PM Capital Asian Opportunity Fund looks beyond China

PM Capital was started by Paul Moore in 1998. Over the years they have rolled out new funds, starting with an international fund that initially had a North American focus. Now PM Capital has four unlisted funds covering all bases, Australian, global, Asia and an enhanced yield strategy. On top of this they floated two listed investment companies (LICs) last year. The team saw potential of high growth from Asia and wanted to capitalise on the long-term opportunity.

The PM Capital Asian Opportunities Fund (PAF) is similar in style and holdings to PM Capital's unlisted Asian focused (ex-Japan) unit trust which started in July 2008. The LIC and the unit trust are both managed by portfolio manager Kevin Bertoli. PAF closely mirrors the unit trust with the key differences being the ability to short sell and the fee structure. The unlisted fund has a higher management fee at 1.4 per cent pa but no performance fee, compared to PAF's 1 per cent pa management fee and 20 per cent performance fee.

As the PAF has only been in operation just over one year it has no performance to point to, however Bertoli has successfully steered the unlisted unit trust to beat its benchmark (MSCI Asia (ex-Japan) Equity Index) by 10.2 per cent pa net of fees. This is a total return since inception of 234.8 per cent.

The mandate for PAF to follow is quite straight forward and apart from excluding Japan it is relatively open. Bertoli and his team have the ability to be long or short, and hold as much or as little cash as they like. Further they actively manage their currency exposure and are sector, region and index weight unaware. Basically they are free to look for opportunity wherever they can find it.

Finding opportunity in Asia

Kevin Bertoli and the team attempt to travel to Asia roughly three times per year. As they have been successfully running an Asian focused fund they are comfortable with the landscape in terms of market drivers and the range of companies.

From speaking with Bertoli last week and simply looking through their material it is pretty clear the investment team looks to pick growing thematics and then select the best equities rather than taking a broader approach and purchasing a whole basket of them to suit that specific theme.

Because of this the portfolio is relatively concentrated holding from 15-35 stocks at a time. This is a real benefit PAF brings to the table. Bertoli commented: “That gives us the opportunity to sit back and say ok, of the 23,000 stocks listed in Asia at any one point in time I should be able to find 20 to 25 on the long side and a couple on the short side that we're comfortable with.” Clearly they are stock pickers, and the same approach can be seen across all their funds.

PAF top 10 holdings as of June 30

Source: PM Capital

No defined filters

The team at PM does not have hard and fast rules when it comes to key investment criteria. You won't see them running a filter with a prerequisite of x per cent return on equity and above and x per cent of net debt to equity across the investable universe of 23,000 listed companies. The team is more focused on learning about the individual companies and industries and then the key driving forces behind them. Bertoli believes running predefined filters is where a lot of investors, both professional and retail, fall down.

His view is that the simple metrics aren't relevant for all businesses. For example when looking at consumer goods businesses, they are typically looking for businesses that are in duopoly markets – or where they see the potential to go to duopoly markets through consolidation.

They are trying to look at the structure of the market as opposed to one specific metric because the reality is it's not what the metric is today, it's what the metric is going to be in five years time. So people may run through a filter they have put together and what they will do is pick up yesterday's stories. A good example of this is Chinese ports – their return on equity might be five per cent, which is pretty low when compared to ports in Australia where the return on equity is usually at least 10 per cent. “What we see is the market valuing them on their five per cent return on equity but we believe over a period of three to five years they have the position to take it to a 10 per cent ROE through pricing, through economies of scale, through growing the volumes on a fixed cost base.”

Understanding the dynamics of a business is core to their approach. “We won't look at things or won't spend much time looking at things like steel and airlines because the business can't control a lot of the factors that will determine whether or not it is successful. It's important for us to try to understand what a business can control and find ones that are basically the masters of their own destiny.”

The team is looking for opportunities where the market is missing something about the structural story and therefore mispricing that particular security. And that's the root of their investment philosophy, looking at businesses and industries from the ground up and once they've done that they get an understanding of how the businesses operate, they get an understanding of how the market is treating them or viewing the businesses and what they want to get over time is a disconnect between those two factors. This is how the portfolio comes together, patiently, one stock at a time.

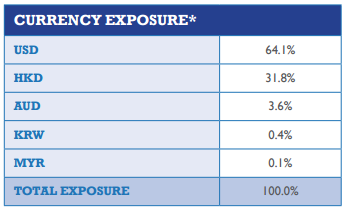

Currency

Currency management is incredibly important for Bertoli and team as 99 per cent of investors are Australian (including themselves). The last thing people want as investors is to see their returns diminish due to currency movement. “What is key is the management of stock and the management of currency is are two separate categories.” If going out to buy a business in Malaysia they focus on two separate decisions. One is whether they want to buy the business and secondly whether they want Malaysian currency exposure. The big currency movements over the last twelve months haven't been the Aussie dollar versus the Korean won or the Aussie dollar versus the Malaysian ringgit, they've been all of these currencies against the US dollar. “So what we have done is basically the portfolio has had no Aussie dollar or Aussie dollar equivalent as far as the Asian currencies are concerned, we've basically been 100 per cent US and Hong Kong dollars,” Bertoli says.

Currency exposure as of 30 June

Source: PM Capital

Right now as the dollar sits in the mid to low 70s in US cents, active management of the currency is incredibly difficult and not something the team tend to be more neutral on. What they will look to do is hedge the currency when it is in the upper or lower extremes and lock it in for the long term.

China A shares exposure

PAF's monthly announcements show it has had no direct exposure to China A shares. Recently close to 50 per cent of companies listed on the Shanghai Stock Exchange went into a trading halt or suspension, not off the back of specific announcements like earnings guidance or acquisitions etc but to simply stop their price from falling.

Compared to the other Asian markets it's still in its infancy and it's a closed system. China has been a closed system and still is which leads to inefficiencies, manipulation, corruption etc and it takes a long time before a market opens up and those issues are cleaned out. Bertoli said: “These are some of the reasons why we are sceptical and prefer to play in the Hong Kong market as it is a much better regulated market.”

Investing in the emerging markets of Southeast Asia

When looking through the PAF portfolio you'll see businesses domiciled in Vietnam, Cambodia and Malaysia and this exposure is something that attracted me to PAF. “We're looking for businesses that have non-Chinese earnings, one because we think markets are less focused on them so therefore there is a probability of a greater opportunity and secondly the demographics of Southeast Asia are far stronger than China, Korea, Japan etc and the structure of industries is much more favourable to the operators.”

One good example of this is their holding in Astro Malaysia. It's basically the monopoly pay TV player in Malaysia. It is able to capture all of that positive shift in demographics and it appears the structural dynamics won't change overnight. It will have challenges from the Netflix equivalents but what gives it the advantage is content. The company creates 50 per cent of its own content. So that makes it very hard for people to come in and compete against them when a lot of the content the people are watching is actually produced by the pay TV operator.

“We try to focus more on the business itself as opposed to where the business operates, don't be too worried if it is Malaysia or Indonesia etc, what we've done is gone and looked at how these businesses operate within their industry and we are comfortable with the dynamic that they operate in,” Bertoli says.

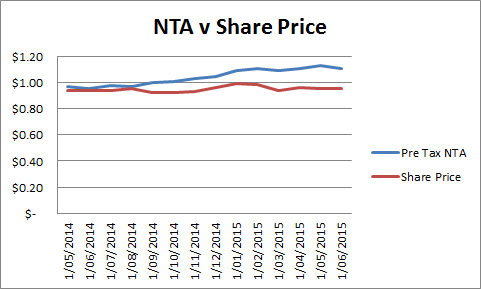

Discount to NTA and size

Since listing PAF has traded at a healthy (or not so healthy if you're an early shareholder) discount to NTA. This is not uncommon for new LICs that don't have the established track record of their counterparts, especially one that is operating in foreign markets. But the LIC is being proactive with shareholder engagement by providing a lot of commentary with its monthly updates, regular video interviews on its website with the portfolio managers, holding regular broker presentations and now putting out weekly NTA guidance. These are all things that won't have an immediate impact on the discount but it will help with a sustained effort to close the gap over time.

This is an advantage PAF has over its other smaller LICs. PM Capital manages $2.2 billion so it can afford to stomach the cost of roadshows and marketing efforts for a LIC with only $55 million. LICs of a similar size or even smaller may struggle to engage shareholders and get the marketing push needed to close the gap as they just don't have the coin to do it.

Share price to NTA since inception

Source: ASX

This brings me to my main issue with PAF. Even though I do like the approach of the team and the diversity and Southeast Asian exposure it brings, at $55m it is too small. It is thinly traded and building a meaningful position in it will be tough. For my portfolio a $10,000 allocation won't be too difficult to achieve however for a SMSF with $1m getting an allocation of $100,000 may test your patience. In May next year they have options expiring, exercisable at $1. This will take the portfolio up to $110m and hopefully make it easier for shareholders and potential shareholders.

Dividend policy

Don't expect PAF to be a big dividend payer. The fund will eventually pay dividends but the main focus is long-term capital growth. It will aim to give you long-term capital at a discount tax rate rather than pay it out to the shareholder on a consistent basis where they're then getting taxed at the marginal tax rate.

Does it make the model portfolio cut?

PAF will be added to the model portfolio with a 10 per cent weighting. You may see a little theme developing here. Two of my first three LICs have been international focused and the one Australian LIC I included has quite a decent portion of international exposure too. I am trying to get them in before we see the dollar decrease any further and as I publish an article a week on the model it has been a race against time.

You will also see another theme developing. Relatively unconstrained mandates. I want my managers making the currency decisions. I want my managers making the cash weighting decision too and I want my managers making the decision on which industry and region to invest on my behalf. And I want my managers to back themselves. I don't want 100 stock portfolios. I can buy an ETF if I want to track an index. So all three so far, Magellan Flagship Fund, Cadence Capital and now PM Capital Asian Opportunities Fund tick the boxes above. Yes I have my hesitations bringing on a brand new Asian focused fund but it ticks the right boxes. It has a sound investment approach and the people running it have a solid track record of outperformance under their belt too. PAF will slot in nicely alongside MFF and provide some much needed diversification to my international exposure and if I can get it at a 13 per cent discount then that's even better.