kevin McLaine is managing director and has over 20 years' experience in Australian public companies. He held senior roles at Shomega Ltd and CSG Ltd, as well as a number of years with GE Capital as managing director of its commercial lending business.

Julian Graham is chief financial officer and company secretary. Julian has over 25 years' experience in the manufacturing, distribution and software industries; He was most recently the CFO of ASX-listed Wellcom Group.

The senior staff includes the founders and key management personnel from the six acquired businesses. As mentioned, a critical part of the strategy is to retain these staff, and especially during the initial integration.

Summary

We believe PSZ has been unfairly discarded by the market and can see the stock re-rating over the next 12 months as organic growth is achieved. Further, there will be continued acquisition opportunities to expand the capabilities and diversification of the group.

The impact of the cyclical nature of IT spending is reduced by revenue diversity through a wide range of sectors (government, finance, telecom, automotive, retail and healthcare).

Panel agreements are a key driver for the company. As the group continues to grow the opportunity to leverage each other, agreements will increase.

The high yield is sustainable (FY15 - 7.3 per cent) and growing due to our forecast of a continued 50 per cent payout ratio.

However, the stock is high risk due to the early stage of business integration and small scale.

Our discounted cash flow valuation of $1.25 assumes an 11.5 per cent cost of capital. Further, the valuation implies a modest PE ratio well below the sector and market ($1.25 is at an FY15 PE of 11).

We have a “buy” recommendation with a $1.25 target price.

To see PS&C's forecasts and financial summary, click here.