Portfolio Update: Selling out of WAX

It is with a heavy heart that I farewell one of the LIC portfolio's best-performing holdings, WAM Research Limited (WAX). Since adding WAX into our portfolio in August 2015 it has increased by a total of 33.65 per cent, including dividends.

Why am I selling out? It's not an easy decision to exit such a strong performer, but if we are to remain consistent WAX has to depart as it is just too expensive.

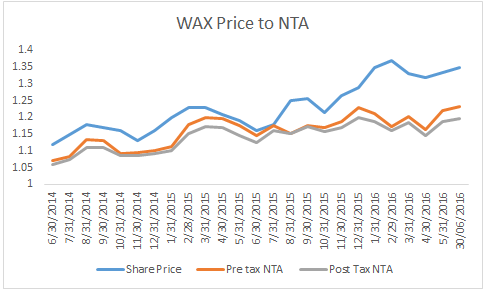

Currently the WAX share price sits at $1.49 and the last reported pre-fee and pre-tax net tangible assets (NTA) per share was $1.23. This represents a 21 per cent premium to the NTA.

This was the NTA for the end of June, but I find it hard to imagine the underlying portfolio had closed that much of a gap to be within reach of the share price. The share price of $1.54 is literally off the (below) chart.

Let's get one thing straight. This decision is purely based on value and not a call on the underlying portfolio and the management of it. The team at the Wilson office is second-to-none, and the results speak for themselves.

The gap between price and the value has grown too great. We will continue to monitor WAX and the other Wilson LICs for opportunities and hope to be able to have another chance to buy it.

This leaves the LIC portfolio with a decent amount of cash. Stay tuned as we pour over for the next opportunity to fill the void WAX has left. SELL