Picking a Budget winner

There have been two significant events in recent weeks that we think are worth highlighting with regard to consumer related stocks.

Firstly, third-quarter trading updates have been supportive and are consistent with our view that consumer related stocks should see robust sales growth this year.

Secondly, the budget has provided meaningful improvements to some consumer related businesses.

Both of these events play nicely into our positive investment thesis on Dick Smith (DSH).

Retailer trading updates suggest continued positive momentum

Earlier this year we discussed how declining interest rates and petrol prices impact consumers (here). Clearly, both of these factors are supportive of the consumer, however, it is difficult to forecast to what extent low levels of consumer confidence constrain these dynamics translating into increased expenditure.

Against this uncertainty, we noted that first-half reporting season for FY15 and January trading updates suggested that consumption expenditure in some areas, particularly relating to domestic listed businesses, was increasing.

To keep you updated we note that a number of retailers have recently released third-quarter trading updates at a recent investor conference. Pleasingly, the updates suggested a continuation of this trend.

JB Hi-fi, Super Cheap and Dick Smith all reported robust third-quarter sales results. Even the troubled retailer Myer reported positive momentum in a separate company specific release.

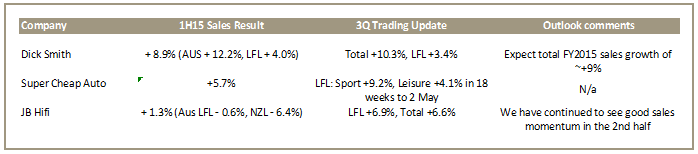

We outline some of the key items from the trading updates in the below table:

Considering we recommended Dick Smith not to long ago we wanted to draw out a couple of specifics with regard to this company's trading update. Key take-aways from Dick Smith's presentation include:

- Total sales growth in the first 9 months of FY15 has been 9.3 per cent. This is largely in line with our assumptions.

- Total Australian sales were up 12.6 per cent (4.5 per cent LFL) in 3Q15.

- NZL remains challenging with sales down 5.1 per cent in 3Q15 in local currency terms.

- Management reiterated FY15 EBITDA guidance for 7-9 per cent.

- Private label penetration is greater than 12 per cent (in line with our estimates).

- Online penetration is 7 per cent (in line with our estimates).

- Performance of Sydney Airport since taking over in Feb 2015 is consistent with annualised incremental sales of $50m.

All in all, the trading update is largely in line with our expectations and the company's turnaround appears to be on track.

Decoding the Budget for retailers

In aggregate the Budget appears mildly supportive of consumption. The FY16 and to a lesser extent FY17 proposals appear to be quite modest relative to overall household incomes.

Furthermore, the initiatives appear to be somewhat back-end loaded over the forward estimates. Specifically, programs such as the family's package ($3.5bn spread over 5 years and contingent on cuts to family tax benefits) are likely to take some time to benefit household budgets.

Accordingly, the Budget appears to have a greater emphasis on redistribution of expenditure rather than being significantly stimulatory to the consumer.

While the aggregate impact on the consumer may be limited, the investment opportunities lie in the companies favorably exposed to redistribution. So what are the key measures and who will benefit?

- Instant asset write off scheme. The government will allow an immediate deduction for any asset costing less than $20,000. However, this measure is only scheduled to run from now until June 2017, encouraging expenditure to be brought forward into the next two years.

- Increasing the breadth of FBT exemption. The budget proposes to expand the FBT exemption to include all work-related portable electronic devices. Previously, the FBT exemption applied to one device per employee per annum. As an example an employer will be able to provide both a laptop and a tablet to an employee without incurring FBT tax.

- Tax cut for small business. The tax rate for businesses generating less than $2m will reduce from 30 per cent to 28.5 per cent. This measure will benefit in excess of 90 per cent of incorporated businesses.

The greatest beneficiaries of these measures, in the relative context of their overall business, will be the consumer electronics retailers JB Hi-fi (JBH), Harvey Norman (HVN) and Dick Smith. These companies will clearly have the most leverage.

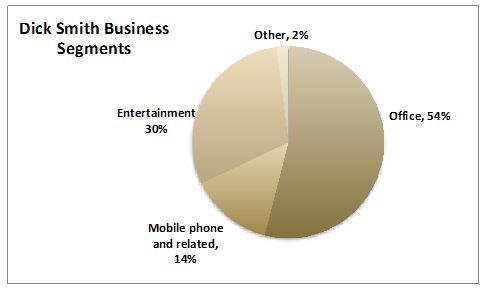

Again, with regard to Dick Smith, the company is exposed to a number of areas that should benefit directly from the budget initiatives. Specifically, DSH sells a broad range of consumer electronics primarily focusing on the following segments:

- Office: desktop computers, laptops, monitors, printers, related accessories.

- Mobility: Mobile phone handsets, pre-paid and post-paid contracts, sim cards, accessories. DSH provides pre and post paid plans for Telstra, Optus and Vodaphone. Move stores will largely focus on this category.

- Entertainment: televisions, audio products, digital cameras, headphones and docks, gaming and related accessories.

We outline below the relative contribution of these segments to Dick Smith's overall business.

While it is challenging to forecast the impact of the budget proposals, we make the following observations:

- We expect a roughly 4 per cent increase in consumer electronic retail spend in Australia in FY16, with a modest impact in FY15.

- We do not expect a meaningful uplift in overall consumption expenditure without first seeing improvements in consumer confidence.

In consideration or 3Q trading updates and the budget initiatives we have increased our FY16 and FY17 earnings per share (EPS) estimates for DSH by 2.8 per cent and 1.8 per cent. Our FY15 estimates remain unchanged. As a result our valuation increases to $2.70.

Dick Smith – Our thoughts

Dick Smith is our preferred exposure to the Budget initiatives. Not only will it benefit from increased budget related expenditure, but it will also benefit from its store roll out program and an overall business restructure.

The company has now delivered three results since its initial public offering (IPO), which have indicated that management is executing on its key objectives. Clearly, the market remains skeptical of execution risks but if these positive trends continue, as again indicated in the 3Q trading update, we expect the share price to re-rate to a more appropriate multiple when compared to its peer group.

While certainly not without its challenges, at a FY16 price-earnings (PE) multiple of 10 times and a dividend yield of greater than 6 per cent these challenges appear to be more than discounted into the current share price. DSH offers above market EPS growth and dividend yield at a share price where the downside risk of investing would seem to be limited.

To see Dick Smith's forecasts and financial summary, click here.